pyradius 🔰

@pyradius

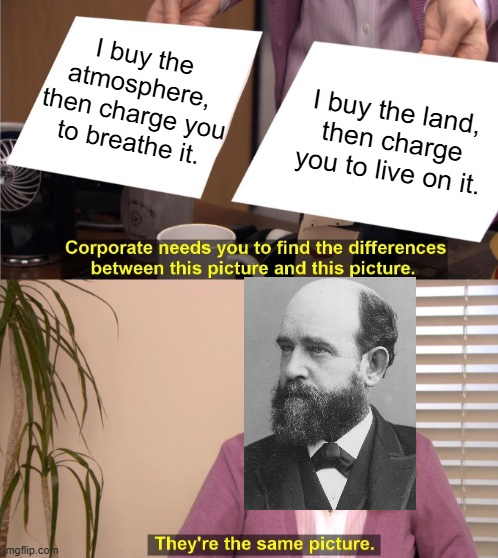

#Georgism #LVT #UBI (Citizen's Dividend) henrygeorge.org/whowashg.htm

ID: 167416263

http://www.henrygeorge.org/taxable_capacity.htm 16-07-2010 14:50:32

30,30K Tweet

1,1K Followers

2,2K Following

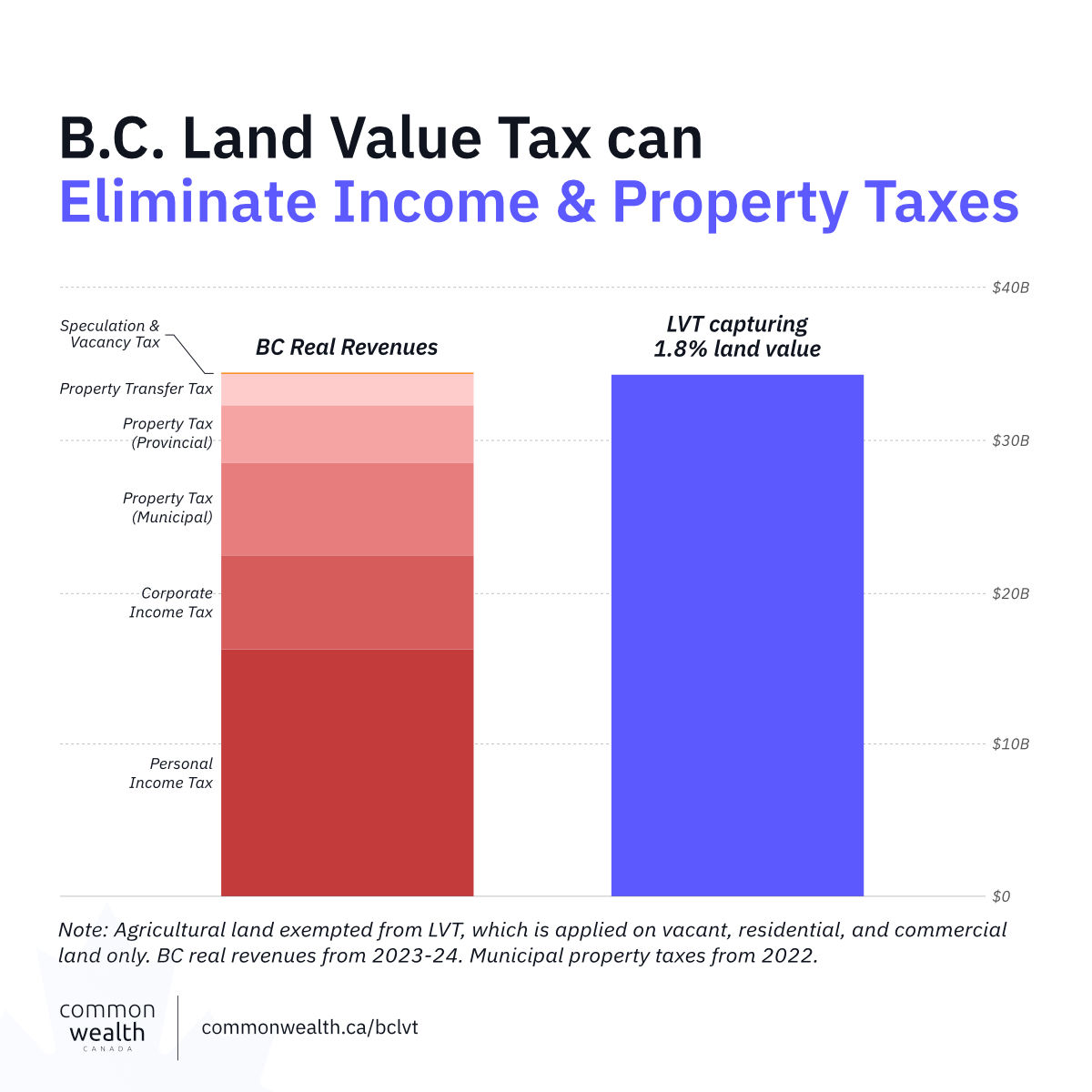

In Greater Greater Washington Matt Girardi argues for a land value tax to fund transit. He cites ATU Local 689's report: 3% of land in greater Washington is within a half mile of transit stations, but these areas represent 27% of the region's assessed land value. ggwash.org/view/98548/its…