Dustin Jalbert

@2x4caster

Mainer🌲 Wood products analyst 🏘️ Macro tourist 📊 Opinions are my own. @Fastmarkets.

ID: 550652423

https://www.risiinfo.com/ 11-04-2012 03:10:18

33,33K Tweet

6,6K Followers

1,1K Following

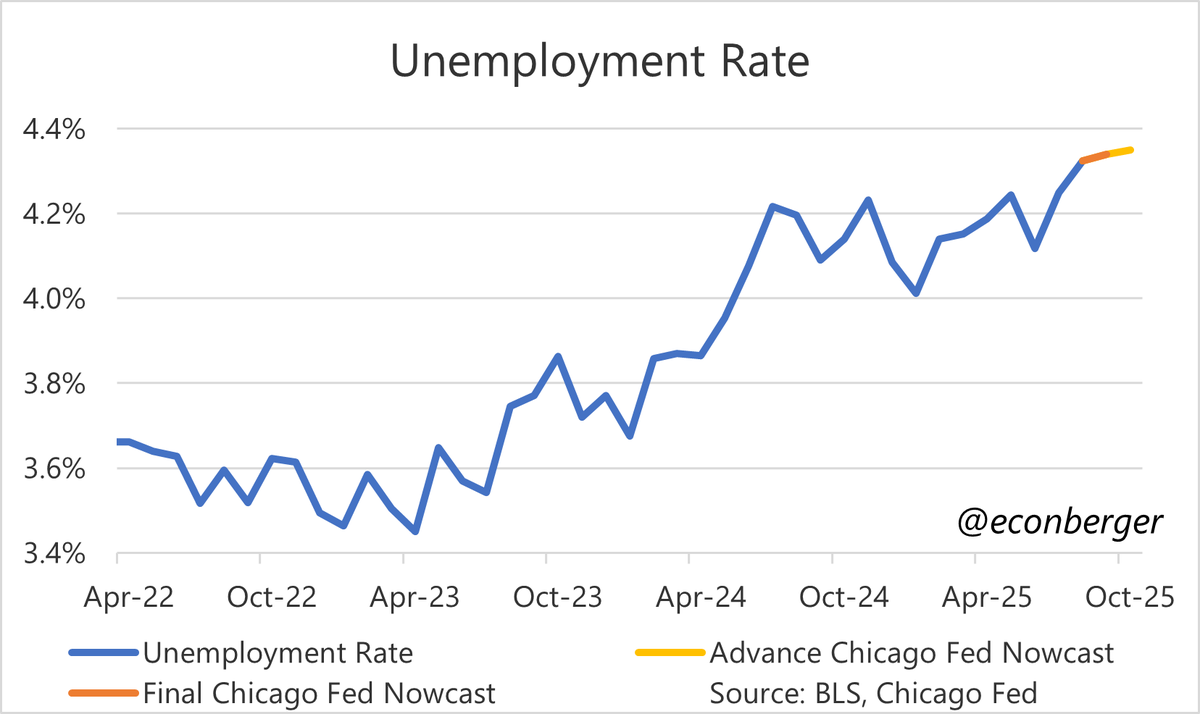

The ChicagoFed unemployment rate nowcast, which imho is one of the most valuable labor market indicators during the ongoing shutdown, shows a very small upward increase (to 4.35%) in their advance October estimate.