Hamza

@hamzaolubaba

ID: 1133035659034337282

27-05-2019 15:42:06

660 Tweet

107 Followers

403 Following

✨ We are at day 2 of the Inclusive Fintech Forum 2025! Yesterday was a busy day for the EMSquad, as our founder and CEO Carmelle Cadet joined a panel "Paving the Future of Payments in Africa," while the rest of the team including our Vice President of Sales Hannatu Adegboyega

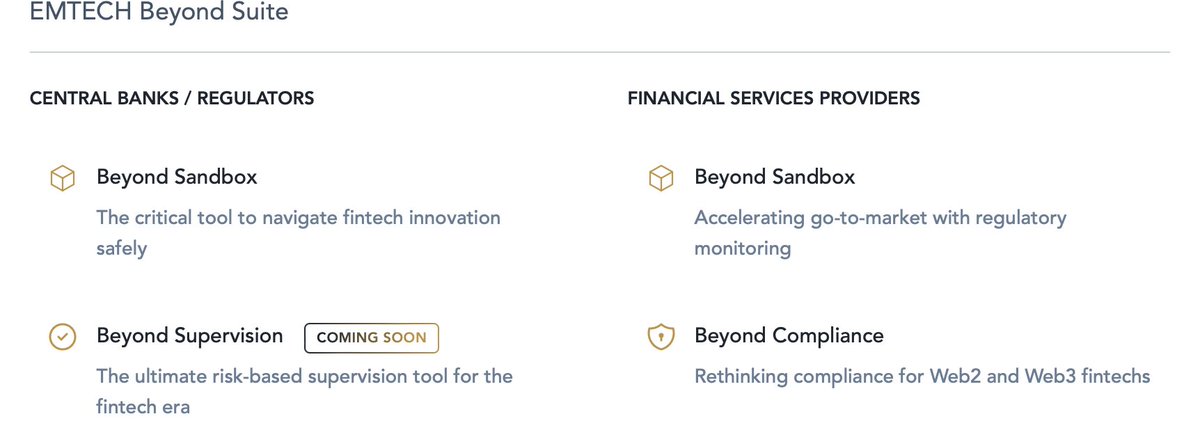

EMTECH was pleased to be part of the conversations at the conference. Our CEO Carmelle Cadet took part in conversations around CBDCs, stablecoins and tokenisation.

Don't miss the Haiti Tech Podcast on June 4th. Carmelle Cadet founder and CEO of EMTECH, a technology company that works with central banks, particularly in Africa, to develop innovative solutions such as #CBDC platforms and regulatory sandboxes will be joining the program.