Tracy Wang

@0x_tracy

special projects + investing @hiframework / prev: @coindesk @rollingstone / NFA, views my own / gossip maxi

ID: 802320550588715008

26-11-2016 01:18:20

2,2K Tweet

12,12K Takipçi

2,2K Takip Edilen

in flight to join my Solana friends at Solana Crossroads ✨ ISTANBUL for the rest of the week say hello if you’re around IBRL

Sam Kessler Sam Kessler doing real journalism... 🔥

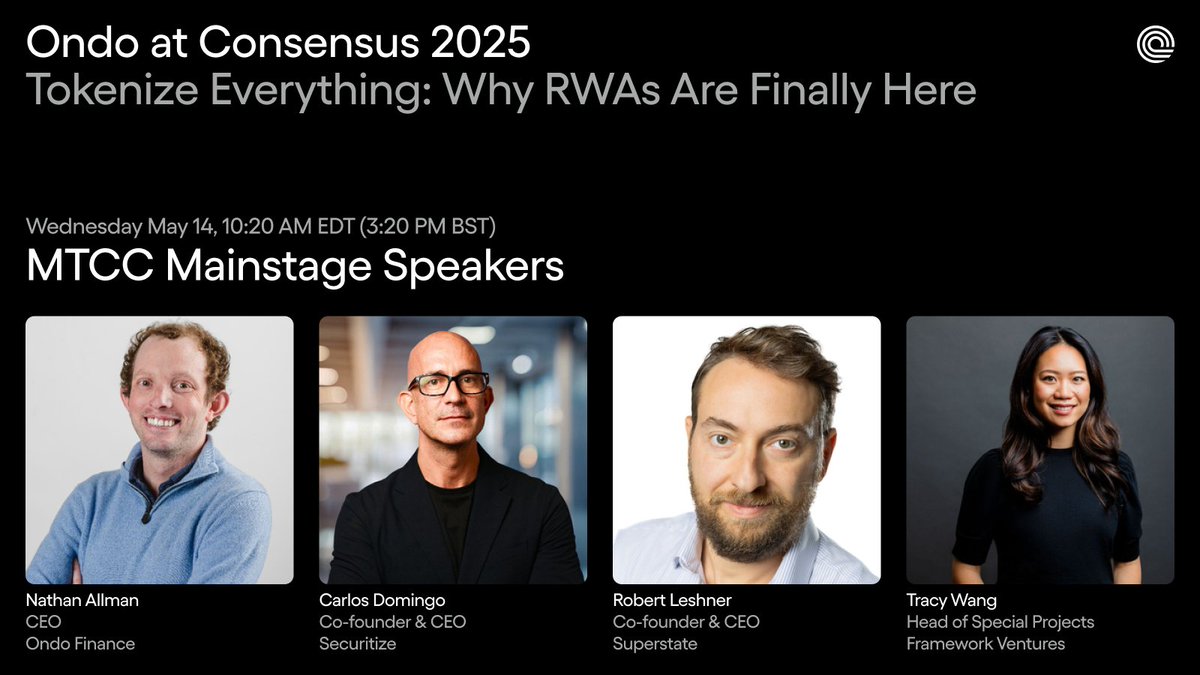

On May 14, Ondo Finance Founder & CEO Nathan Allman 🌊 takes the #Consensus2025 mainstage for “Tokenize Everything: Why RWAs Are Finally Here.” He’ll be joined by Carlos Domingo (@securitize), Robert Leshner (Superstate), Tracy Wang (@hiframework), to discuss the future of RWAs.

Amazing time chatting RWAs last week at @Consensus2025 Toronto with the best and brightest founders in the space while donning the national outfit of the people 🇨🇦👕👖 Nathan Allman 🌊 Ondo Finance Carlos Domingo Securitize Jim Hiltner Superstate