Jonathan Ferro

@ferrotv

Good Morning, Good Morning. Anchor @Business

ID: 1015241814

https://www.bloombergmedia.com/talent/people/jonathan-ferro/ 16-12-2012 13:50:02

2,2K Tweet

190,190K Takipçi

1,1K Takip Edilen

Jonathan Ferro “apparently stagflation is bullish” line of the day

Treasury Secretary Bessent tells annmarie hordern the equity market selloff is quote “A Mag7 problem not a MAGA problem”

One of those weekends… See you Sunday Bloomberg TV

On trade talks with China, Stephen Miran tells Jonathan Ferro and me—“I would be surprised if tariff rates are where they are now, you know, within a few weeks from now.”

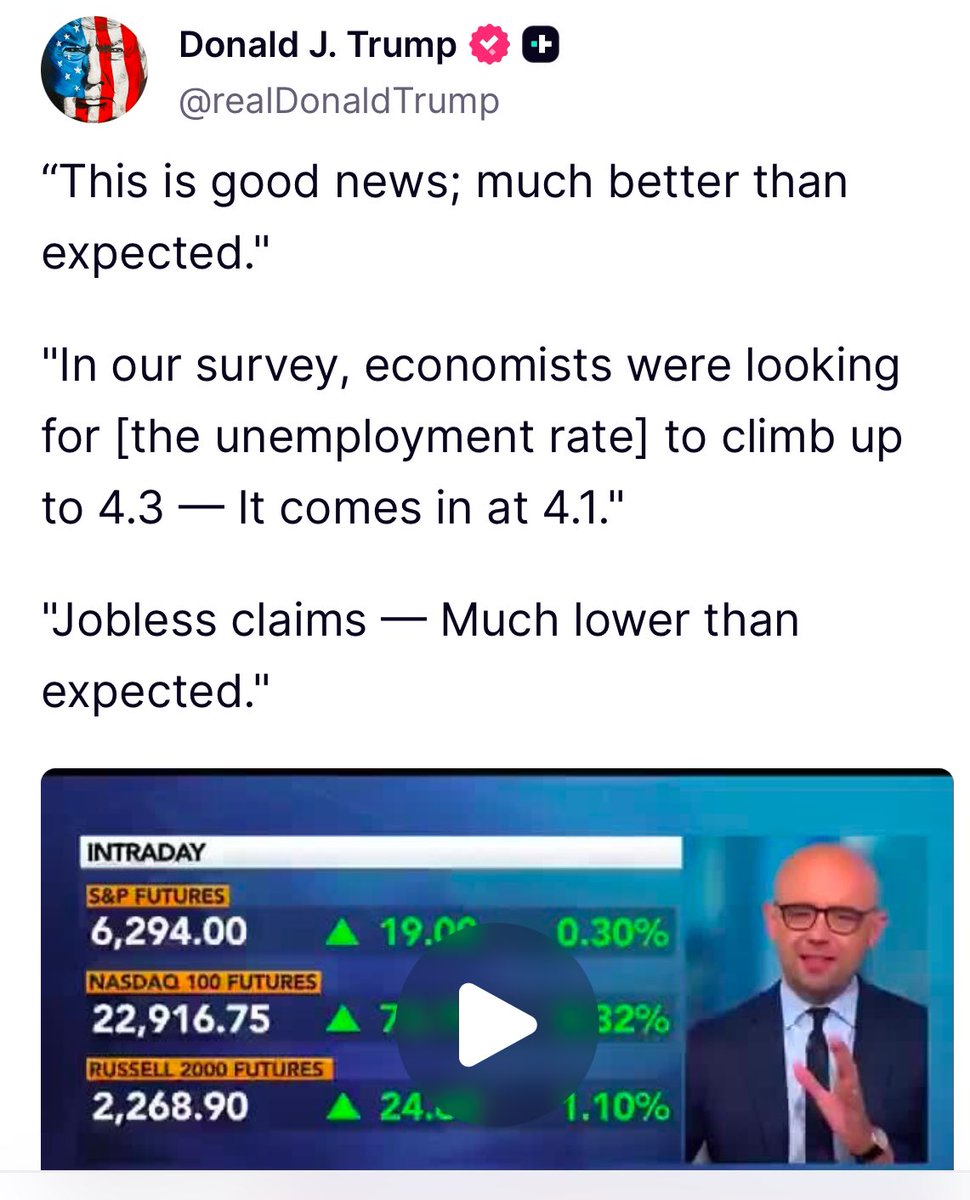

Good morning, good morning POTUS. Only place to be on jobs day is with Jonathan Ferro BSurveillance.

Tomorrow 8am Bloomberg TV “I believe it makes sense to cut the FOMC’s policy rate by 25 basis points two weeks from now” Governor Waller

Ford: A $40 billion company complaining about tariffs. versus Microsoft: A $4 trillion company absolutely crushing estimates. As Rick Rieder said this week “Markets are not ignoring risk; they are pricing a system built to absorb it”