ebisu ethan 🎣

@ebisuethan

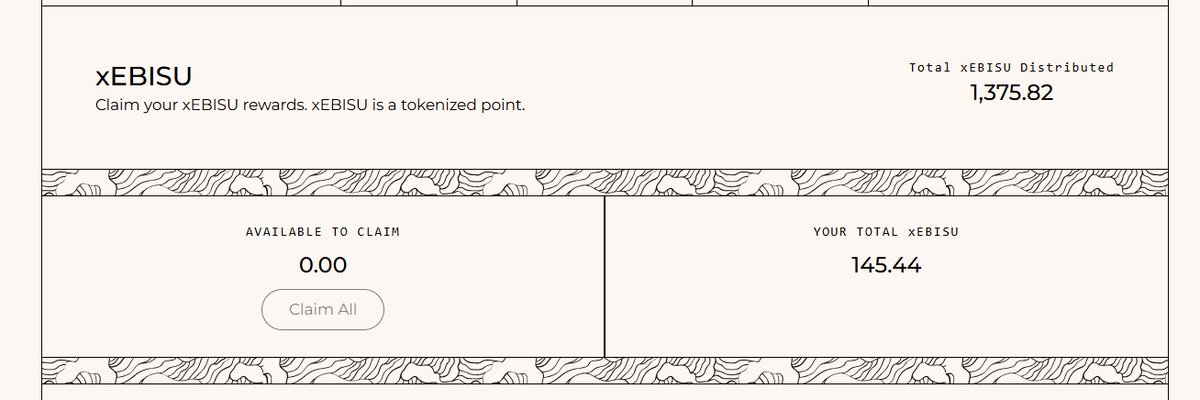

@ebisu_finance fishing for yield

ID: 1328489591460884482

17-11-2020 00:11:00

1,1K Tweet

2,2K Takipçi

4,4K Takip Edilen

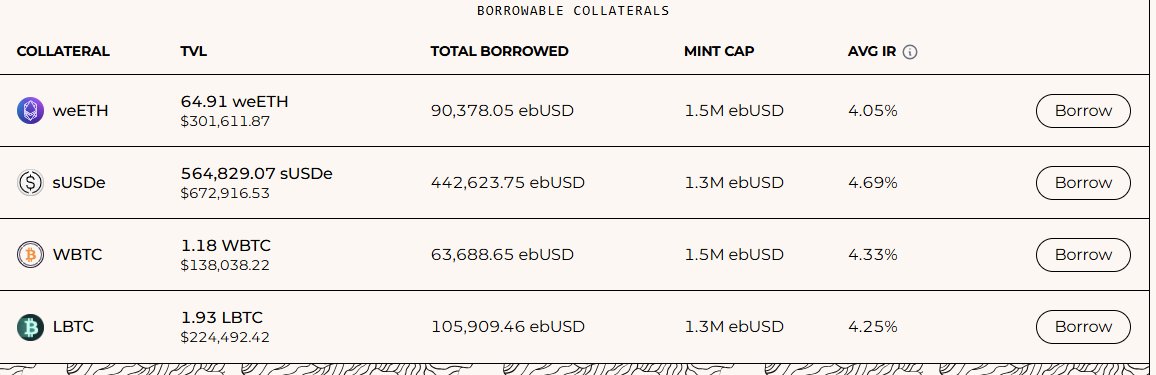

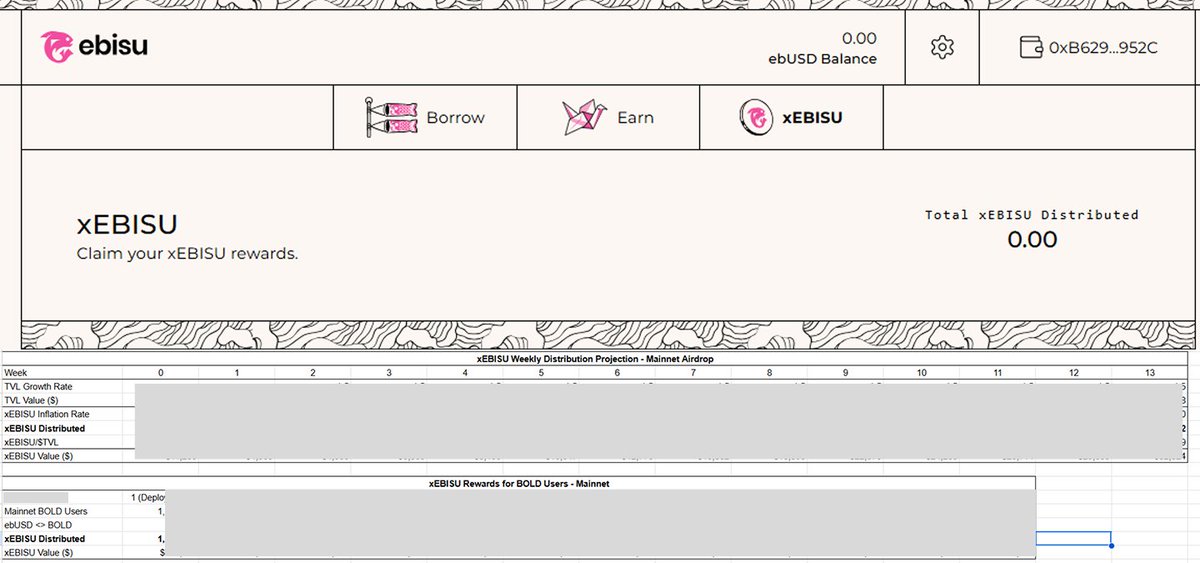

At Ebisu 🎣 (MAINNET LIVE), we aim to always offer the most competitive interest rates for borrowing against your wrapped Bitcoin. You can either set your own rate or let one of our interest rate managers handle it for you

🗳️ Bi-Weekly Votemarket Roundup Top protocols deploy $888K on Votemarket to capture Curve Finance $CRV incentives across 88 campaigns from 21 protocols (+$48K vs last round): Origin Protocol $158K MetronomeDAO $120K Falcon Finance $117K 🧙🏼♂️ $114K Inverse $90K