PlanB

@100trillionUSD

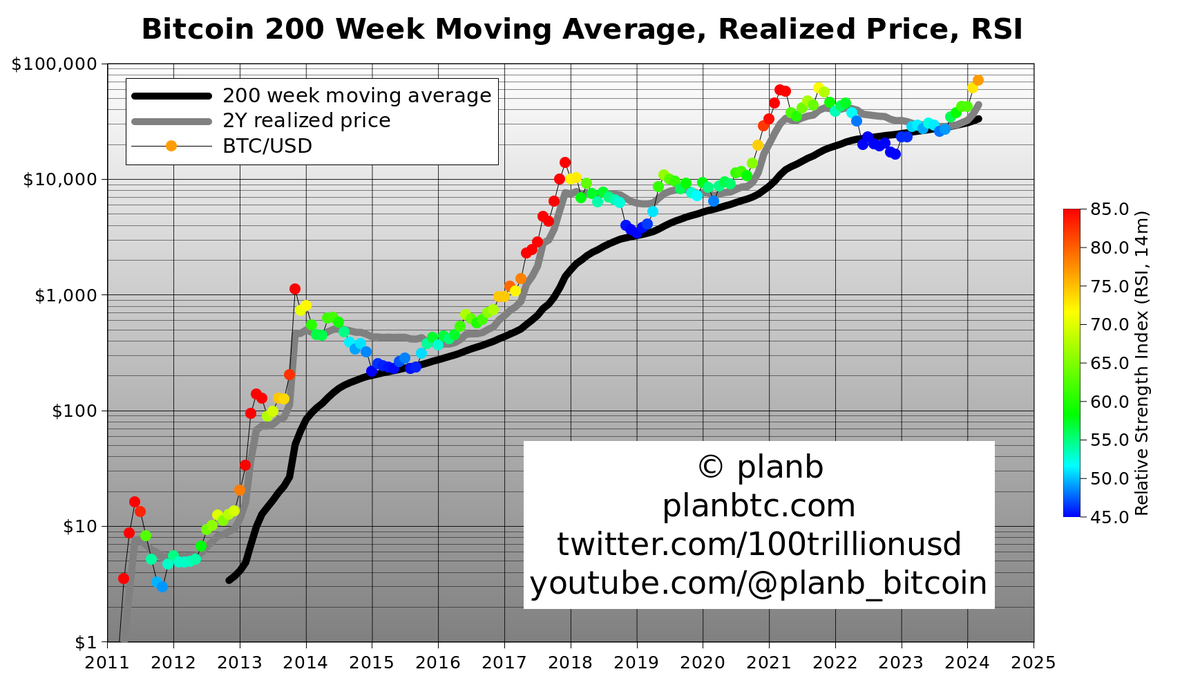

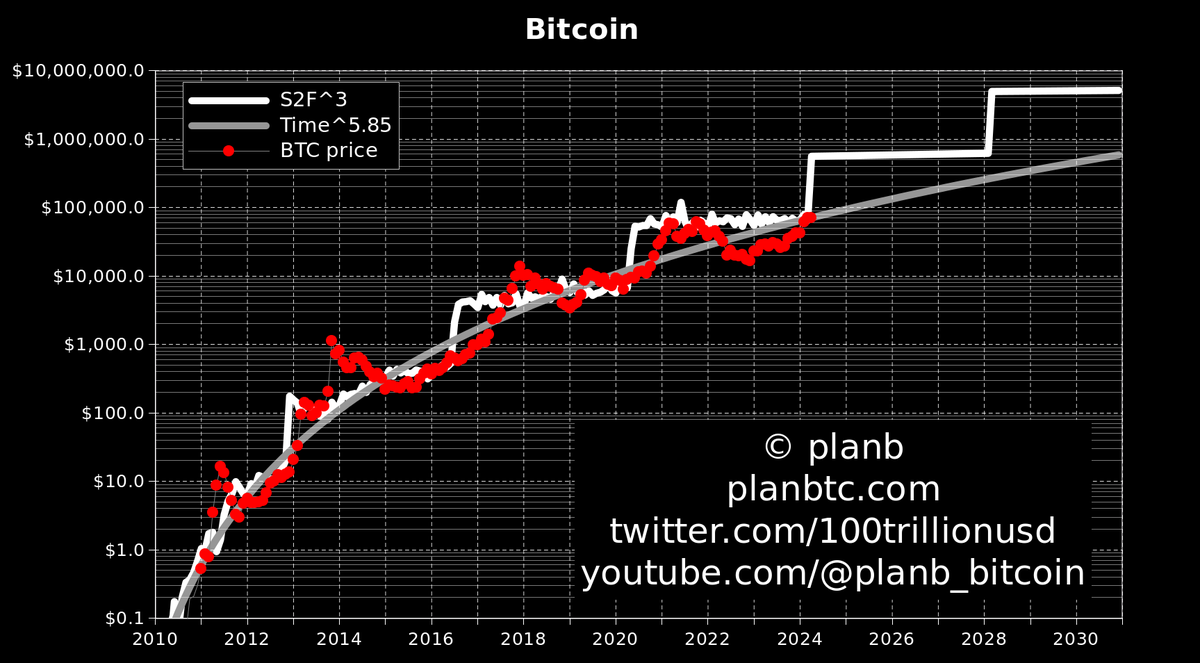

Creator of the stock-to-flow (S2F) model. https://t.co/4UQOQ8ejKv

ID:918804624303382528

https://planbtc.com/ 13-10-2017 11:44:27

12,8K Tweet

1,9M Takipçi

177 Takip Edilen

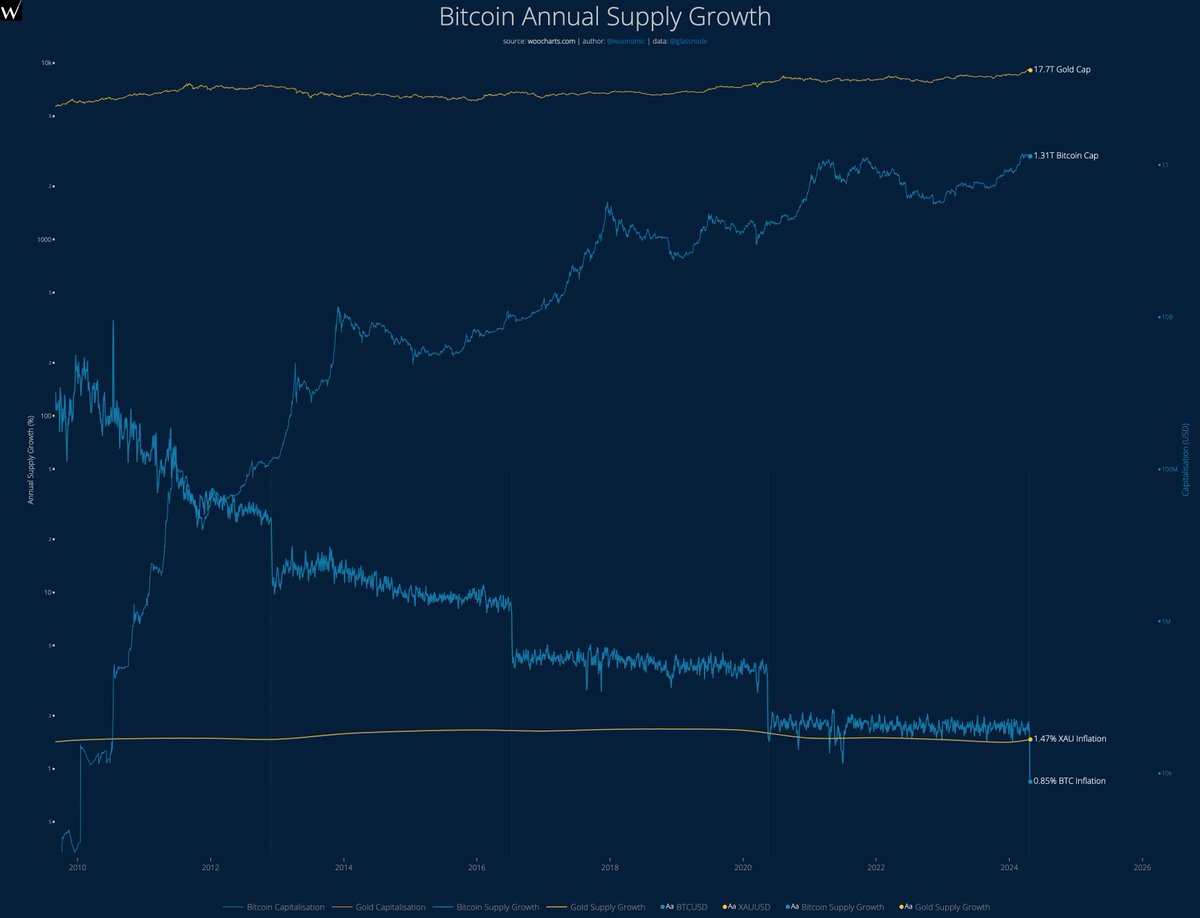

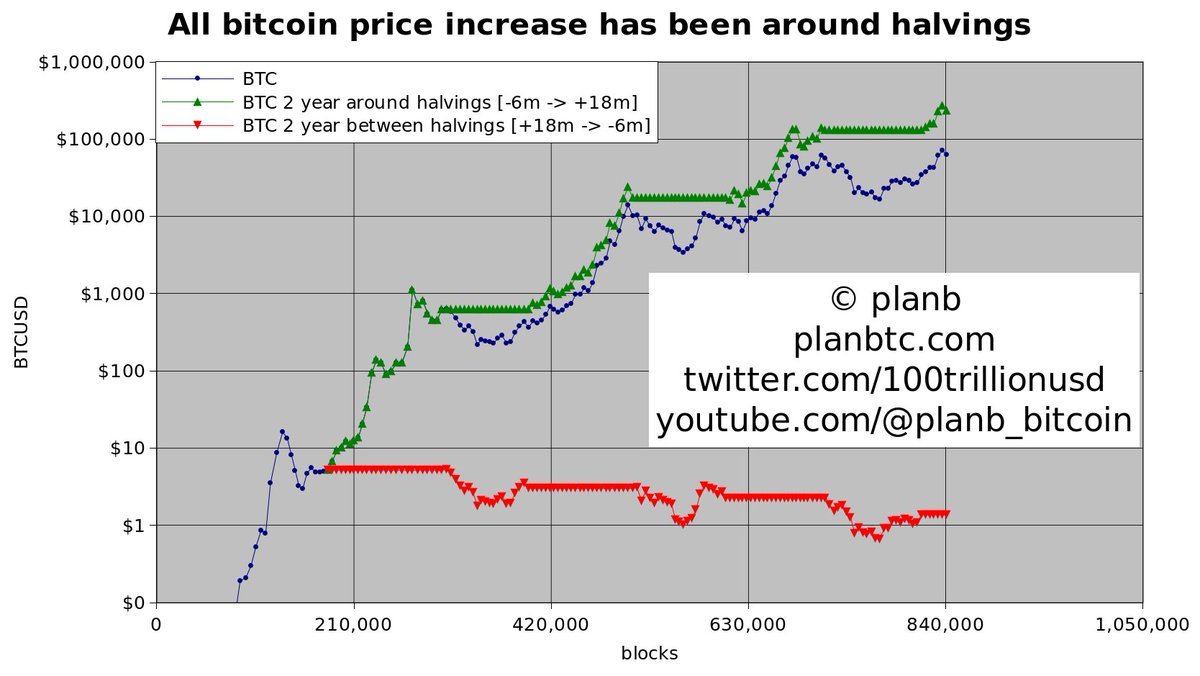

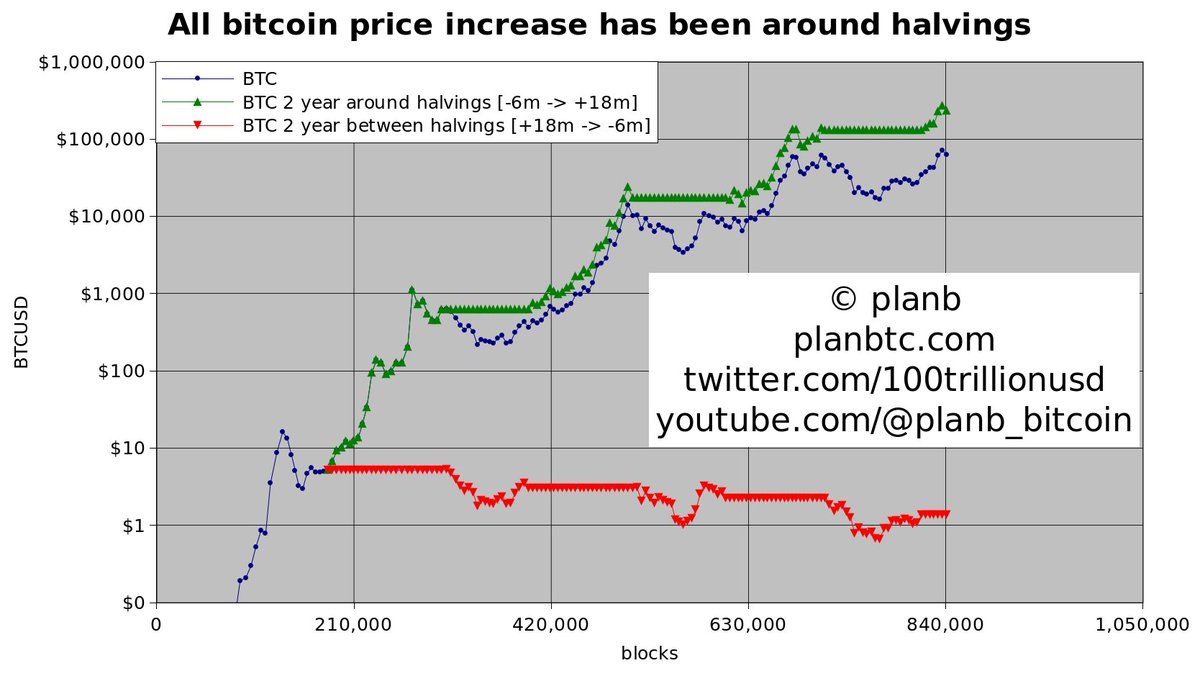

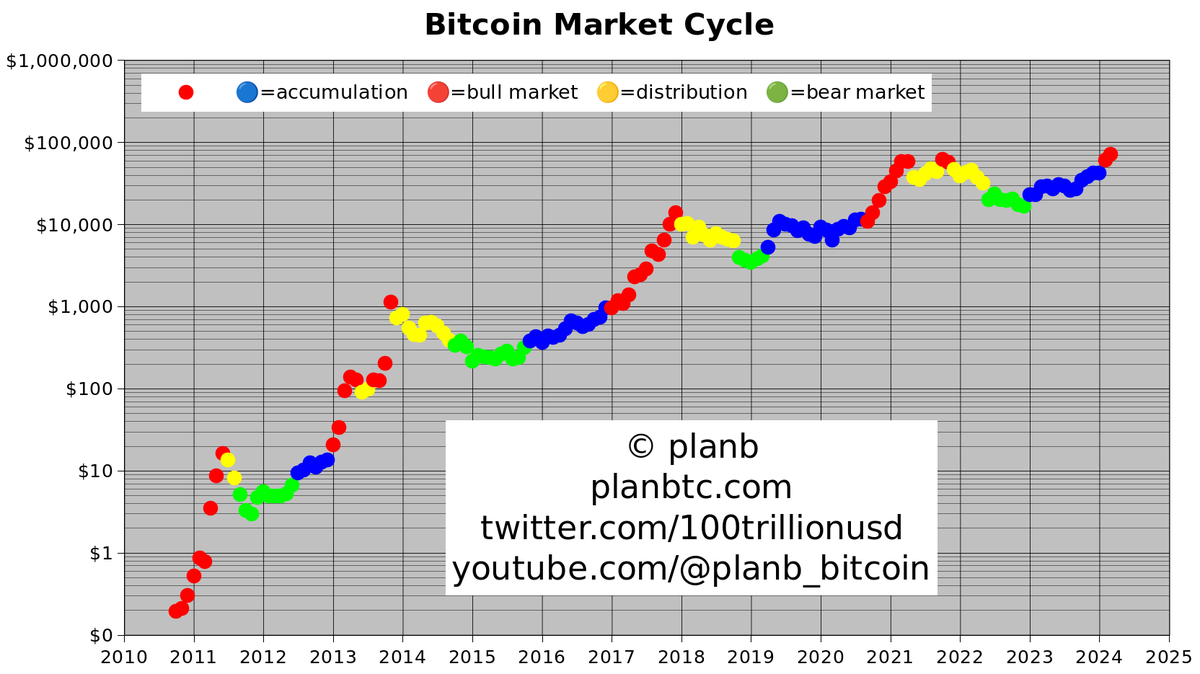

What if an investor with unlimited capital announced a program to acquire 450 $BTC daily at the market price for the next four years and hold the asset forever? What if they increased their purchases to 675 BTC daily in 2028, and to 787.5 BTC daily in 2032? #BitcoinHalving .

Funny how people like Peter Schiff Paul Krugman & Jamie Dimon think bitcoin is a bubble and pyramid scheme, while simultaneously the largest asset managers like Fidelity & BlackRock embrace bitcoin's monetary use case, and DoD Jason Lowery and others explore military use cases:

Very, very important article!

The biggest misconception with regard to gold – High stock-to-flow ratio is the most important characteristic of gold vongreyerz.gold/the-biggest-mi…

ht RobertBlumen