Habil Olaka, EBS

@habilolaka

ID: 606568405

12-06-2012 19:18:52

1,1K Tweet

2,2K Takipçi

553 Takip Edilen

Dr. Habil Olaka, EBS: Agriculture's contribution to the GDP is pretty strong, between 20 to 30 percent. But exposure of the banking sector to the agriculture sector is fairly small, about 2 to 3 percent. The banking industry has identified this as a challenge. #ThisWeekinBanking

Dr. Habil Olaka, EBS: We are instituting specific measures to ensure that the challenge the agriculture sector is facing in terms of access to credit are addressed so that we start to see more flows into the sector than we have currently. #ThisWeekinBanking

Joined my Cabinet Secretary Hon.Florence Hon. Florence Bore, EGH in a meeting with the Board of Directors of Federation of Kenya Employers (FKE) led by their President Habil Olaka, EBS and the CEO Jackline Mugo . FKE is a key social partner in our labour sector.

Dr. Habil Olaka, EBS: We have not seen growth in the utilization of the current credit guarantee scheme as well as it should. We are in the learning phase, tweaking a few things to ensure that the uptake of the facility is improved. #ThisWeekinBanking

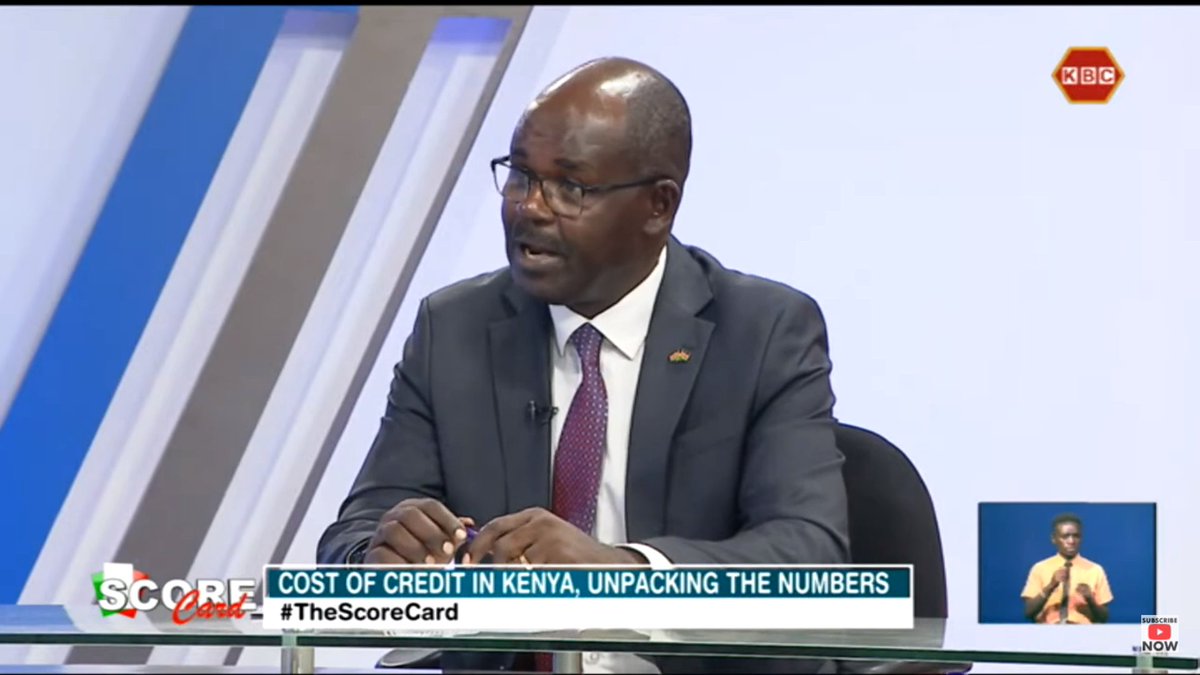

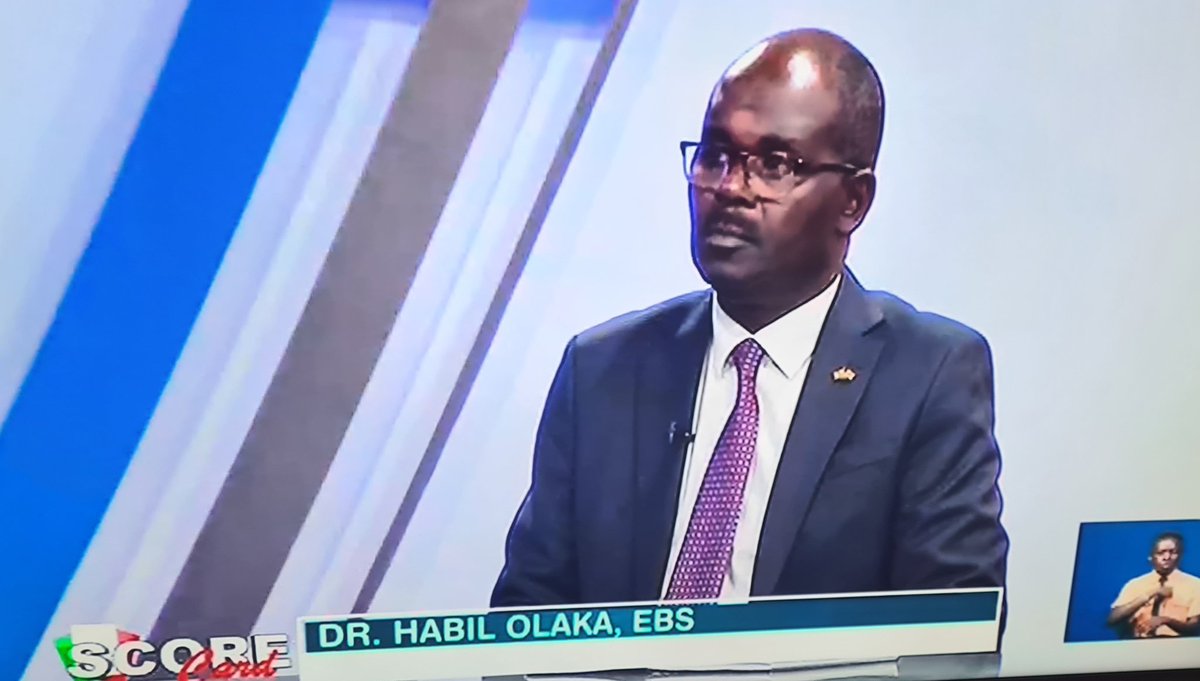

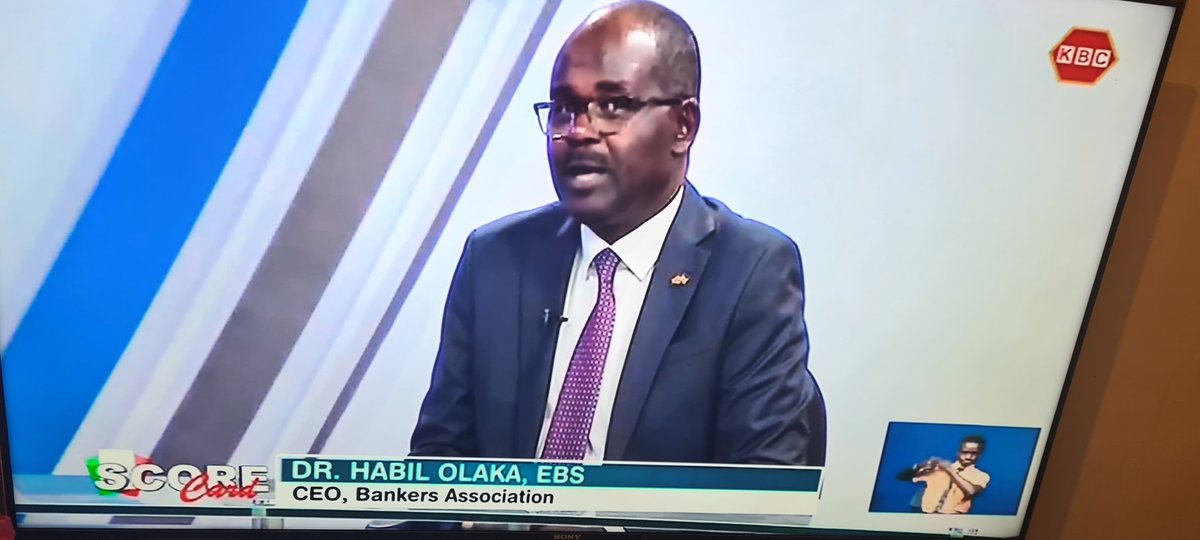

Dr. Habil Olaka, EBS : Banks are well placed to support the economy. When banks are well capitalised they are able to withstand shocks. Although we have headwinds ahead but we are in a good position to support the economy. #TheScoreCard KBC Channel 1 News

Dr. Habil Olaka, EBS : Banks are well placed to support the economy. When banks are well capitalised they are able to withstand shocks. Although we have headwinds ahead we are in a good position to support the economy. #TheScoreCard KBC Channel 1 News

Dr. Habil Olaka, EBS : The cost of funds does not affect banks only. It also affects businesses in the economy. #TheScoreCard

Dr. Habil Olaka, EBS: The costs that banks include in the pricing of credit include the cost of funds, the normal running costs of the business, administrative overheads costs, risk margin and an element of profit. Watch Full Interview: youtube.com/watch?v=PN8u94… #TheScoreCard

Dr. Habil Olaka, EBS : When the cost of doing business comes down, banks transmit it to lending.Full Interview: youtube.com/watch?v=PN8u94…

Dr. Habil Olaka, EBS : Credit risk is based on the fact that there is a likelihood that when the money goes out it may not come back. There are various interventions that have been put in place to bring down credit risk. They include the Credit Information Sharing framework.

John Gachora: We appreciate the support by the Central Bank of Kenya under the leadership of Governor Dr. Patrick Njoroge in formulating guidelines with specific timelines for resolution of bank customers complaints through the Banking Sector Charter. #MediationSummit2023

Dr. Habil Olaka, EBS : Litigation resolves our conflicts however, I think the future lies in mediation and as banks we seek to lead the way in this culture change in the country. #MediationSummit2023

Dr. Habil Olaka, EBS: Most disputes involving banks involve capital and monetary resources held up in the disputes, and mediation will facilitate speedy settlement and release of this capital and resources back to the economy #MediationSummit2023

Dr. Habil Olaka, EBS: The banking industry considers it most appropriate and efficient to have conversations with customers, suppliers, or employees with the assistance of qualified 3rd party to review mutual interests in any dispute and resolve amicably. #MediationSummit2023

Dr. Habil Olaka, EBS: the banking industry is focused on referring all disputes in the first instance for settlement through mediation, the only exceptions being criminal cases, constitutional and legislative interpretation, and public interest cases. #MediationSummit2023