Sam Callahan

@samcallah

Senior Analyst @swan | Host of Swan Signal | #Bitcoin | Macro | History | Digital Privacy Advocate

ID:1136358150943256576

http://swan.com/samcallahan 05-06-2019 19:44:30

10,5K Tweets

29,2K Followers

1,5K Following

Follow People

Happy post-halving everyone!

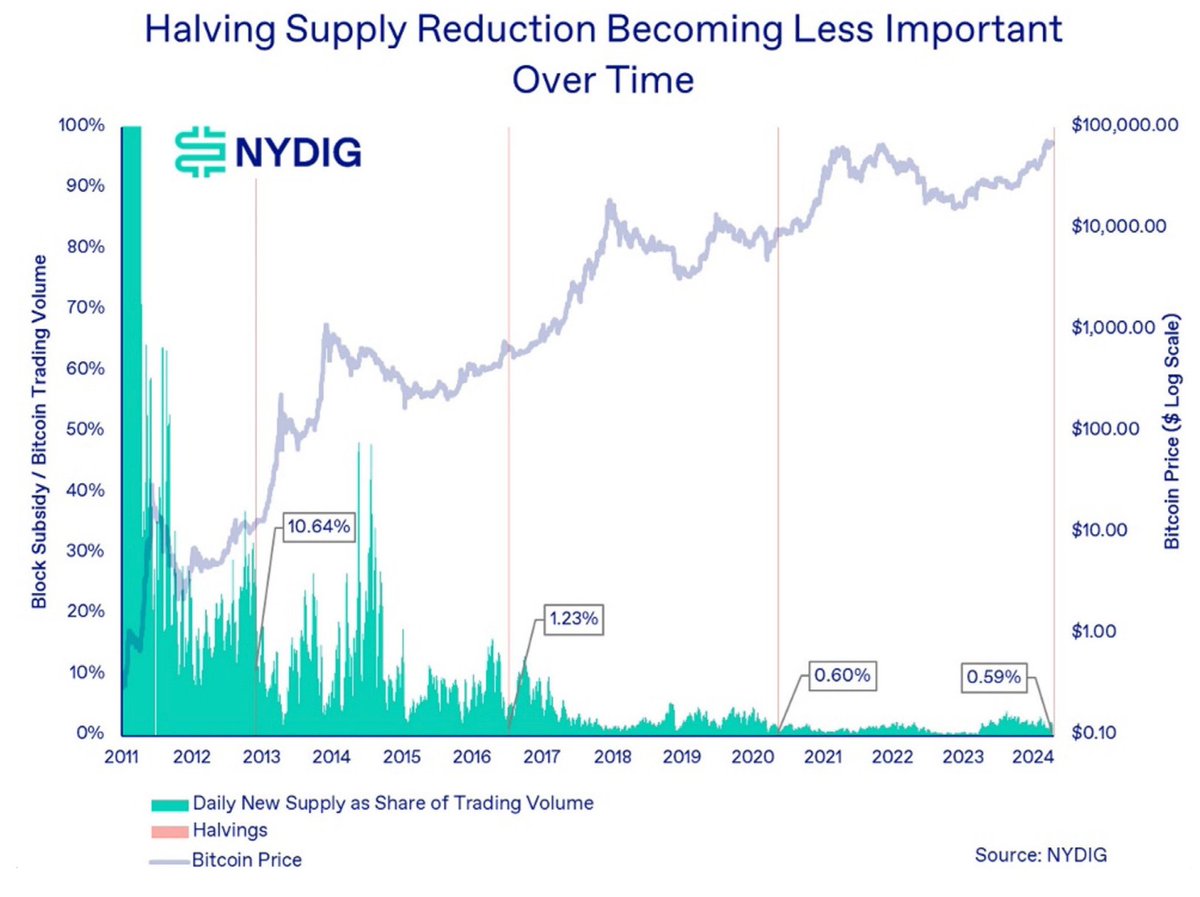

I really enjoyed this conversation with Sam Callahan where we talked about the halving.

Sam really does his homework and this was one of the more in-depth conversations I've had on our 'Understanding Proof-of-Work' report:

youtube.com/watch?v=NTyQD5…

“The industry grows much more efficient every 4 years... Only the best operators, with the best sources of electricity, and the most efficient machines are able to survive” - Sam Callahan

Pardon me for the long post, but something has been on my mind lately...

Last year, Jack Farley interviewed former Fed official Robert Kaplan. One thing from the conversation really stuck with me, and I think it's important to share it here.

In the interview, Kaplan said:

Always a pleasure to sit down and chat with Alex Thorn. Thanks for having me on Galaxy Brains!

This was a really great conversation.

My favorite part was when Chris Kuiper, CFA explains his strategy to invert the convo around Bitcoin when talking with advisors.

Instead of telling them why they should own Bitcoin, he asks them to explain why they don’t own it. Brilliant! 👏