Christopher Pulliam

@chrislpulliam

Social policy PhD student @ColumbiaSSW & RA @CpspPoverty | Former research analyst @BrookingsInst | Proud @MaxwellSU alum | Views my own

ID: 1029860370960314377

15-08-2018 22:40:21

1,1K Tweet

291 Followers

190 Following

1/6 Really? SALT again? {sigh}. OK, here we go. The SALT deduction is a massively regressive tax cut for the rich. Trump was right to cap it. For the data from me and Christopher Pulliam see this The Brookings Institution piece brookings.edu/articles/the-s…

The number of defined-benefit plans like pensions shrunk by half since the '80s while defined-contribution plans like 401(k)s quadrupled, making it harder for workers to plan out lifetime income, write Mark Iwry, David John 🇺🇦, & @WilliamGale2 -> brookings.edu/articles/secur…

Virtual event on Opportunity Insights latest now happening 7/31 with Abigail Wozniak moderating - be there! Brookings Econ brookings.edu/events/the-cha…

I am thrilled to announce that our ANNALS Volume on the 2021 Child Tax Credit dropped today! Open access for the full volume is available! Thanks to my Co-editors Zach Parolin Megan Curran and the star studded cast of authors. journals.sagepub.com/toc/anna/710/1

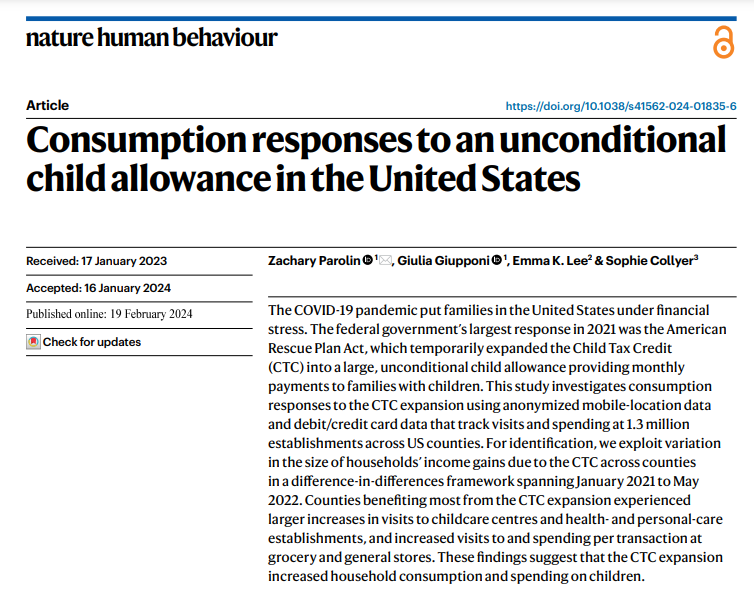

Our study (Effects of the expanded Child Tax Credit on employment outcomes) is out in the world after finding a home with Journal of Public Economics. We found statistically insignificant and inconsistently signed differences in emp and LF participation for eligible adults during the the CTC exp.

.Tara E W & I are excited to announce the 24-25 lineup for the Virtual Economics of Poverty and Policy Seminar (VEPPS), w/seminars by Aaron Sojourner Krista Ruffini Alejandro Cid Sakshi Bhardwaj Zach Parolin Melissa McInerney Bradley Hardy. For more info see lucieschmidt.com/vepps-seminar

Thrilled to be an American Institute for Boys and Men Student Fellow and to work with Richard V. Reeves again!