Canadians for Tax Fairness

@FairTaxCanada

Non-profit, non-partisan research & advocacy for fair taxation / OSBL, non-partisan, recherche et plaidoyer pour équité fiscale

08-03-2011 01:40:06

12,8K Tweets

4,7K Followers

1,1K Following

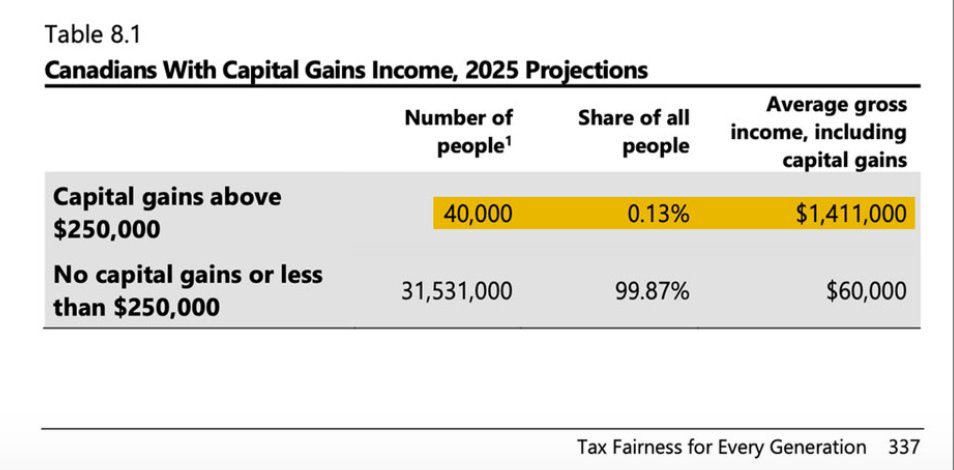

In #Budget2024 , the capital gains inclusion rate will be raised to 66% on gains above $250,000, impacting only the richest of Canadians, with an average gross income of $1,411,000 🎩 It’s an effective way to #TaxTheRich