Wolfran.eth

@ethwolfran

🦙 Proud member of the llama's community @WenLlama ,@llamaquestnfts and all things Aladdin DAO (Opinions are my own)

ID: 1425460911263948800

11-08-2021 14:16:17

2,2K Tweet

534 Takipçi

1,1K Takip Edilen

Convex Finance f(x) Protocol $cvxFXN holders eating soon 🫵⚓ x.com/0xHarborFi/sta…

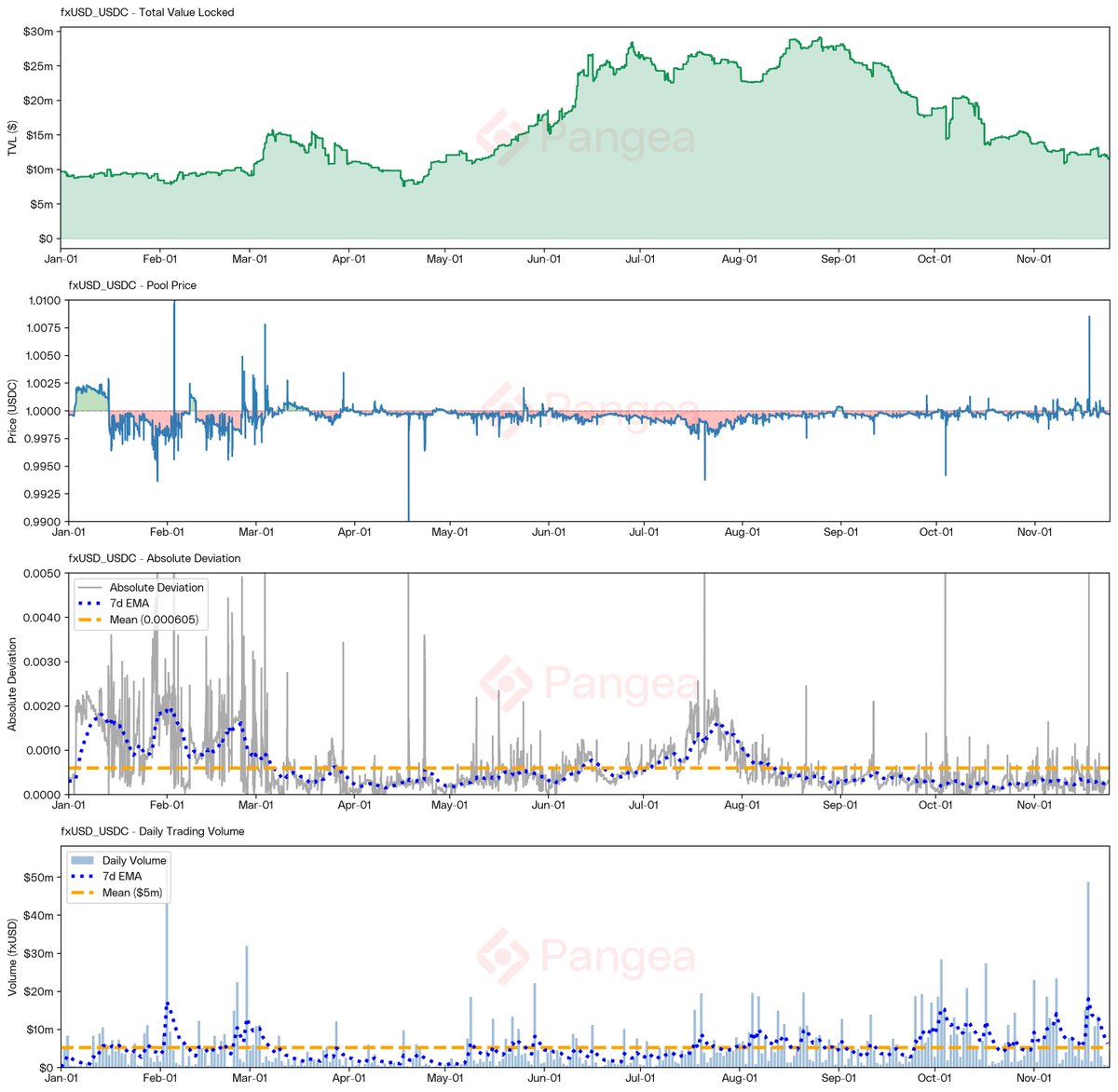

Bearish price action on $ETH and $BTC resulted in some f(x) Protocol whales to unwind their positions and derisk. This catapulted the fxusd/usdc pool to the top of the charts on Curve Finance

Every point on this chart represents positions on f(x) Protocol that were rebalanced. Instead of being completely liquidated, their trades were safely deleveraged by paying down their $fxUSD debt. In total, $23.76m has been rebalanced across the wstETH and WBTC markets.

While a lot of long positions on f(x) Protocol have closed over the last few weeks resulting in lower tvl, we finally starting to see bigger adoption of the s-positions. Volume has been picking up because of this.

Same as it ever was. Time to open a 0% interest free $BTC collateralized loan on f(x) Protocol. fx.aladdin.club/v2/fxmint/

Would be good news for f(x) Protocol $fxSAVE. More capacity and better borrowing rates on Llamalend down the line.