Axel 💎🙌 Adler Jr

@axeladlerjr

FREE daily on-chain & macro research from a #Bitcoin Verified Author @cryptoquant_com. Don't miss out - subscribe for cutting-edge Substack insights 💡 📨 👇

ID: 92823417

https://adlerscryptoinsights.substack.com 26-11-2009 19:54:45

4,4K Tweet

22,22K Takipçi

409 Takip Edilen

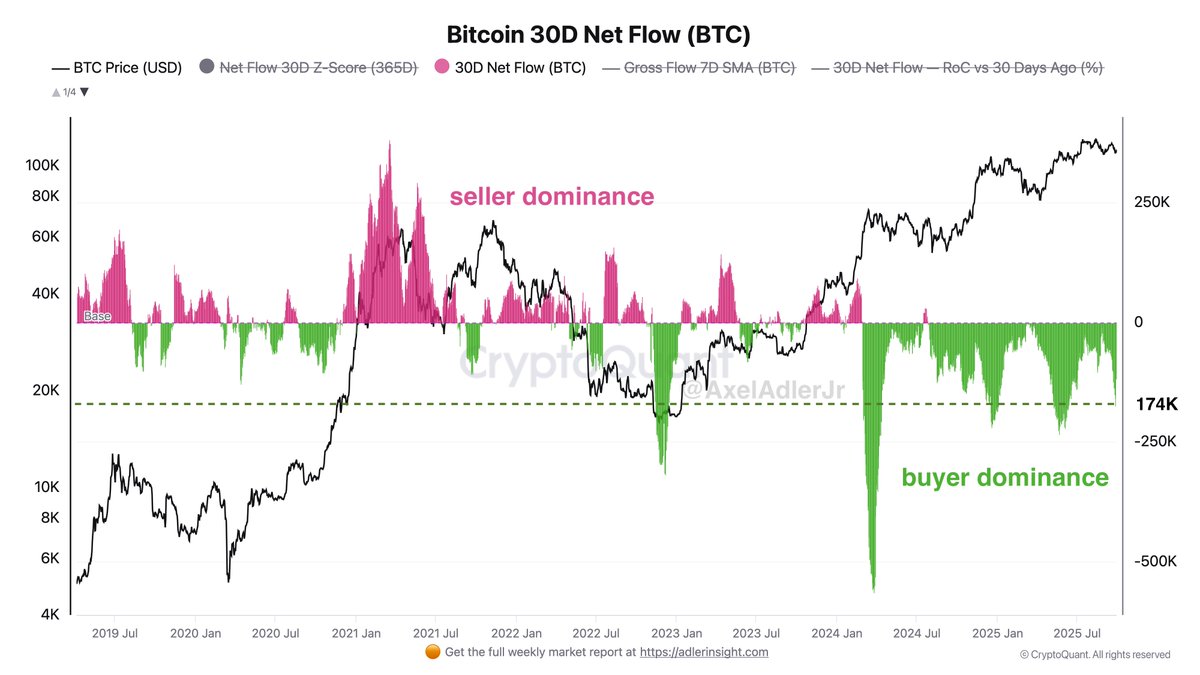

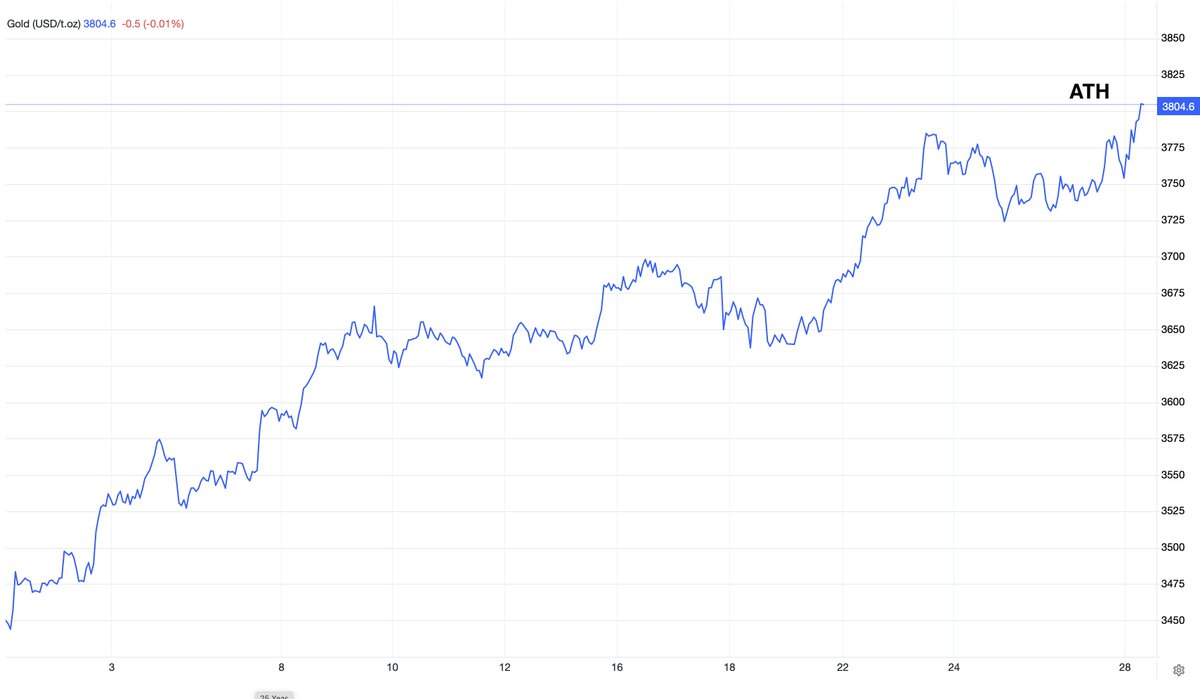

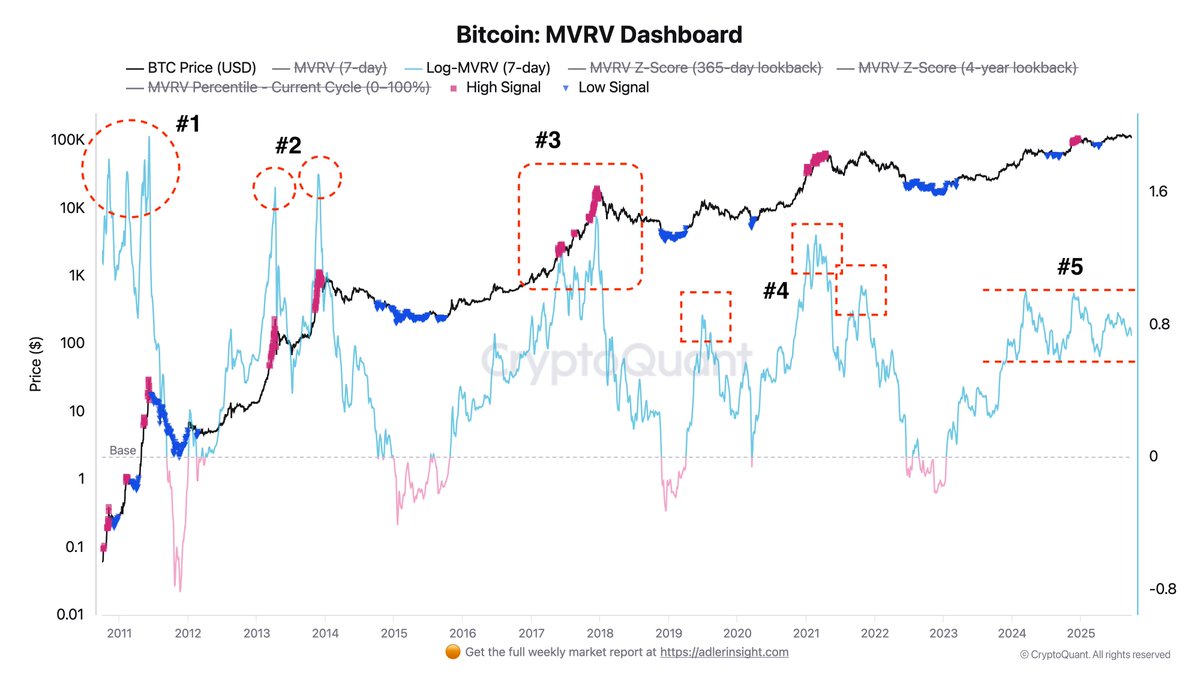

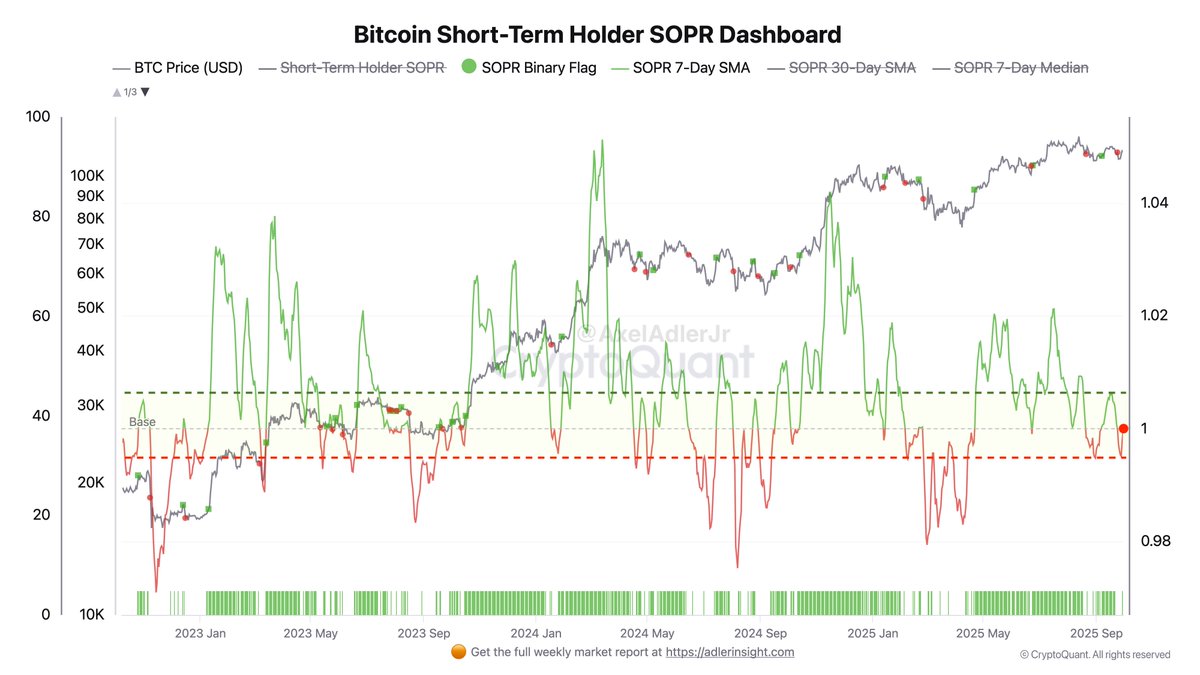

Bitcoin in equilibrium with growth potential to $130K via CryptoQuant.com cryptoquant.com/quicktake/68dd…