Coinbase Asset Management

@coinbaseam

Premier asset manager creating strategies/infrastructure for institutions to engage in digi assets. Wholly-owned, independent subsidiary of Coinbase Global Inc.

ID: 1734580138497523712

12-12-2023 14:25:59

56 Tweet

224 Takipçi

8 Takip Edilen

On today's Crypto Mondays by Coinbase Asset Management with President Sebastian Pedro Bea, OLY and Portfolio Manager Sarah Schroeder, we discuss: • Coinbase Bitcoin Yield Fund (CBYF): This morning, we announced CBYF—an institutional solution built to invest in BTC that seeks a conservative BTC

Gold revaluation could lead to US treasury buying Bitcoin sooner than expected - Coinbase Exec Coinbase Asset Management President Sebastian Bea, OLY joined Frank Chaparro at our NYC office to discuss Bitcoin's continuing maturation as an asset class, and how a government move to revalue gold could

Is bitcoin’s “digital gold” narrative becoming a reality? @SebastianBea joined Frank Chaparro on The Scoop to discuss bitcoin’s recent decoupling from traditional risk assets, how institutions are integrating BTC into portfolios, and more. Listen to the full episode:

On today's Crypto Mondays by Coinbase Asset Management with Sebastian Pedro Bea, OLY and Head of Credit Doug Wilson, we discuss: 1. Capital Market Assumptions: In “The Case for Store of Value,” we provide long-term return forecasts for gold and bitcoin to help allocators better navigate a transformative

How can institutional investors incorporate store-of-value assets, like gold and bitcoin, into their strategic asset allocations? In our new report, Capital Markets Assumptions: The Case for Store of Value, Coinbase Asset Management’s CIO Marcel Kasumovich outlines our framework

On today's Crypto Mondays by Coinbase Asset Management with Sebastian Pedro Bea, OLY and @MarcelKasumovich, we discuss: • Macro: How should we think about corrections? Historically, corrections were deflationary and inflation had a ceiling. Today, inflation has a floor—making store-of-value assets more

On today's Crypto Mondays by Coinbase Asset Management with Sebastian Pedro Bea, OLY and @MarcelKasumovich, we discuss: 1. Macro: Does the US debt downgrade matter? Despite market concerns around US fiscal sustainability, all eyes will be on how the ‘Big Beautiful Budget Bill’ impacts fiscal conditions.

On today's Crypto Mondays by Coinbase Asset Management with Marcel Kasumovich and Portfolio Manager Sarah Schroeder, we discuss: 1. Macro: When assets without cash flows are leading, it signals monetary change. A monetary reset is happening, which has historically led to a Bretton Woods event.

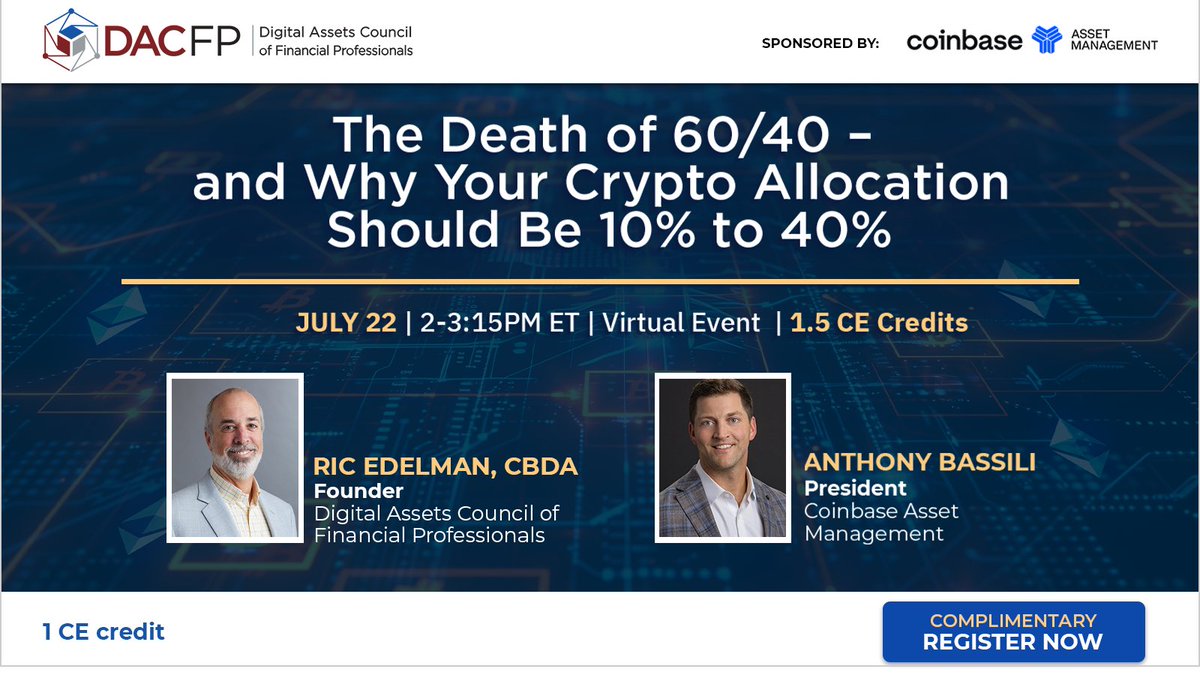

We’re joining Ric Edelman and Digital Assets Council of Financial Professionals tomorrow to discuss digital asset allocation and strategies to help position your clients for this new era of crypto. If you’re an advisor, wealth manager or investor, tune in here: dacfp.com/events/the-dea…