Convex Finance

@convexfinance

Boosted Curve staking, Frax, and f(x)! Maximize your yields! Governance on Curve, Frax, f(x), and Resupply!

Discord: discord.gg/TTEVTqY488

ID: 1368226092050345985

https://convexfinance.com 06-03-2021 15:45:08

1,1K Tweet

55,55K Takipçi

112 Takip Edilen

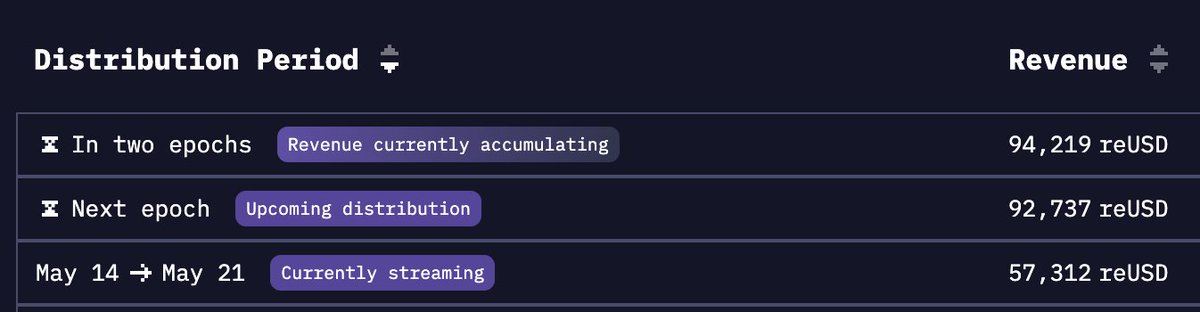

Here's an update on the $ETH long on f(x) Protocol: Basically, what I did was go in with 12 $ETH with 2,4x leverage 2 months ago. Horrible timing ofc as the position went down to $1,385. But the good thing is that you can't be liquidated, and you don't pay any funding fee. Let

For every $1 of voting incentives, $3.02 of $crv emissions are directed to Curve Finance's pool llama.airforce/incentives/ove… If you are a stablecoin team and looking to build liquidity on mainnet, specifically Curve, DM's are open We'll help navigate how you to efficiently and