HML_Compounder

@hml_compounder

Engineer with an interest in systematic investing.

ID: 1267570649268137984

01-06-2020 21:36:15

37,37K Tweet

4,4K Followers

928 Following

Interesting new stacked exposure out from WisdomTree today focused on inflation protection. $1 invested gets you: - $0.85 in TIPs - $0.15 in Gold/Silver - $0.05-0.10 in Long/Flat Bitcoin - $0.80 in Long/Short Commodities Congrats Jeremy Schwartz

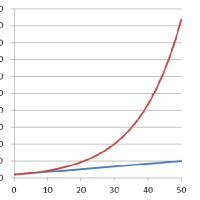

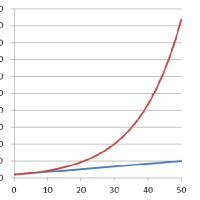

I want to thank Clifford Asness and team for providing little ol' investors like me the opportunity to access more levered, systematic, factor-based (though I know there's some proprietary fun) strats. These new funds alongside the return stacked suite allow me to build an

The problem with managed futures? No one really knows what they are. To one manager, they're crisis alpha. To another, just a slick way to chase returns. As Jack Vogel warns: You better know what you’re actually getting into.