Arthur

@arthur_0x

Founder & CIO @DeFianceCapital

ID: 1357451976

https://DeFiance.Capital 16-04-2013 17:45:13

13,13K Tweet

194,194K Takipçi

1,1K Takip Edilen

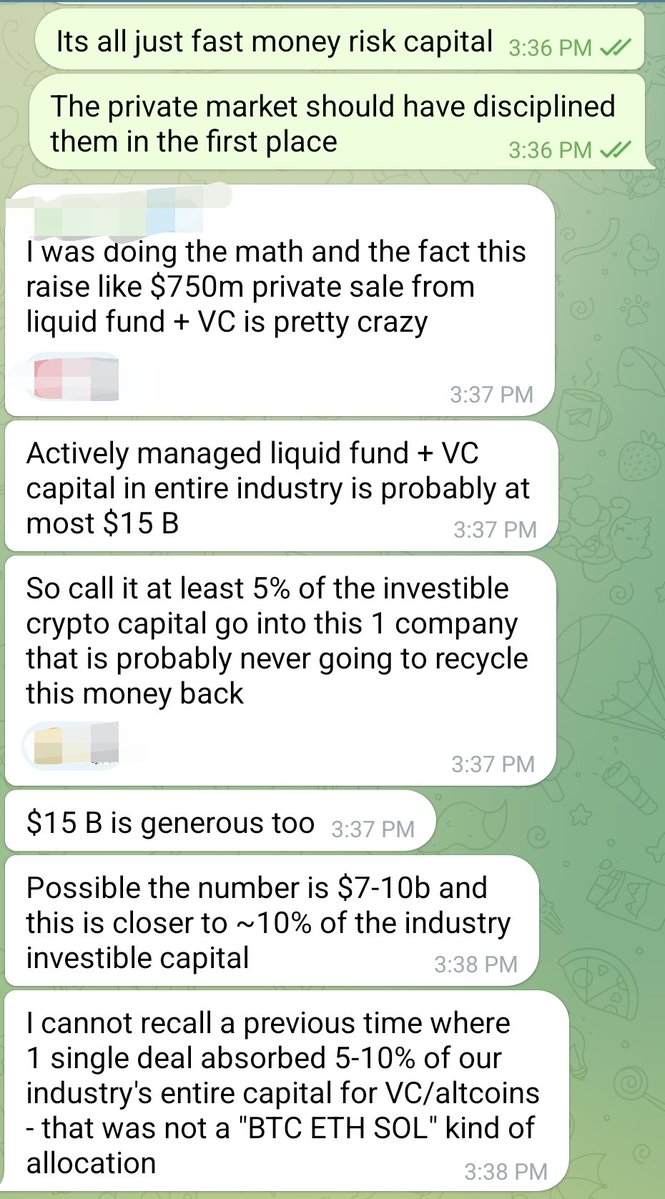

🎉 Edition 31 of my newsletter, The Funding, is live! Many thanks to Rob Hadick >|<, Arthur, Cosmo Jiang, Rajiv Patel-O’Connor, Balder, Ryan Watkins, Lex Sokolin | Generative Ventures, Thomas Klocanas for sharing insights 🙌 theblock.co/post/364334/wh…