Mohamed A. El-Erian

@elerianm

President, Queens' College, Cambridge Uni. Allianz, Gramercy advisor. Wharton Professor. Lauder Senior Fellow. Former Pimco CEO/co-CiO. Chair Cambridge Union.

ID:332617373

http://mohamedel-erian.com 10-07-2011 04:00:32

24,7K Tweet

681,6K Takipçi

1,0K Takip Edilen

Follow People

The Varsity interview with Mike Spence and Reid Lidow, two wonderful co-authors.

varsity.co.uk/interviews/274…

#Economy #cambridge #permacrisis #econtwitter

Some thoughts on the challenges facing those forecasting an inherently uncertain global economy experiencing major structural transitions, both domestically and internationally.

project-syndicate.org/commentary/us-…

Project Syndicate #economy #markets #EconTwitter

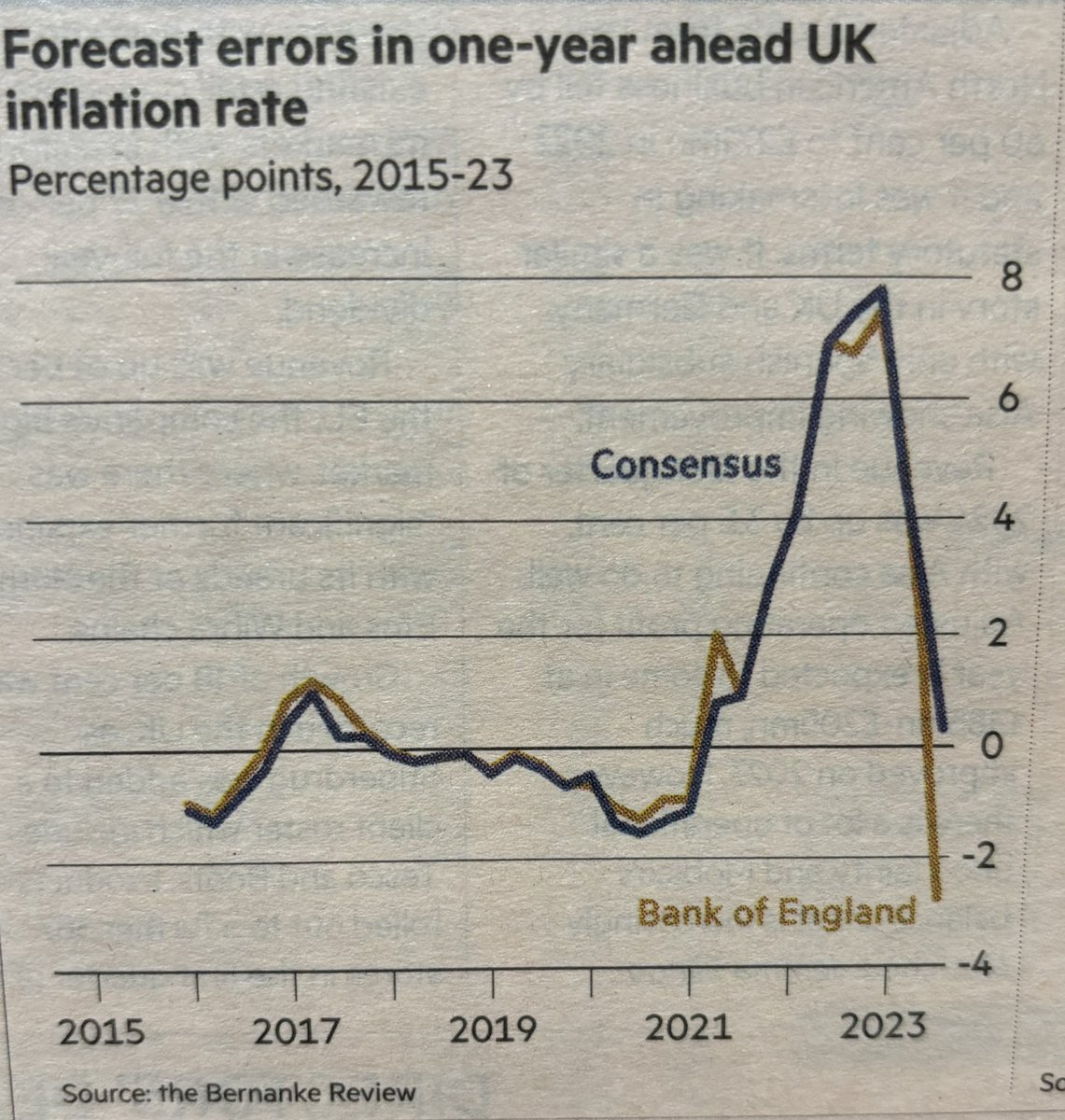

From the Financial Times column by Martin Wolf, 'What we must still learn about the great #inflation disaster: Past and present policymakers should ask more searching questions about the causes and impact of the price surge.'

#economy #markets #econtwitter

Some thoughts on the challenges facing those forecasting an inherently uncertain global economy experiencing major structural transitions, both domestically and internationally.

project-syndicate.org/commentary/us-…

Project Syndicate #economy #markets #EconTwitter

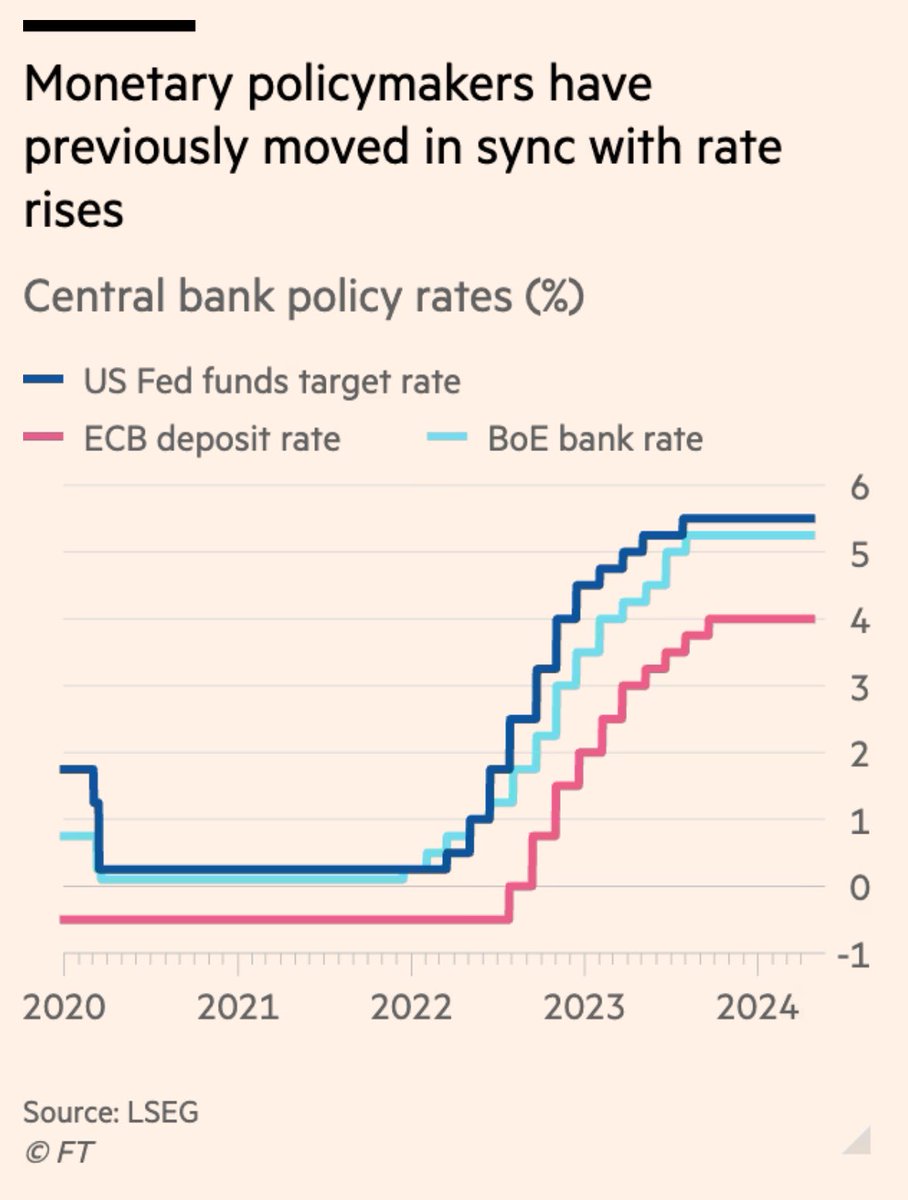

“As the US reported the latest in a string of poor #inflation figures, markets reined in their forecasts for rate cuts by the European Central Bank and the Bank of England, as well as by the Fed itself.”

As captured by this Financial Times quote, the markets’ repricing of central bank cuts…

The difficulties facing economic and market forecasters are complicated by two broader phenomena that could last for years to come, cautions Mohamed A. El-Erian. bit.ly/3QlNef4

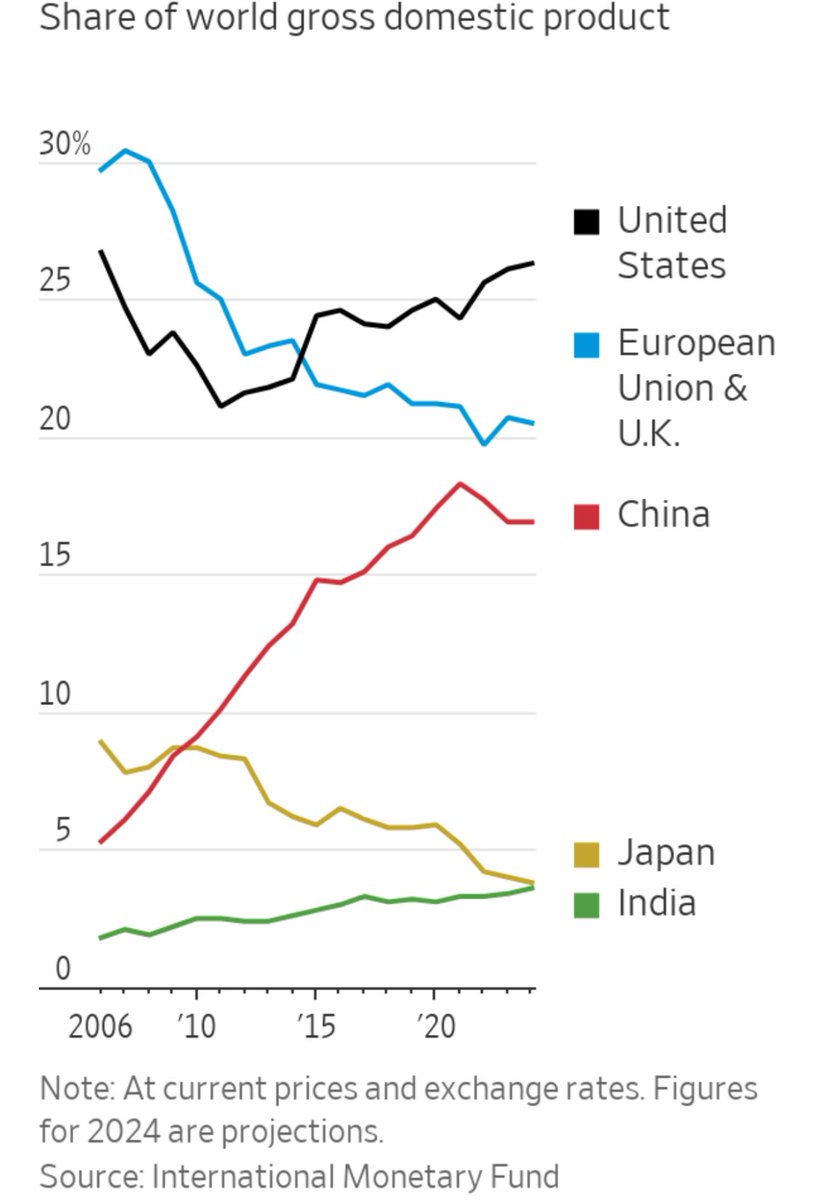

With globalization giving way to fragmentation, we will continue to see a greater divergence in outcomes between and within countries, writes Mohamed A. El-Erian. bit.ly/3QlNef4

.Mohamed A. El-Erian sees three issues as key to deciphering what 2024-25 will look like for the US economy: the Federal Reserve, low-income consumers, and the effects of new technologies on economic, social, and political life. bit.ly/3QlNef4

Looking forward to the #FederalReserve 's policy meeting next week:

Not just the recent elevated readings of actual #inflation will make officials a little uncomfortable about the dovish December pivot.

Forward expectations have also moved up. At 3.2% for the next year,…

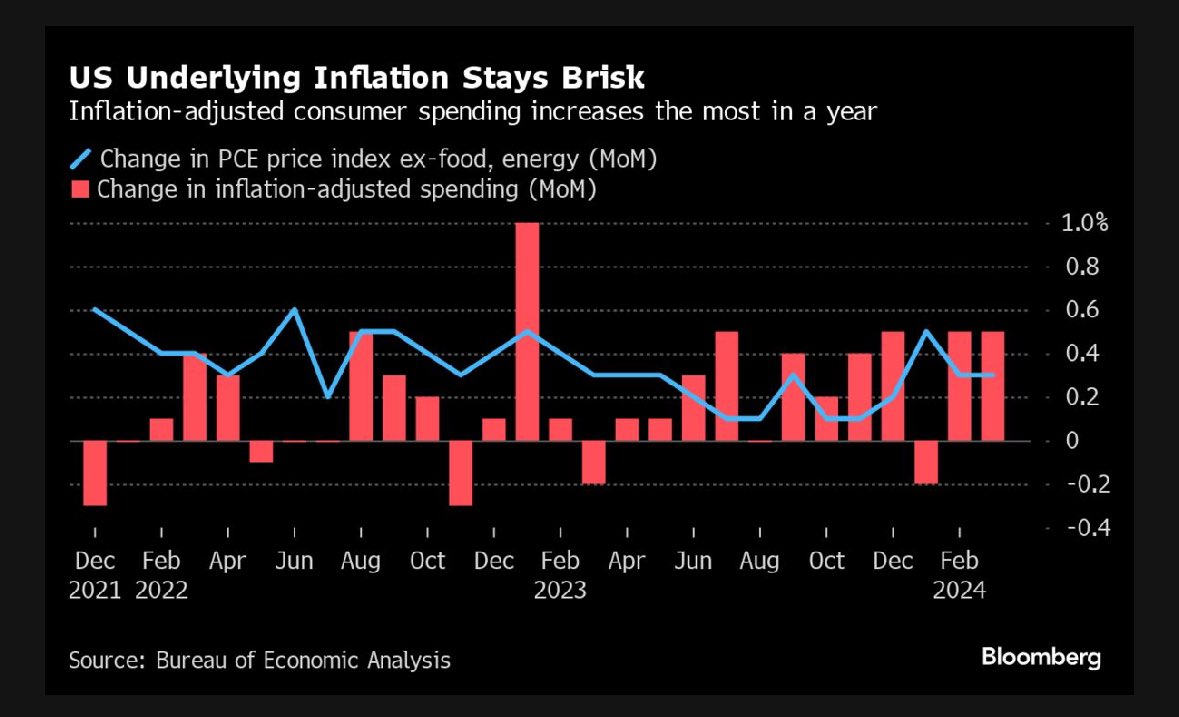

According to the just-released data, March headline and core PCE #inflation are slightly higher than the consensus forecasts (2.7 vs. 2.6 and 2.8 vs 2.7).

Having said that, the miss is smaller than yesterday, and the monthly readings are in line.

Meanwhile, personal spending rose…