Chung Tran

@chungqtran

ANU Economics

ID: 4438527854

http://orcid.org/0000-0001-8252-469X 03-12-2015 05:01:24

51 Tweet

229 Followers

348 Following

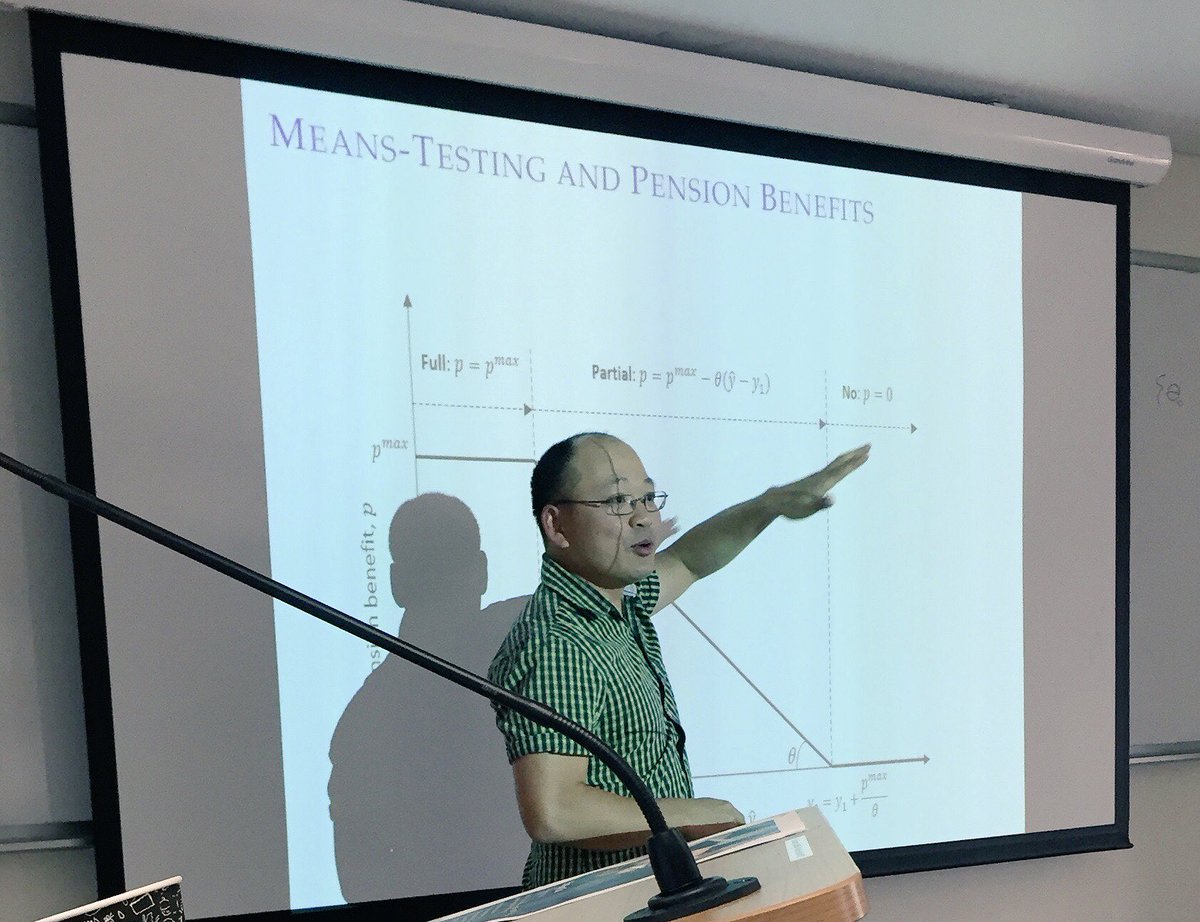

#centreForEconomicHistory ANUDemography Chung Tran - at ANU’s Fertility Workshop - points out problems of designing sustainable and equitable #pensions in low #fertility ageing economies ANU Economics ANU CBE @RabeeTourky

Check out "Quantitative Macroeconomics and Fiscal Policy in Action" by Laboratory for Macroeconomics and Policy and ANU Economics: eventbrite.com.au/e/quantitative… @Eventbrite

SED 2019 Annual Meeting (sed2019stlouis.org) is a showcase of frontier macroeconomics research. ANU RSE Macro/ANU LaMP Laboratory for Macroeconomics and Policy contributes 3 papers to the program: editorialexpress.com/conference/SED…

Research conducted by Chung Tran at anusha ANU Economics Life Advice Lamp contributes to designing better pension systems in aging economies.

Cross fertilizing academic and fiscal policy research at the first ANU-Treasury Policy Modelling Workshop A collaborative event at Laboratory for Macroeconomics and Policy ANU Economics ANU CBE

How much additional revenue could be generated by raising taxes? What is the limit to raising taxes? Chung Tran & Nabeeh Zakariyya ANU Economics on quantifying the fiscal limit of Australia’s tax system. #austax #BudgetForum buff.ly/353pF6u

#NewPost "The United States system is somewhat of an outlier." Juergen Jung and Chung Tran on expanding US Medicare and its public finance effects. buff.ly/3Llroow

Forthcoming article by Juergen Jung and Chung Tran “Health Risk, Insurance and Optimal Progressive Income Taxation” EEA @OUPEconomics doi.org/10.1093/jeea/j…

To what extent can a tax and transfer system moderate the distributional impact of uneven economic growth? Nabeeh Zakariyya will address this question in this Friday's #TTPI #seminar. buff.ly/3OKMDng

New working paper with Chung Tran MacroPublicFinance_OZ ANU Economics . Australia had 3 decades of uninterrupted growth. We ask how was this growth distributed? How did it impact lifetime incomes? What was the role of tax and transfers in moderating uneven gains? 1/4