Jeffrey A. Hirsch

@AlmanacTrader

CEO Hirsch Holdings, Publisher Almanac Trader, Editor Stock Trader’s Almanac | “Those who understand market history are bound to profit from it!”

ID:55308734

http://www.stocktradersalmanac.com 09-07-2009 17:58:07

10,3K Tweets

37,3K Followers

1,0K Following

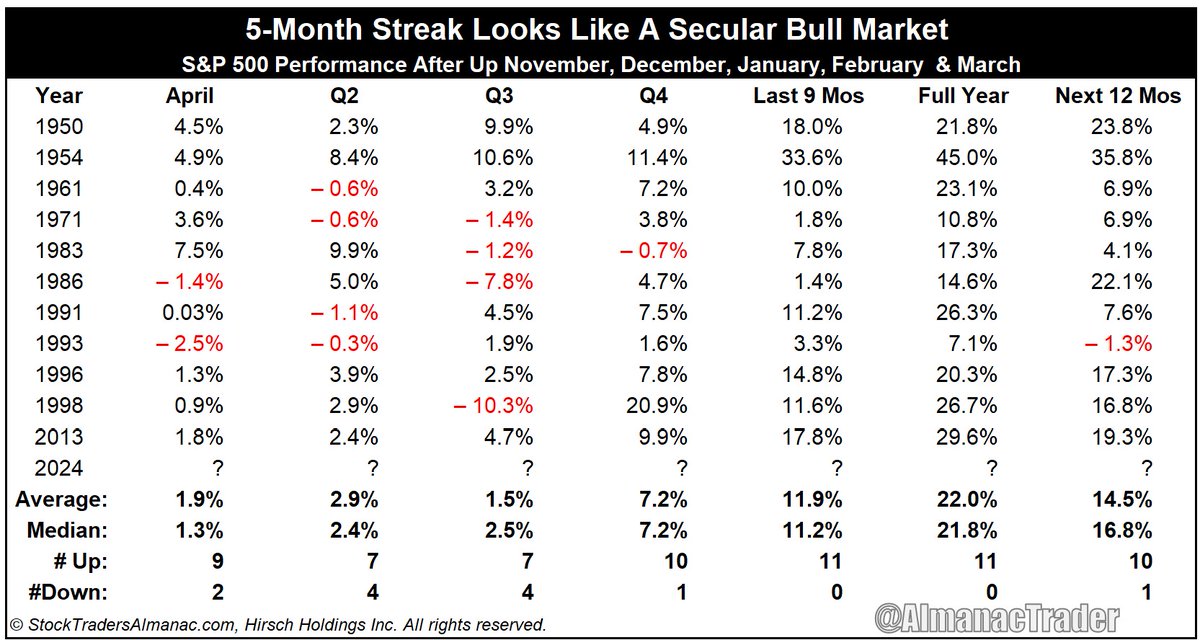

I am scheduled to join Making Money w/Charles V Payne on FOX Business today Friday at 2:15pmET. I will discuss a couple seasonal sector ETF picks and mid-cap pharma stock pick. Plus Election Year seasonality and gearing up for the end of the Best 6 Months in April.

Evan Stock Talk WOLF Kevin Green (KG), MSDA Monetive Wealth Tom Nash Shay Boloor Against All Odds Research Logical Thesis Nate | WFH Trading Don’t miss the market analysis on Spaces this Tuesday at 3 PM EST!

Featured Speakers:

Evan

@StockTalkWeekly

WOLF

Kevin Green (KG), MSDA

Monetive Wealth

Against All Odds Research

Logical Thesis

Brian Lund

Jeffrey A. Hirsch

Steven Strazza

Scott Redler

Frank A Delaney

Mark Sebastian

twitter.com/i/spaces/1kvJp…