Fiona Greig

@fionagreigdc

Global Head of Investor Research and Policy at Vanguard. JPMorgan Chase Institute, McKinsey, City of Philadelphia, Harvard, Stanford alumna. Tweets are my own.

ID: 347408581

02-08-2011 19:12:53

1,1K Tweet

2,2K Takipçi

901 Takip Edilen

🚨 New WP🚨 401(k) plans often have vesting schedules for employer contributions. Despite their prevalence, we know little about the effect of these provisions. With Aaron Goodman, we ask: 1. Does vesting keep workers at firms? 2. How does it affect 401(k) wealth? 🧵⬇️

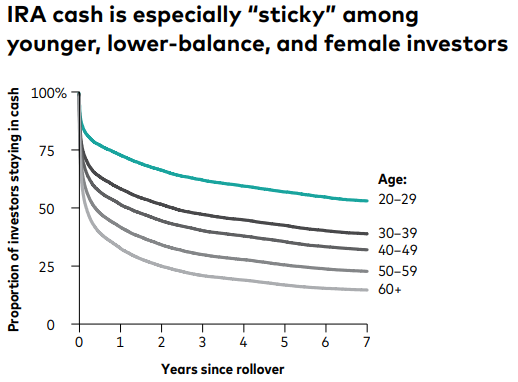

Cash sits in IRA accounts. People contribute or roll their retirement savings to IRAs. 28% stay in cash for 7+ yrs. Solution: Make Target Date Funds the default. Policy allows this in 401(k)s. tinyurl.com/2uecdt3v Covered by anne tergesen @wsj & Beth Pinsker, CFP® Marketplace

Are employers optimizing their 401(k) match? NEW research by Tobin Faculty Affiliate Cormac O'Dea O’Dea & Yale University PhD student Guillermo Carranza, together w/ coauthors Fiona Greig & Anna Madamba (Vanguard) and Taha Choukhmane & Lawrence Schmidt (Massachusetts Institute of Technology (MIT)): tobin.yale.edu/news/240821/ar…

Tips for boosting retirement readiness, provided by Vanguard Investment Strategy Group's Fiona Greig: 1. Take advantage of employer match 2. Educate yourself on retirement investments 3. Be mindful when changing jobs 4. Use retirement calculators

Job transitions slow retirement savings. Workers see a 10% increase in pay but a 0.7 ppt decline in their saving rate when they switch employers. Low default savings rates in 401(k) plans are part of the problem. Covered by anne tergesen The Wall Street Journal. digital-assets.vanguard.com/corp/research/…

Four things to consider when switching jobs, according to Vanguard global head of investor research and policy Fiona Greig: 1. Enroll in your employer’s plan 2. Maintain your savings momentum 3. Take advantage of employer match 4. Stay invested

Here's how "auto features" can help with retirement savings, according to Vanguard Global head of investor research and policy Fiona Greig: More Decoding Retirement: open.spotify.com/show/1OJanCZQm…