Great Krisfi

@0xkrisfi

Crypto analyst and DeFi addict.

Busy finding the next 100x. Tweets aren’t financial advice.

Connect with me: @0xKrisfi

ID: 1702357608819232768

14-09-2023 16:25:13

3,3K Tweet

20,20K Takipçi

412 Takip Edilen

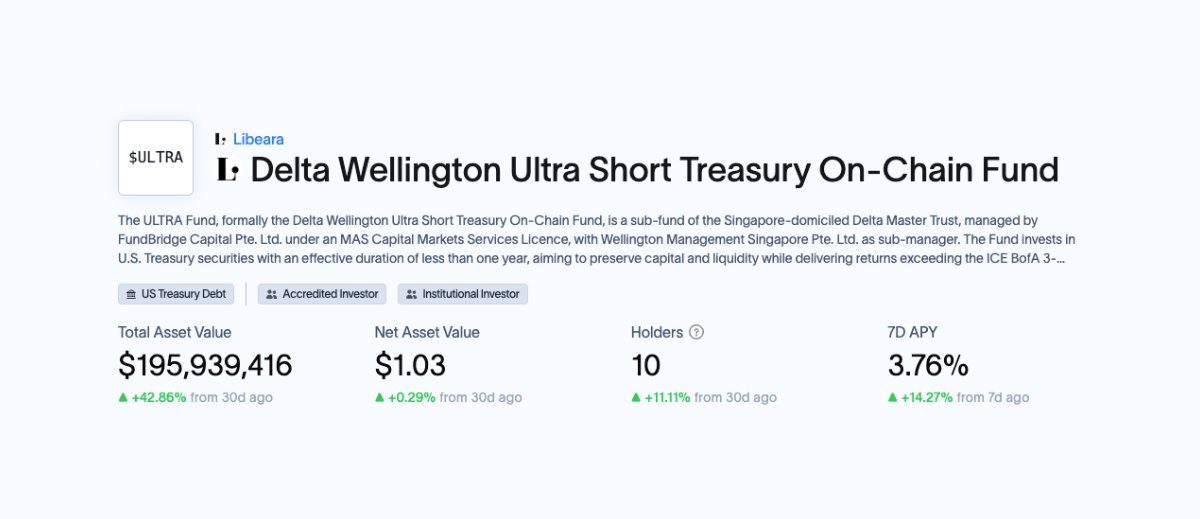

Tokenizing RWAs often feels fragmented + Issuance on one platform + Custody on another + Trading, lending scattered across chains Mavryk Network | Tokenizing $10B in RWAs aligns it all through a dedicated RWA Layer-1. From asset origination to fractional trading and DeFi utility ➜ $50 entry into

There’s a noticeable difference when a post-TGE project focuses on product execution over attention loops. Mavryk Network | Tokenizing $10B in RWAs rolled out live tools with clear direction. Not placeholders. Not previews. Actual systems connecting custody, assets, and onchain utility. Watching how

My recent favorite reading from Mavryk Network | Tokenizing $10B in RWAs’s recap: Tokenization is shaping up as a core layer across sectors. + Real estate, AI marketplaces, and new asset classes are moving on-chain + Value is being stored, moved, and accessed in programmable formats + Chainlink

The era of ComputeFi is right here. One final step before the mainnet of Cysic (mainnet arc) - your new pfp maker sounds pretty interesting. To me, Cysic may think of allowing users to put their mascot on the site and remix it with ComputeFi-ed style. btw, this is so cool.