Jorge Orvananos - GFR

@GFR_Jorge

Quant Research Think Tank established in 2010. Stock Model uses 4 parameters to analyze the trend of a stock: RISK, LIQUIDITY, POSITIONING, and TECHNICALS.

ID:1781544441196531712

20-04-2024 04:44:47

15 Tweets

110 Followers

300 Following

SBUX [GFR Sell] Down -13% after EPS

AMD [GFR Sell] Down -7% after EPS

Website ready in May ... send e-mail to

[email protected] to pre-register and gain access.

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-30 22:21:03 SBUX [GFR Sell] Down -13% after EPS AMD [GFR Sell] Down -7% after EPS Website ready in May ... send e-mail to jorge@gfr-ny.com to pre-register and gain access. SBUX [GFR Sell] Down -13% after EPS AMD [GFR Sell] Down -7% after EPS Website ready in May ... send e-mail to jorge@gfr-ny.com to pre-register and gain access.](https://pbs.twimg.com/media/GMciXmhWkAA98Ez.jpg)

Our very controversial TSLA BUY a few weeks ago is working out perfectly. The LPPL gave a Buy Signal at $164 and continued buying down to the most recent low of $138.

GFR Websire ready in May ... send email to [email protected] for direct access to the 540 names covered.

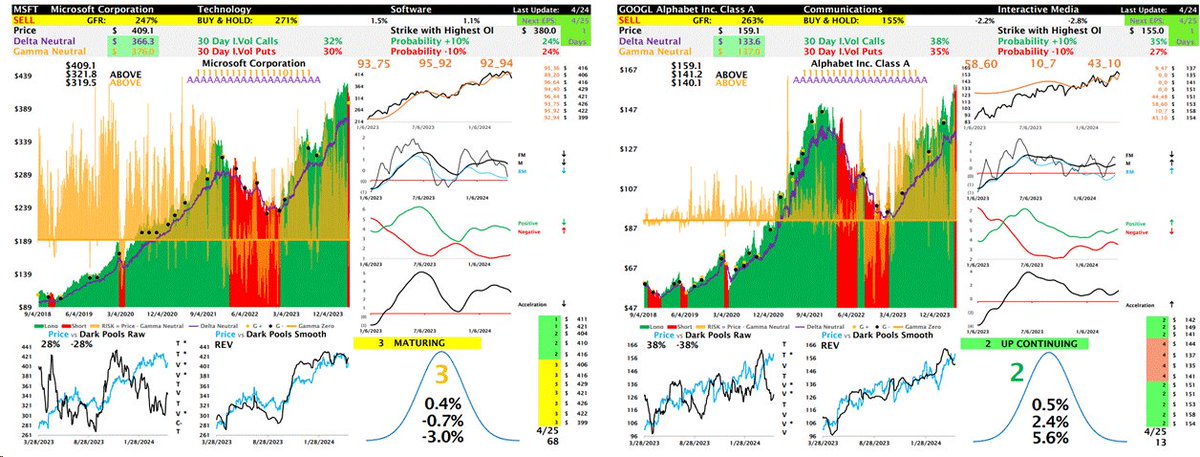

GFR Stock Model is bearish on MSFT and GOOGL because Dark Pools have been sellers lately. META and IBM had similar characteristics into EPS.

*** For direct access to the 540 stocks covered by the model send an email to [email protected] ***

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-05-01 13:48:26 CVS [GFR Sell] DOWN -19% after EPS: RISK = Negative [Price<Gamma Neutral] LIQUIDITY = Negative [Price<Delta Neutral] POSITIONING = Negative [Dark Pools Heavy Sellers] TECHNICALS = Negative [4=Vulnerable Technical] CVS [GFR Sell] DOWN -19% after EPS: RISK = Negative [Price<Gamma Neutral] LIQUIDITY = Negative [Price<Delta Neutral] POSITIONING = Negative [Dark Pools Heavy Sellers] TECHNICALS = Negative [4=Vulnerable Technical]](https://pbs.twimg.com/media/GMf24sYWcAAndRz.jpg)

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-24 15:05:16 TDY [GFR SELL] Reported today. TDY is Down -12% at $360. TDY is trading UNDER Delta Neutral of $387 where liquidity turns negative TDY [GFR SELL] Reported today. TDY is Down -12% at $360. TDY is trading UNDER Delta Neutral of $387 where liquidity turns negative](https://pbs.twimg.com/media/GL8FX3qXMAEXhHr.jpg)

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-24 12:38:29 Yesterday's model calls included: TSLA [BUY] UP +12% LKQ [SELL] DOWN -15% MSCI [SELL] DOWN -13% While TSLA is a controversial Buy, the LPPL component gave a Buy Signal at $164 and the Dark Pools started buying last week. Message me to get access to the 540 stocks that the… Yesterday's model calls included: TSLA [BUY] UP +12% LKQ [SELL] DOWN -15% MSCI [SELL] DOWN -13% While TSLA is a controversial Buy, the LPPL component gave a Buy Signal at $164 and the Dark Pools started buying last week. Message me to get access to the 540 stocks that the…](https://pbs.twimg.com/media/GL7i1hcXUAAWGWK.jpg)

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-22 20:45:18 Cadence Design - CDNS - [GFR SELL] is DOWN -9% after reporting EPS. The GFR Model reversed to a SELL RATING on April 11, 2024, at $310. CDNS is trading at $260. The GFR Website with the 540 names that the model covers will be ready in May. In the meantime, we are distributing… Cadence Design - CDNS - [GFR SELL] is DOWN -9% after reporting EPS. The GFR Model reversed to a SELL RATING on April 11, 2024, at $310. CDNS is trading at $260. The GFR Website with the 540 names that the model covers will be ready in May. In the meantime, we are distributing…](https://pbs.twimg.com/media/GLy_t7OWgAA71iq.jpg)

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-22 15:08:32 VZ [GFR SELL] was UP +3% during the pre-market CNBC interview with Verizon CEO on Q1 2024 Results. The stock in live trading is DOWN -3.7 %. Dark Pools have been sellers during the last 10 days. Dark Pools are hitting the stock again VZ [GFR SELL] was UP +3% during the pre-market CNBC interview with Verizon CEO on Q1 2024 Results. The stock in live trading is DOWN -3.7 %. Dark Pools have been sellers during the last 10 days. Dark Pools are hitting the stock again](https://pbs.twimg.com/media/GLxzLcTXkAAxcK1.jpg)

![Jorge Orvananos - GFR (@GFR_Jorge) on Twitter photo 2024-04-22 03:45:40 The GFR Stock Model was short Globe Life [GL] before the stock declined from $105 to $49 in one day on April 11, 2024. GL reports on Monday, April 22. 1) Liquidity is Negative 2) Risk is Negative 3) Positioning is Negative 4) Technicals are Negative The GFR Stock Model was short Globe Life [GL] before the stock declined from $105 to $49 in one day on April 11, 2024. GL reports on Monday, April 22. 1) Liquidity is Negative 2) Risk is Negative 3) Positioning is Negative 4) Technicals are Negative](https://pbs.twimg.com/media/GLvVMuCWkAA0d-n.jpg)