Jae Sik Choi (d/acc) 🌱

@0x_jaethorn

Portfolio Manager @0xgreythorn

Interesting take in DeFi and Web3

NOT FINANCIAL ADVICE - own views

ID: 1543769025297420290

https://www.linkedin.com/in/jaesikc 04-07-2022 01:31:45

4,4K Tweet

910 Takipçi

1,1K Takip Edilen

Georgios Konstantopoulos Don't hate on the #mooooooo Jae Sik Choi (d/acc) 🌱

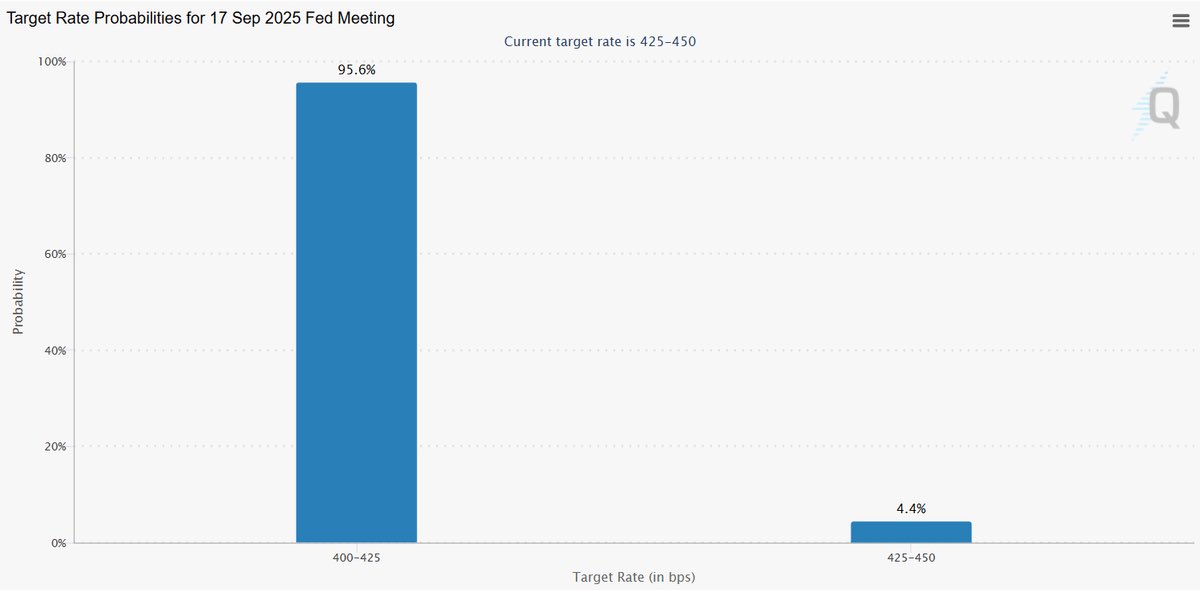

Some good commentary from Joseph Wang on-air with Charles V Payne recently: Comments on Fed Independence: Fed Reputation and Governor Cook Allegations - The Fed highly values its reputation. - Previously, several Fed officials were forced out due to reputational damage, though not