Clearstar Labs

@clearstarlabs

We ♥ DeFi. Sentient since 2022.

Building onchain infra and strategies.

Advising close to 1B EUR in AUM.

ID: 1734253824934563840

https://clearstar.xyz/ 11-12-2023 16:48:43

75 Tweet

104 Takipçi

25 Takip Edilen

We are now tracking Morpho 🦋 USDC on Arbitrum. New sources curated by: ▪ Gauntlet ▪ Hyperithm ▪ Clearstar Labs ▪ MEV Capital ▪ Steakhouse Financial

Let us raise a toast to Clearstar Labs who raised the cap once more for our Fusion (by IPOR) yoUSD Loooper vault! This vault's performance is a testament to demand: → $1.75 TVL fueled by our $7.5m Morpho market → 25% APY/7d → 6x YO points + 5x Fusion points $5m now in effect.

This is the biggest problem in DeFi today with the self-anointed nobility of "curators" At YO we partnered with Clearstar Labs for our relentless focus on users and building cool, transparent products.

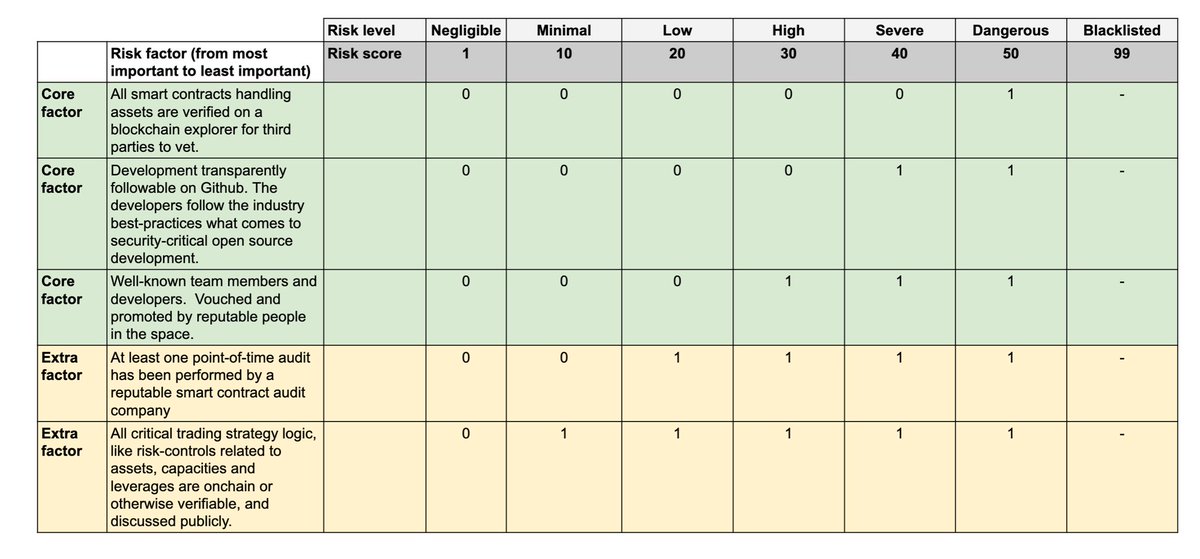

PSA🚨 - Clearstar review confirms Yuzu Money 🍋 has no direct exposure to Stream Finance xUSD. Impact from indirect exposure is capped at 1.4% max loss for full write-off (xUSD marked to zero) As part of Clearstar’s diligence process prior to deploying liquidity into any DeFi

Liquidity flowing back through our Morpho vaults again. We are normalizing rates across the different markets we support. Thank you for trusting Air Clearstar Labs and sorry for the turbulences.