Protecting Every Future

@every_future

Protecting Every Future, an initiative of ACLI, is a collective voice of Americans who believe we deserve policies that protect our financial future.

ID: 1249373700861890561

12-04-2020 16:28:14

1,1K Tweet

592 Takipçi

24 Takip Edilen

We are now over halfway through 2025, and #Peak65 is taking place this year, as 11,200 Americans are turning 65 every day! 🤯 A study conducted by Alliance for Lifetime Income found that 54% of pre-retirees worry about outliving their savings and that annuities are emerging as the most recommended

Is financial health part of your wellness goals? 💪 InsuranceNewsNet highlights how financial health plays a key role in overall well-being. Discover why planning for the future and working with a financial professional are key steps toward long-term stability:

Millennials: Have you thought about purchasing life insurance? ETHealthWorld explains why it’s important to think about purchasing life insurance early and what to keep in mind along the way. Read more here: bit.ly/3HO2LDL

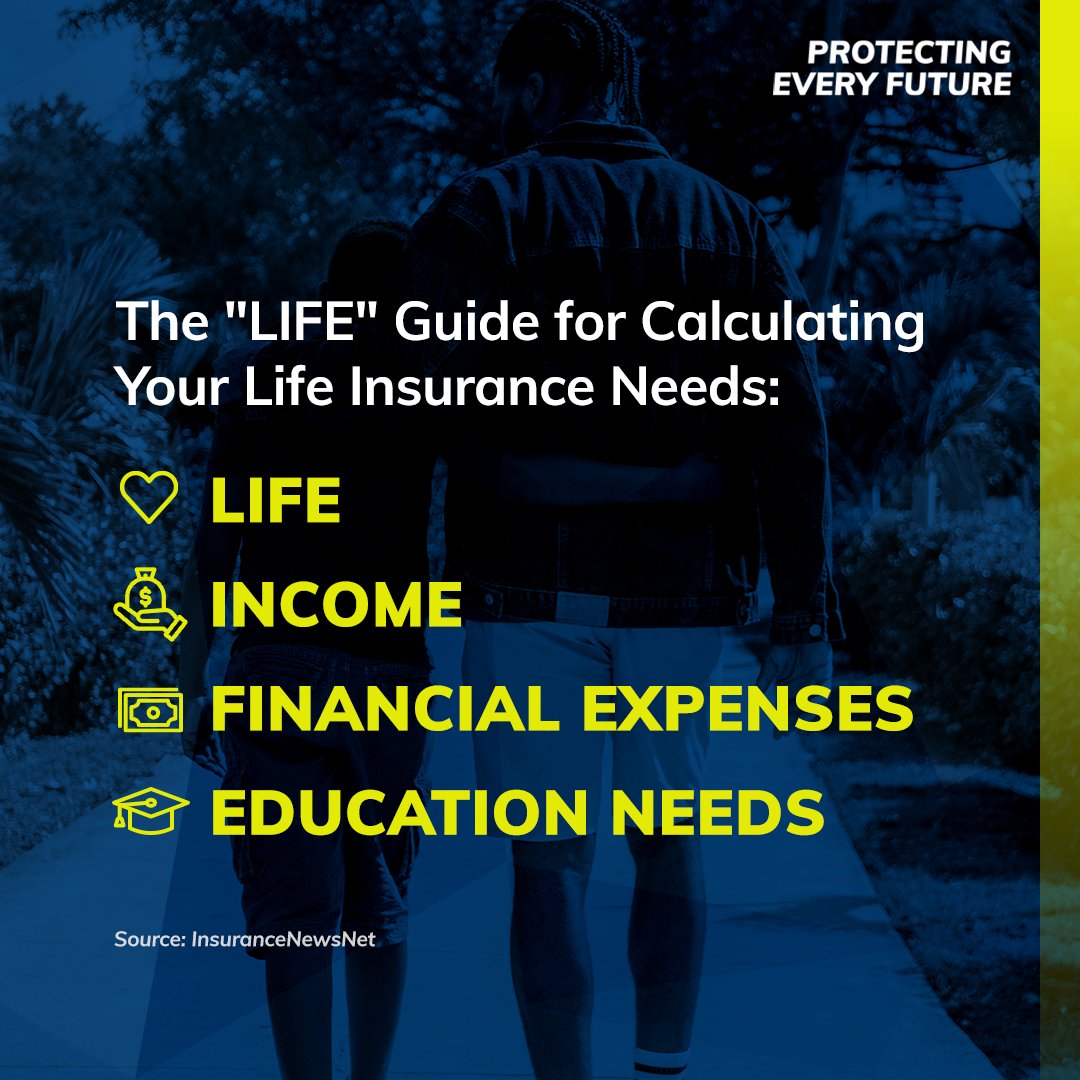

🤔Have you thought about what factors to consider when choosing the right life insurance plan? InsuranceNewsNet explains why the “L-I-F-E” guide (Liabilities, Income, Financial expenses, Education needs) is a smart way to calculate your life insurance needs. Read the full article

Have you calculated your life insurance needs? 🧮 Our friends at Life Happens developed a Life Insurance Needs Calculator to easily help you figure out the right amount of coverage for your family! Check it out: bit.ly/3KA5mlD

New research on annuities just dropped! Learn more about why a guaranteed income for life may be more beneficial than traditional retirement planning from InsuranceNewsNet: bit.ly/46U5Qub