MisterBits 🚬 (unemployement arc)

@0xmiguelbits

/// probably know me for y2k.finance & ivx.fi & sophiaverse.ai ///

building systems that override TradFi and generate you lots of cashmoney

ID: 1475915126519877637

https://github.com/MiguelBits 28-12-2021 19:42:49

1,1K Tweet

797 Followers

1,1K Following

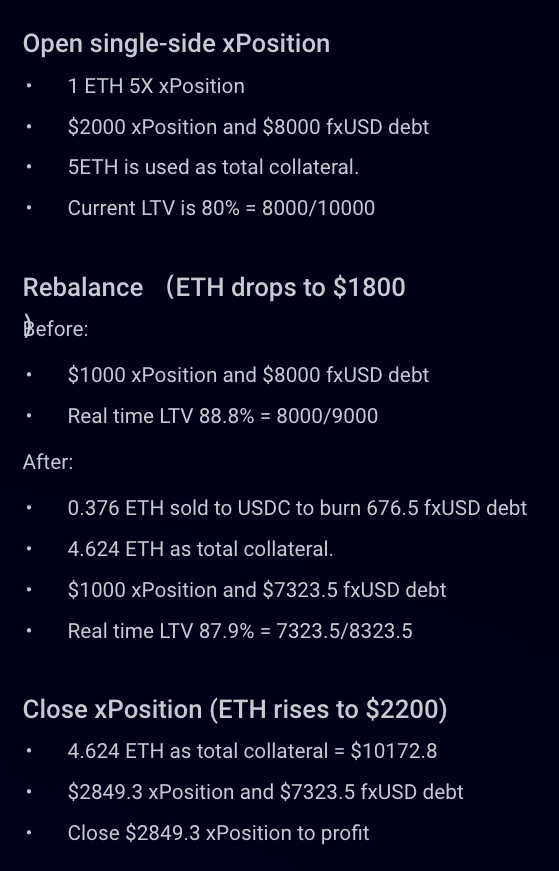

Liquidation protection on f(x) Protocol works by selling some collateral at 88.8% LTV to maintain LTV one tic below that... Meaning if you let a position get rebalanced, you're basically max-longing the bottom instead of getting liquidated No funding fees, liquidation

Edgy - The DeFi Edge 🗡️ in stables we trust Edgy

😮 The Fed will restart QE this year? Goldman Sachs believes the Federal Reserve will start expanding its Treasury holdings again soon. According to this chart (h/t Brent aka Blacklion), current GS expectations are that Fed Treasury purchases will begin again in Q4 2025. But at a

![Axel 💎🙌 Adler Jr (@axeladlerjr) on Twitter photo Best Framework for Short-Term Trades in a Bull Market

Entry Signal

- MVRV Z-Score < 0 (yellow zone)

- STH Breadth [%] SMA(14) < 20% (green zone)

Exit Signal

- STH Breadth [%] SMA(14) ≥ 90% (red zone)

- MVRV Z-Score > 1 (red zone)

Current Values

- MVRV Z-Score: 0.4

- STH Best Framework for Short-Term Trades in a Bull Market

Entry Signal

- MVRV Z-Score < 0 (yellow zone)

- STH Breadth [%] SMA(14) < 20% (green zone)

Exit Signal

- STH Breadth [%] SMA(14) ≥ 90% (red zone)

- MVRV Z-Score > 1 (red zone)

Current Values

- MVRV Z-Score: 0.4

- STH](https://pbs.twimg.com/media/GqXsrlcW8AAdW2c.jpg)