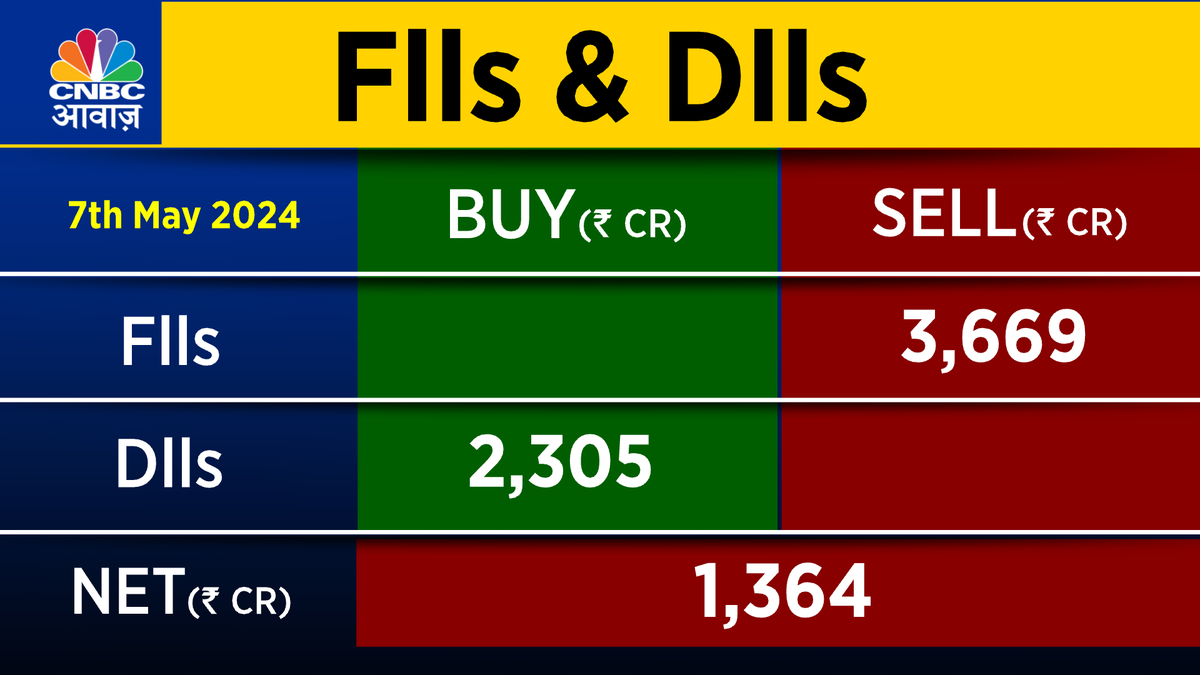

📉👀FIIs के मन में क्या है?🤔

⚡️चुनाव के नतीजों के पहले कर रहे हैं पोजीशन हल्की? 🔻

#LokSabaElections2024 #StockMarket #InvestmentOpportunity

निकुंज की नजर

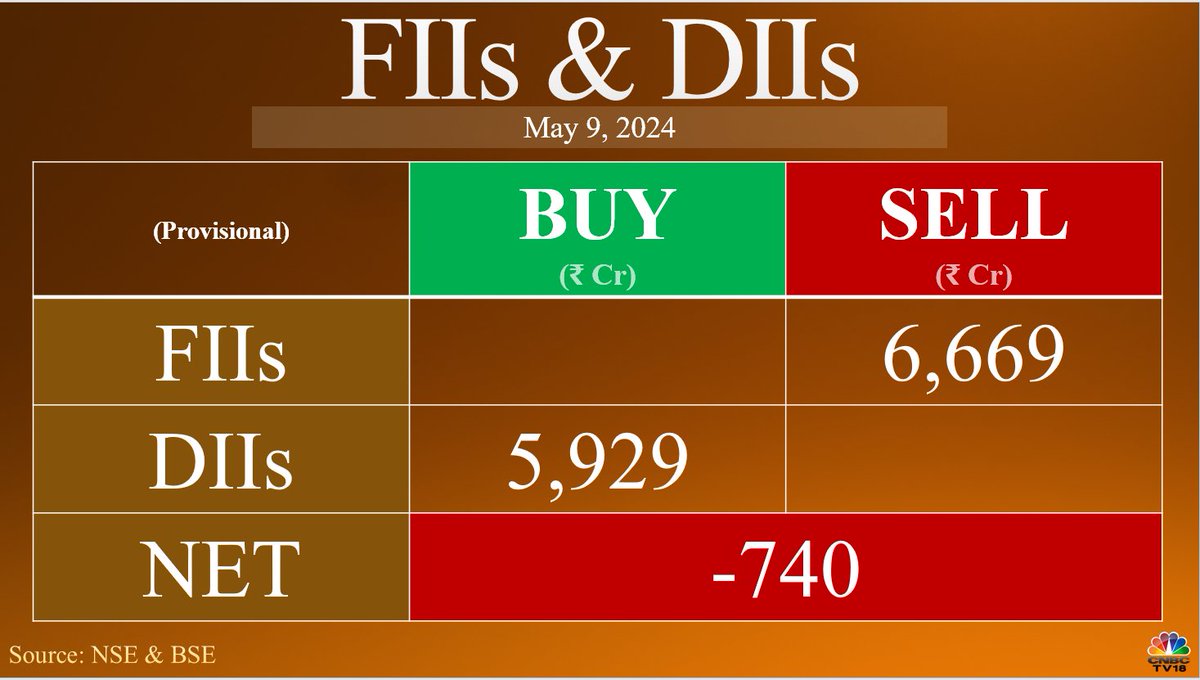

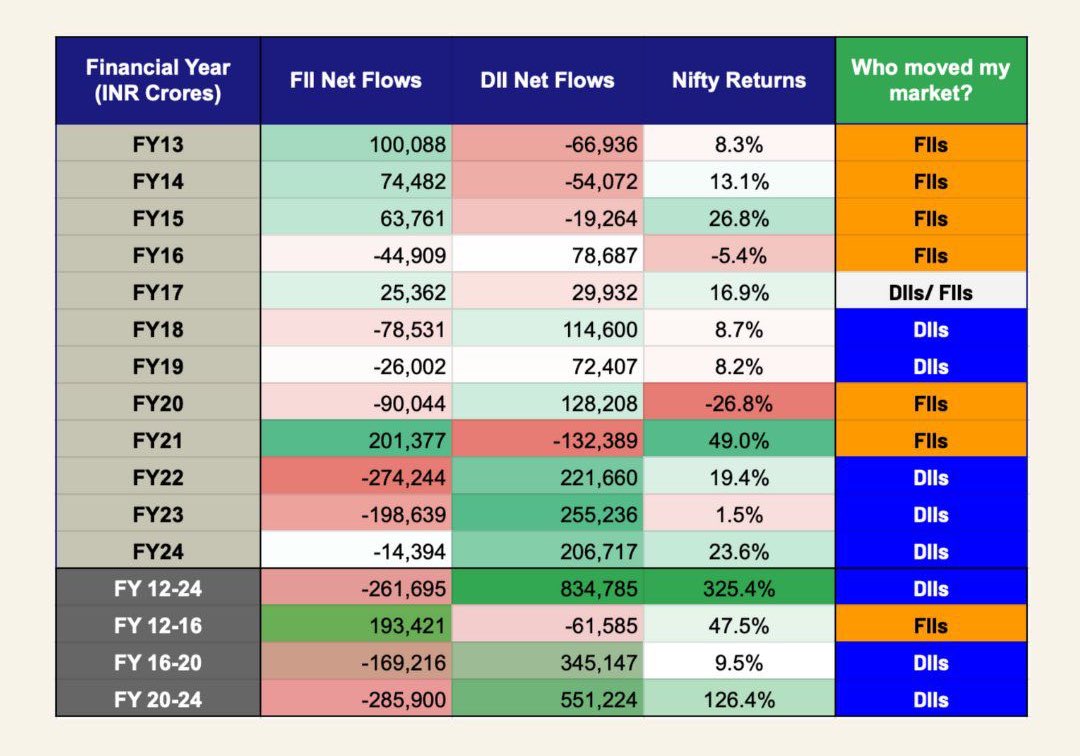

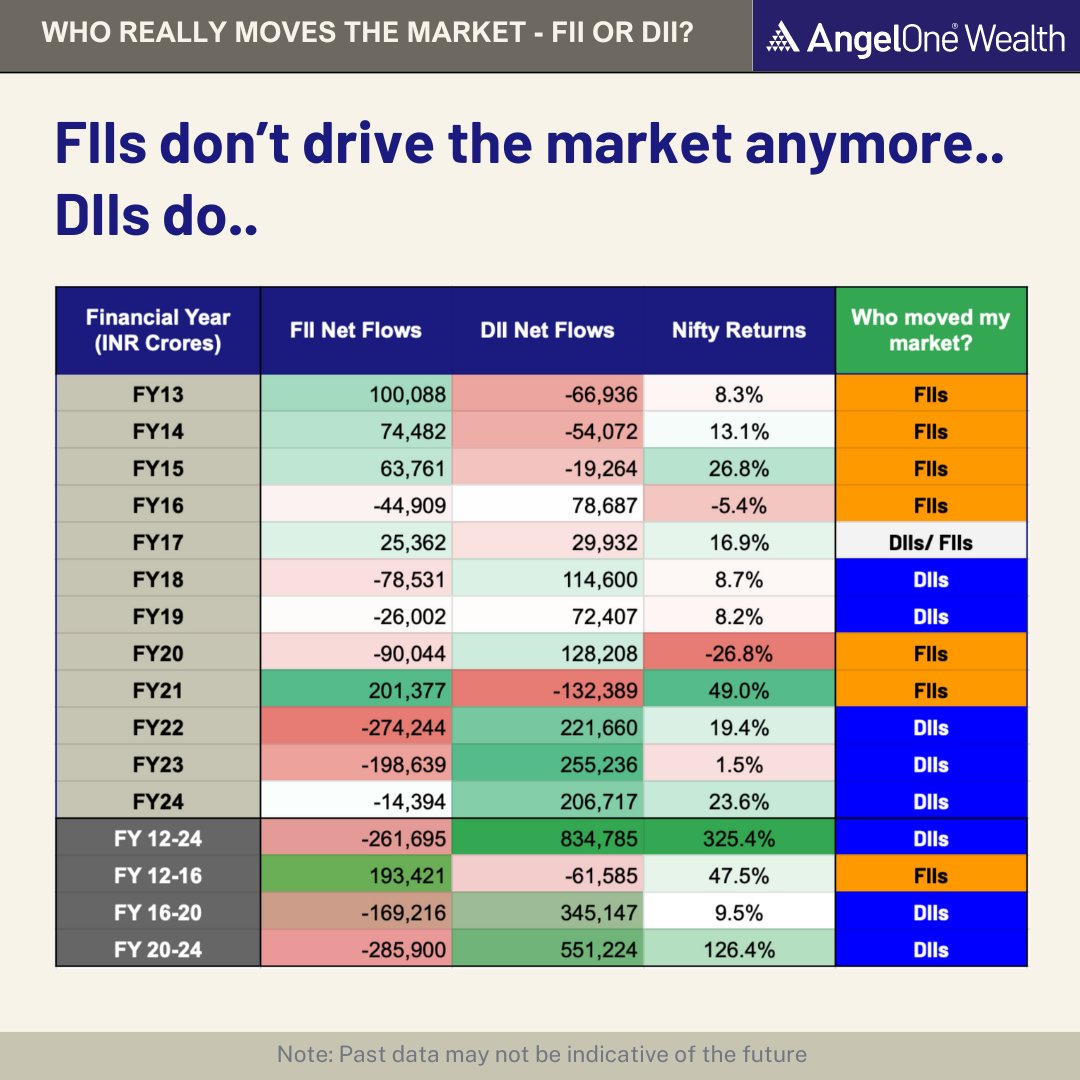

FIIs की लगातार जारी बिकवाली शॉर्ट टर्म के लिए या अभी रहेगी जारी?

चीन पर बुलिश UBS, भारत पर अंडरवेट...क्या हैं इसके मायने?

ET Now & ET Now स्वदेश के एडिटर इन चीफ, निकुंज डालमिया से समझिए

#NikunjKiNazar #NikunjDalmia #Nifty #Sensex Nikunj Dalmia Abhishek Satya Vratam

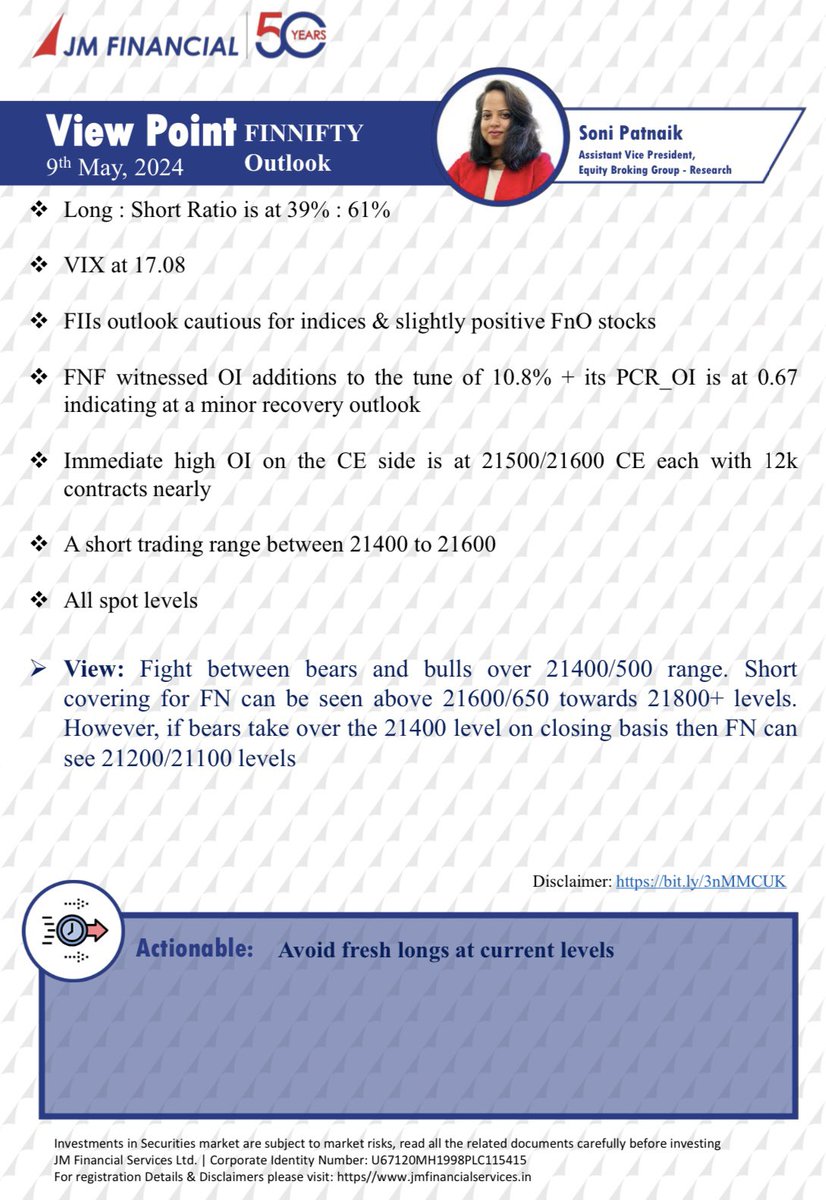

ViewPoint: FN Outlook 9th May, 2024

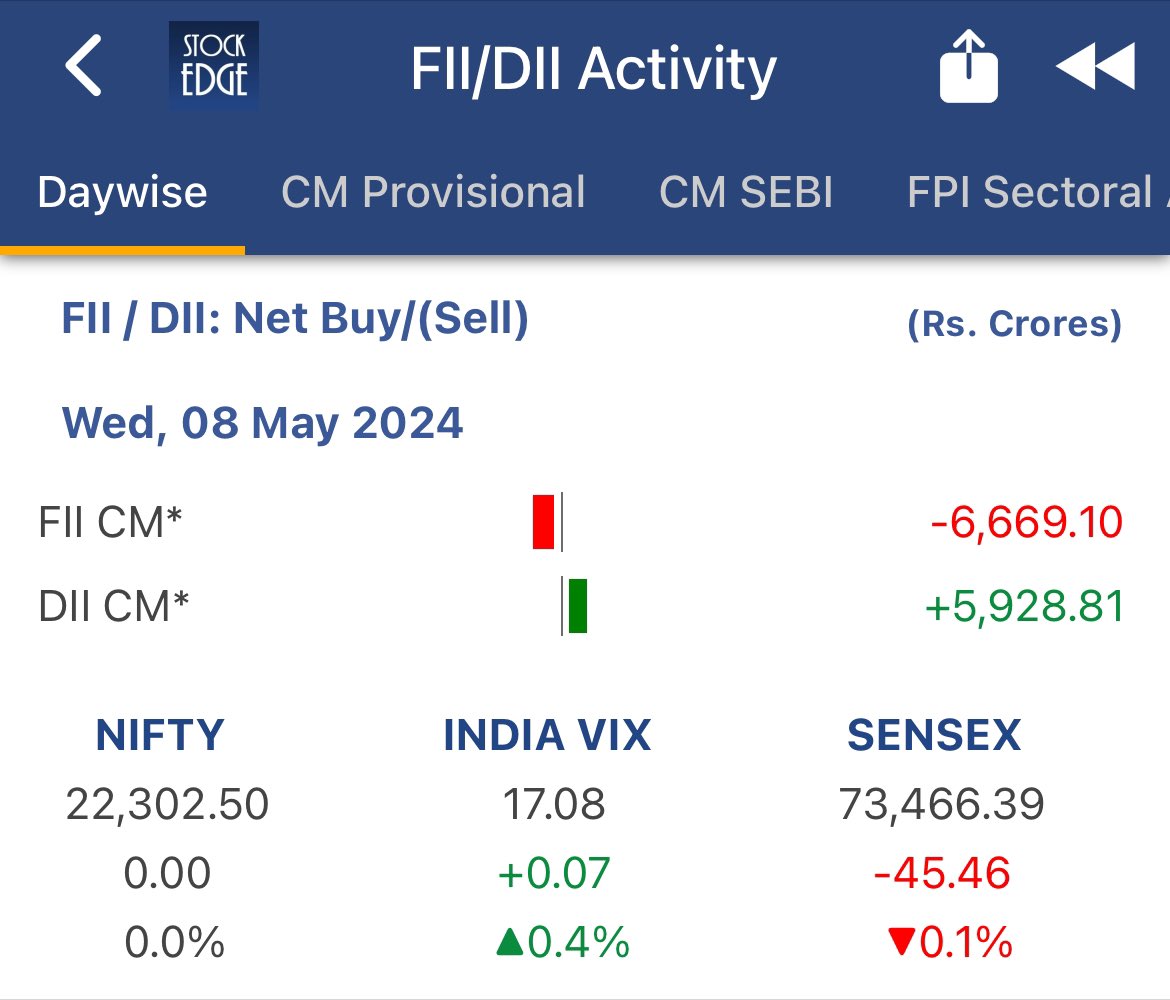

#GIFTNIFTY indicating -20 pts

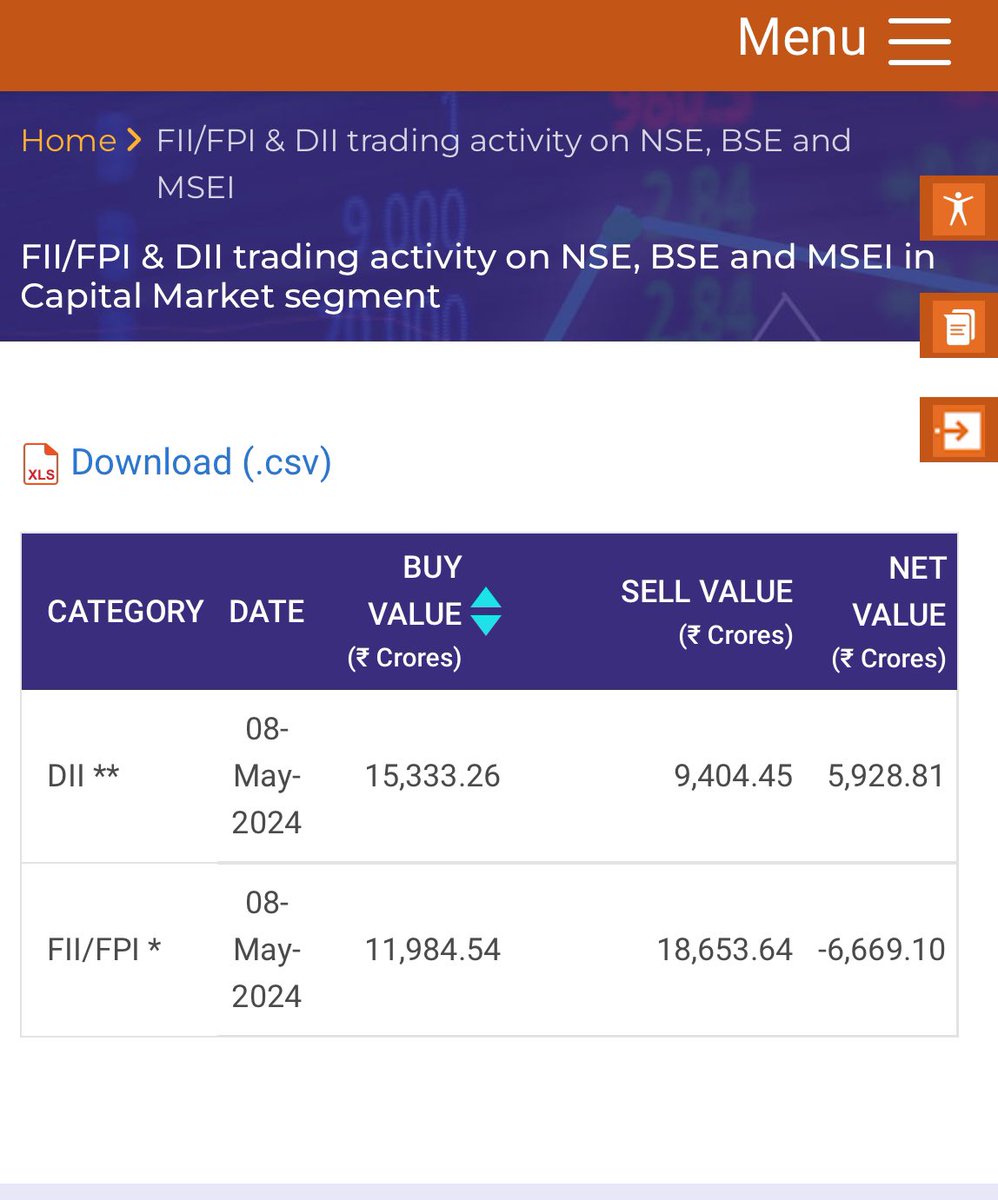

- FIIs positioning in longs have reduced to 39% (it can go till 35%/31%) 🚨

- Fight between bears & bulls for all 3 indices at current levels

#StockMarket #finnifty #nifty50 #NiftyBank #OptionsTrading

🔴 #EditorsTake | बाजार के लिए क्या है पॉजिटिव, क्या निगेटिव फैक्टर्स?

FIIs लगातार क्यों बेच रहे हैं?

अभी 'Sell On Rise' का बाजार क्यों?

PSU, Mid-Smallcap की रिकवरी सेंटिमेंट सुधरा?

NIFTY के लिए क्या है रेंज?

किन शेयरों में करें खरीदारी?

जानिए CA Anil Singhvi Zee Business से...…

निकुंज की नजर

क्या बाजार में बड़ी गिरावट आने वाली है?

क्या संकेत दे रहा है बाजार...चुनाव, इंडिया VIX में तेजी और FIIs की बिकवाली के क्या हैं मायने?

ET Now & ET Now स्वदेश के एडिटर इन चीफ, निकुंज डालमिया से समझिए

#NikunjKiNazar #NikunjDalmia Nikunj Dalmia Srishti Sharma Verma

𝐋𝐈𝐊𝐇𝐈𝐓𝐀 𝐈𝐍𝐅𝐑𝐀 #Multibagger

Mkt cap :- 1500 cr

Upside :-1000/1800/2500

TF :- 4/5 year & more time ,more upside

✴️Strong Fundamentals :-

✅Increasing Qrtrly & yearly profit continues

✅ROE-24

✅Promotors-70%(nil pledge)

✅FIIs & DIIs increased stake in march…