Many thanks to my guests on this morning's edition of Sky Business Live: kathleen brooks from XTB UK; Kriti from Thomson Reuters; James Ringer from Schroders and Shiza Shahid from Our Place. Please join me again this afternoon for our next edition at 1630 BST.

Now for Investment Journalist of the Year (B2B) #HMAwards24 , sponsored by @schroders!

Congratulations to shortlisted journalists Yuri Bender, Luke Clancy, Jeremy Gordon, Valeria Martinez, John Schaffer & david thorpe 👏

tinyurl.com/dxtr4nt8

proactiveinvestors.co.uk/companies/news…

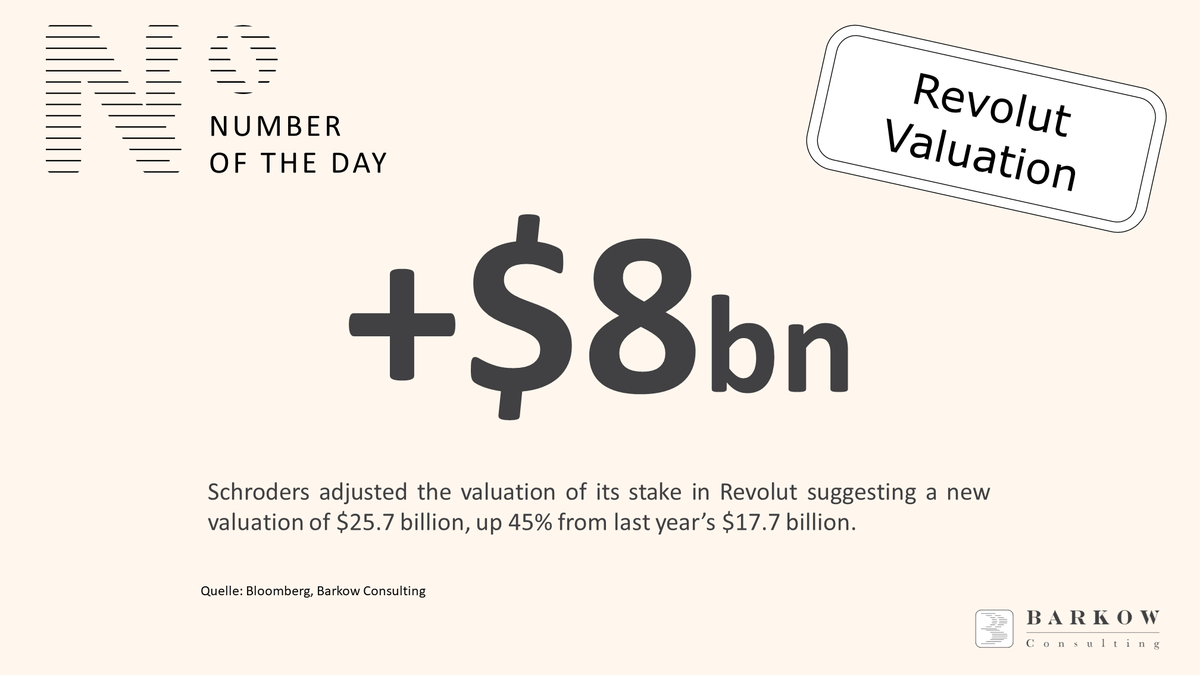

This is exactly what I am talking about. We will see a wave of uplifts in fintech valuations. The increase in Starling would be material for #CHRY . So much so that we could have all its other holdings in the price for free if Starling could ever match…

It’s time to announce the Investment Journalist of the Year (Consumer) #HMAwards24 shortlist, sponsored by @schroders!

Congratulations to Valentina Cipriani, James Fitzgerald, Moira O'Neill, Rachel RickardStraus, Michael Joseph Sheen & Jemma Slingo 👏

tinyurl.com/dxtr4nt8

Deb Boyden, Head of US Defined Contribution, spoke at Institutional Investor’s DC Institute Chicago forum and shared valuable insights on the #retirement industry's current approaches & solutions to the changing needs of an older society. More on DC here: okt.to/ZdENwQ #SchrodersEvents