Del Johnson

@deljohnsonvc

"The Most contrarian thinker in VC" & Father of Modern Venture Capital. VC, Angel, LP. prev: @Google @Oracle @ucberkeley @Columbialaw

ID: 815847044

10-09-2012 19:09:36

27,27K Tweet

22,22K Followers

4,4K Following

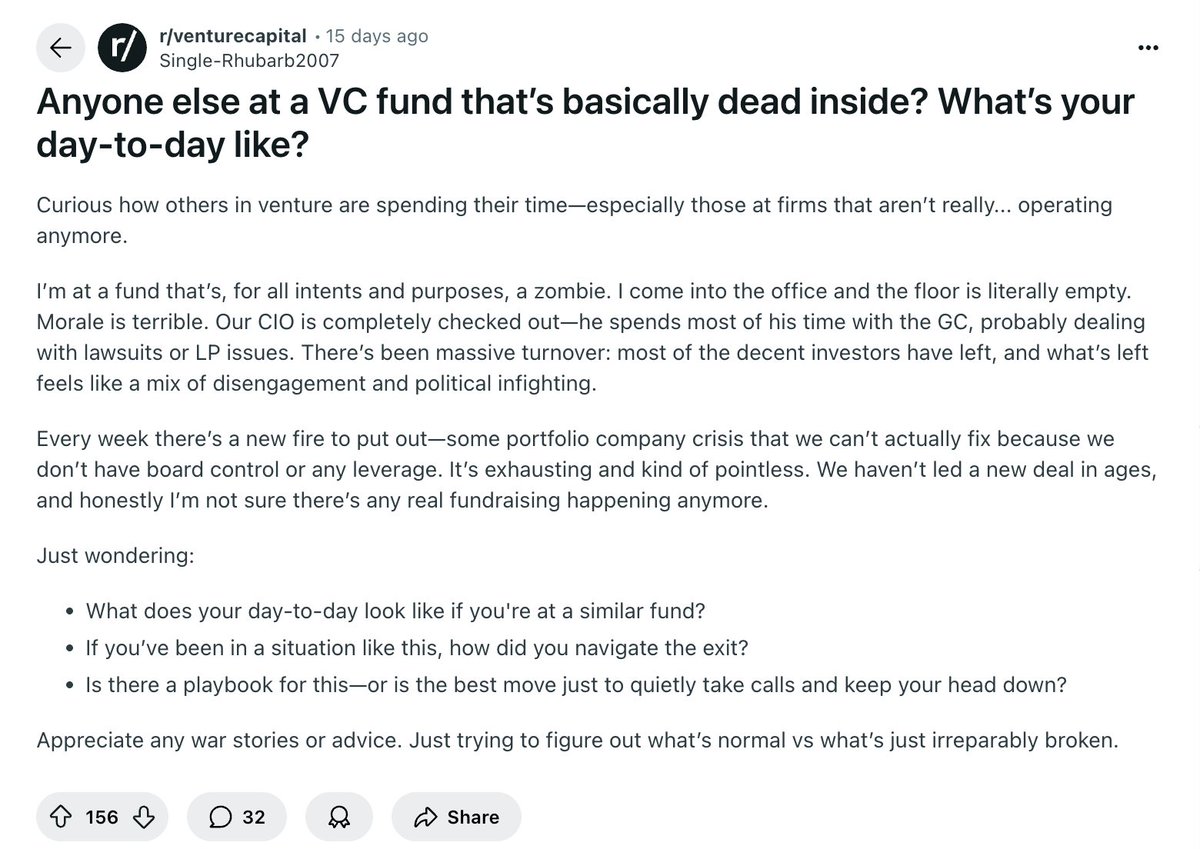

Jay Kapoor This mindset and his tweeting this out to the ecosystem are clear signs the asset class is broken. This tweet emerges from a model looking for quick markups to raise their next fund to pull another decade of fees. Liquidity for LPs not considered. Everyone’s cooked