Joe Hughes

@joehughestax

Econ and tax policy nerd @ITEPtweets. Tennessee boy. Personal account.

ID: 1635299024109727744

13-03-2023 15:17:33

384 Tweet

110 Takipçi

168 Takip Edilen

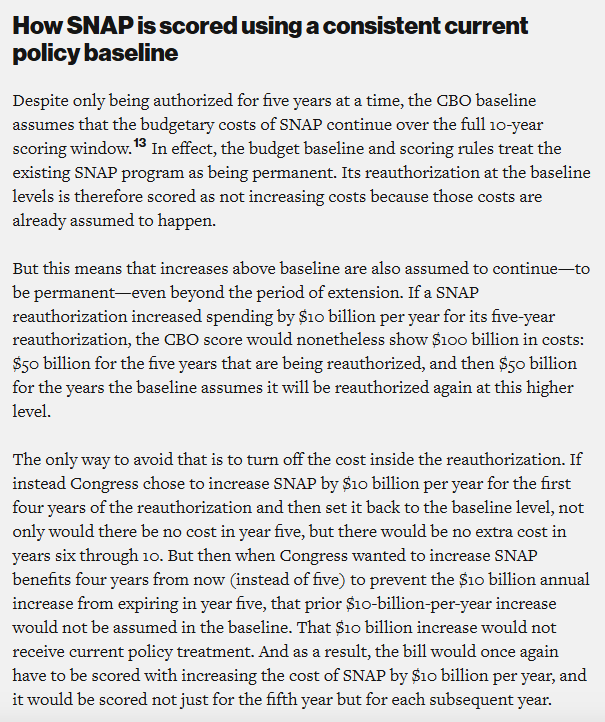

New piece from me, Brendan Duke, and Sophie Cohen on why using a current policy baseline for TCJA is a major gimmick. Crapo's argument is *dead* wrong. What he's asking for is not parity and is instead special treatment that no program has ever received. americanprogress.org/article/republ…

Elon Musk has us barreling toward a government shutdown. Next, he's going to try to use DOGE to cut crucial programs that people rely on in order to fund tax giveaways for himself and his billionaire friends. 💰 New from Lindsay Owens ⬇️

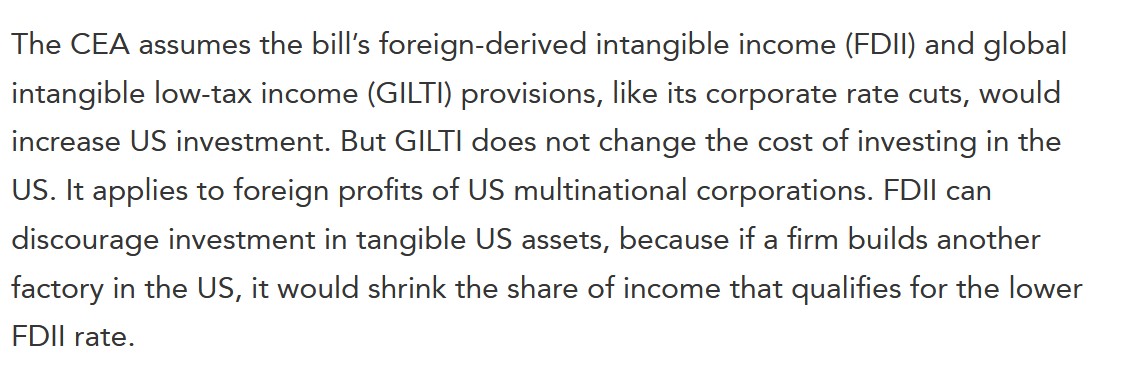

America-first or America-last? If Rep. Jason Smith Ways and Means Committee Republican Study Committee are serious about America-first tax policies, here's a place to start: end hundreds of billions of $ in tax breaks and loopholes for big companies that outsource profits and domestic jobs overseas