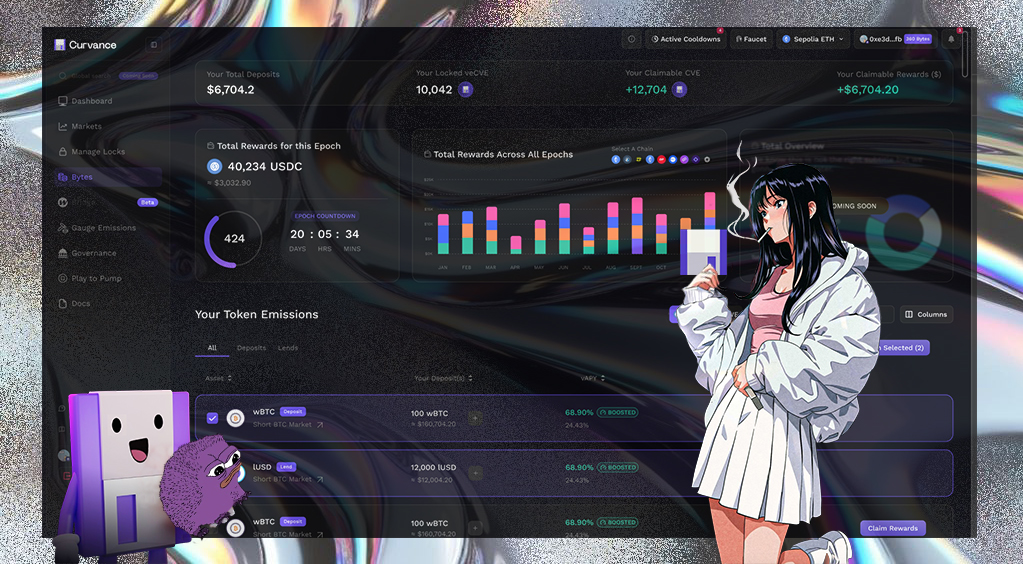

Curvance (Loading...)

@curvance

Click Less, Earn More. Powered by @wormhole.

ID: 1445781144125857796

https://linktr.ee/curvance 06-10-2021 16:02:39

2,2K Tweet

155,155K Followers

472 Following

🏛️ The Legends of Atlantis return! Who built the pyramids? Join us Thursday at 1 PM UTC alongside Curvance (Loading...) and Dot AI 「∅, ✧」| v1 is Live for another 𝕏 spaces covering modern DeFi innovation on Monad ⨀, with a touch of ancient mystery! ✨ ▶️ x.com/i/spaces/1Mnxn…

Monday Chat: The DeFi Edition We’re back with another power-packed Roundtable diving deep into the Monad ecosystem and the future of DeFi with an all-star panel. 🗓️ June 16 🕒 3 PM UTC 📍 X Spaces 🎙️ Host: Toni Morales 👥 Speakers: • Mai 💾 - CEO of Curvance (Loading...) • just ray ⌘