Dignity Gold

@digau_official

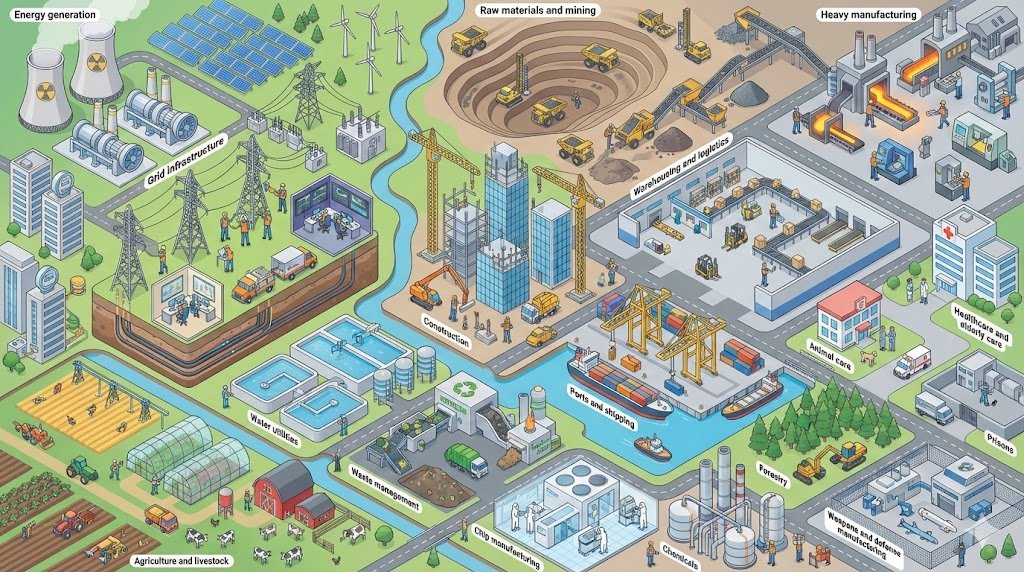

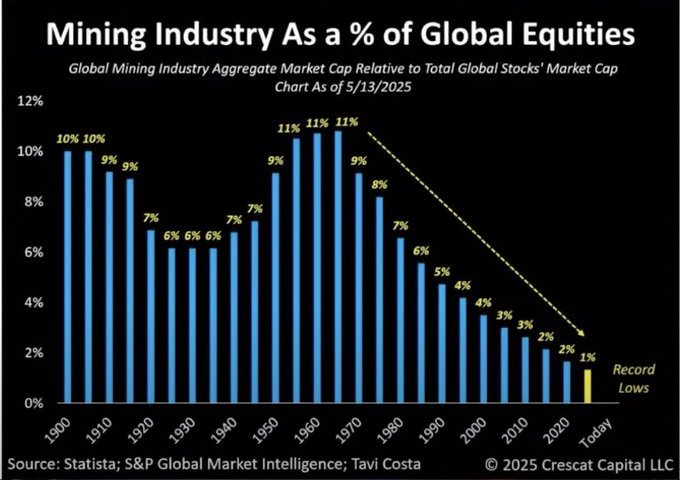

DIGau is a security token which gives holders access to previously unimagined opportunities within the precious metals industry.

ID: 1804978103867076608

http://dignitygold.com 23-06-2024 20:41:45

41 Tweet

482 Takipçi

201 Takip Edilen