Cristià Calle Mercado

@ccalleinvesting

Official eToro value investor. Over 19% ARR.

CFO of a company with over 60M EUR annual revenue.

ID: 1499171266116218880

https://med.etoro.com/B21123_A121994_TClick_Setoro.aspx 02-03-2022 23:54:36

287 Tweet

106 Takipçi

133 Takip Edilen

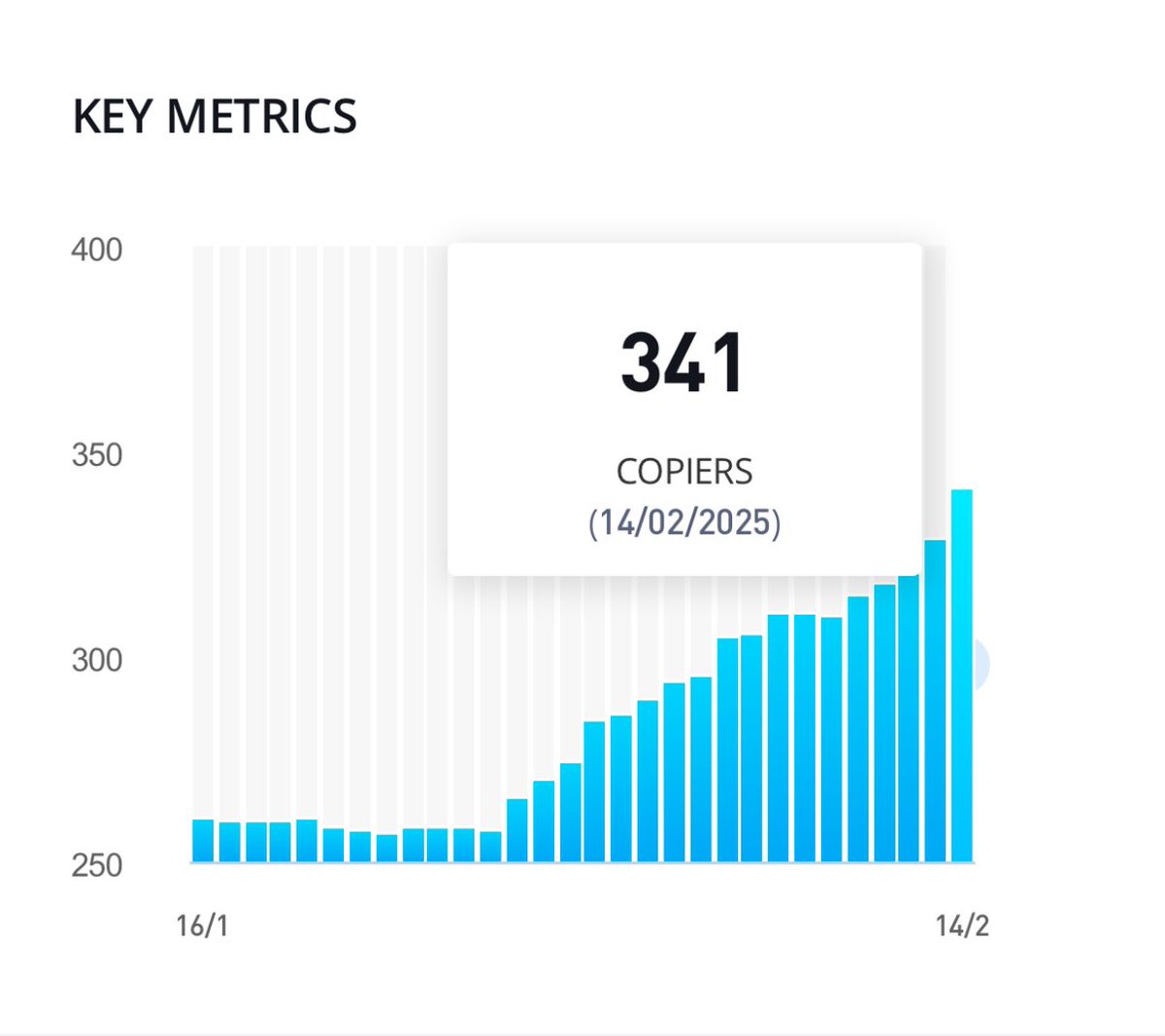

Récord de copiadores en etoro 🙌🏼 341 personas invierten conmigo a día de hoy. eToro en Español #fintwit

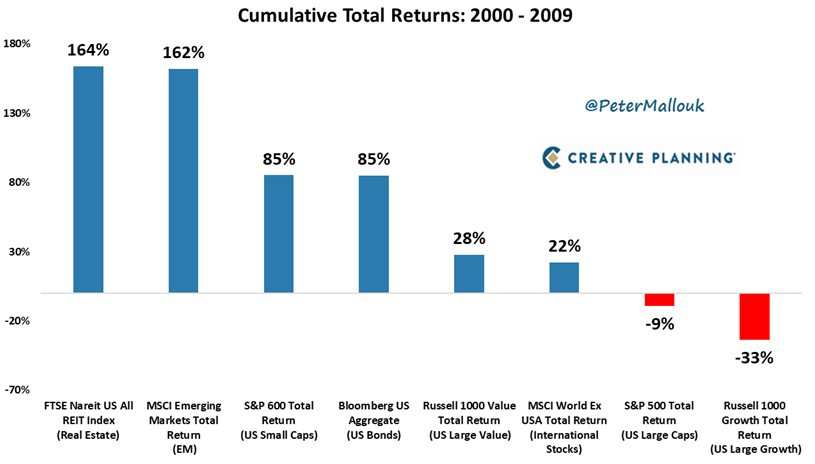

Am I the only one who didn't know this? Index ETF P/E ratios are "fudged," and the QQQ was trading at a 90x P/E? $QQQ $SPY $IWM h/t Kopernik Global & Dave Collum