Amer Sharif

@amersharifofcl

Ex @Amer19817 | Love to dive deep into: Pakistan Economy | Taxation | Accountancy | Power sector | Discriminatory Taxation on the Salaried Class

ID: 1982050984085049345

25-10-2025 11:46:04

422 Tweet

1,1K Takipçi

17 Takip Edilen

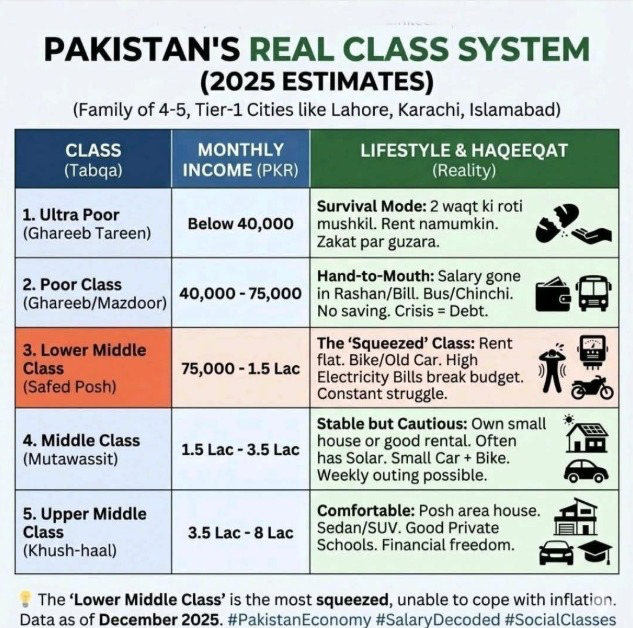

Out of 25 crore, Pakistan has only 1.8 lakh legitimate Upper class people. The rest are thriving on gray economy. The way out: Digitize the economy & kill the bank notes. Courtesy:Amer Sharif

Amer Sharif People talk about salaries but real class changer is generational wealth . A person with generational wealth earning 200k is usually better off than a self made 400k earner

Invest Kar Do Amer Sharif This is what i was looking for in my own life. If you want a car or a house then you’d be be depressed. 200k to 250k just to pay expenses and one hot summer month gets to 100k plus electrictiy month and you get fucked

Invest Kar Do Amer Sharif Invest Kar Do Very prudent point. In 20 years i learnt one thing. In Pakistan, you only change your condition if you have generational wealth. Otherwise, you just move around from fire to fire, trying to survive.

Government need to control inflation, reduce taxes on salaried class and bring reforms in FBR. Good analysis Amer Sharif

Amer Sharif The salaried class is the easiest target for governments for several reasons.