ITEP

@iteptweets

Informing the debate on tax policy nationwide. ITEP provides research and data-driven solutions for more equitable and sustainable tax systems.

ID:153964574

https://itep.org 10-06-2010 01:06:22

19,4K Tweets

9,3K Followers

561 Following

IRS Direct File pilot program was used by 40% more tax filers than target and they gave it overwhelmingly high marks. Will TurboTax and tax-prep lobby stop this success from saving more people time and money? bostonglobe.com/2024/05/07/bus… via The Boston Globe

Southern states continue to push for eliminating or severely limiting corporate & personal income taxes.

This approach has forced a reliance on regressive sales taxes, leaving public services underfunded and state tax systems upside down. epi.org/publication/ro… Economic Policy Institute

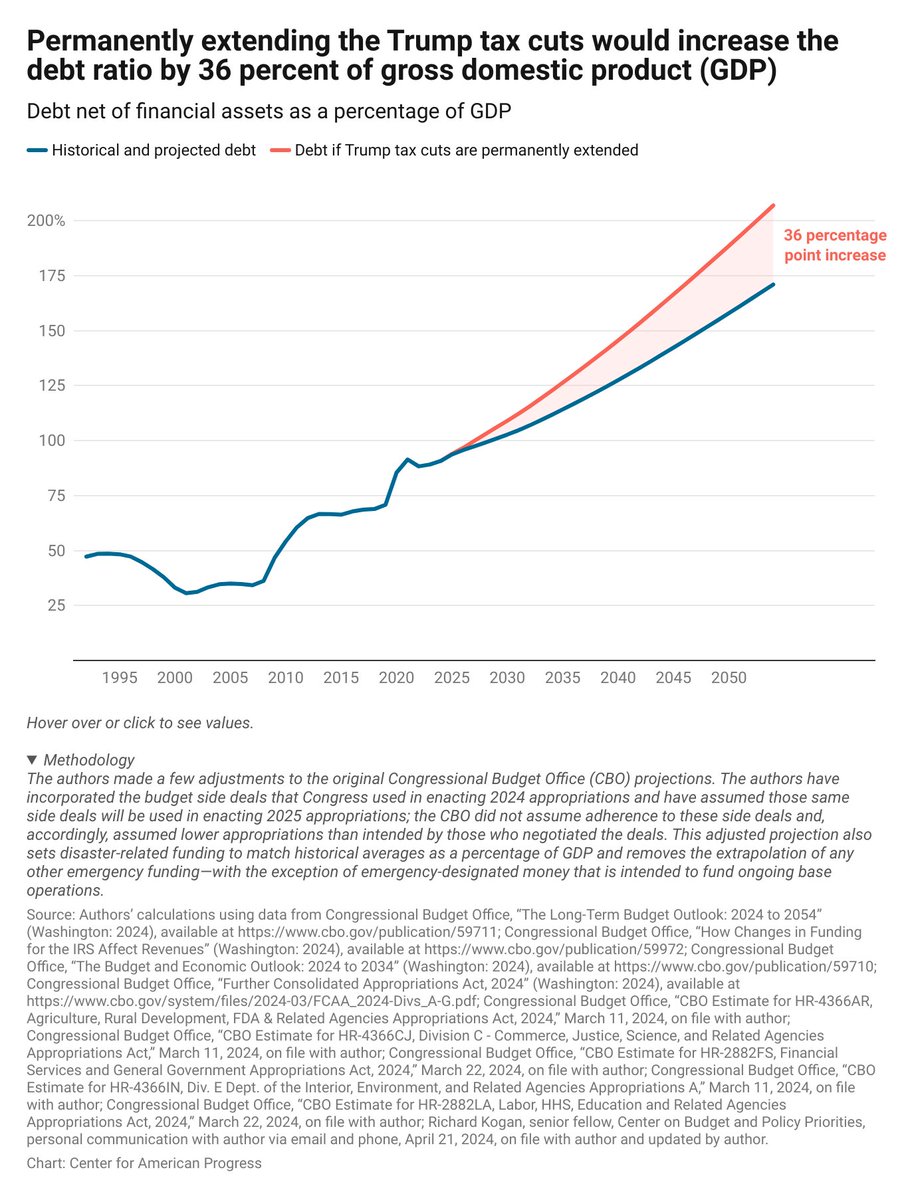

New from me and Jessica Vela: permanently extending the Trump tax cuts would cost $4 trillion over the decade.

On a net-present-value basis, they would cost $10.3 trillion over 30 years, and they'd push debt/GDP up 36%, leaving it above 200% by 2054.

americanprogress.org/article/perman…

A new CBO report finds that extending the Trump tax cuts for the next 10 years would add $4.6 trillion to the deficit.

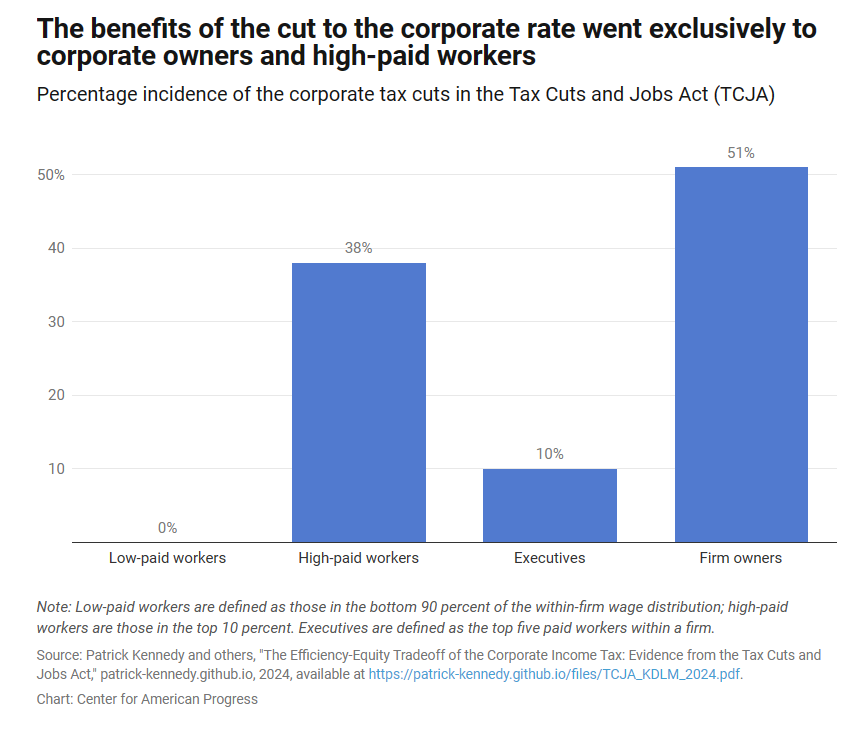

That comes with a $112.6 billion windfall for the richest 5% in the first year alone.

budget.senate.gov/chairman/newsr… Senate Budget Committee

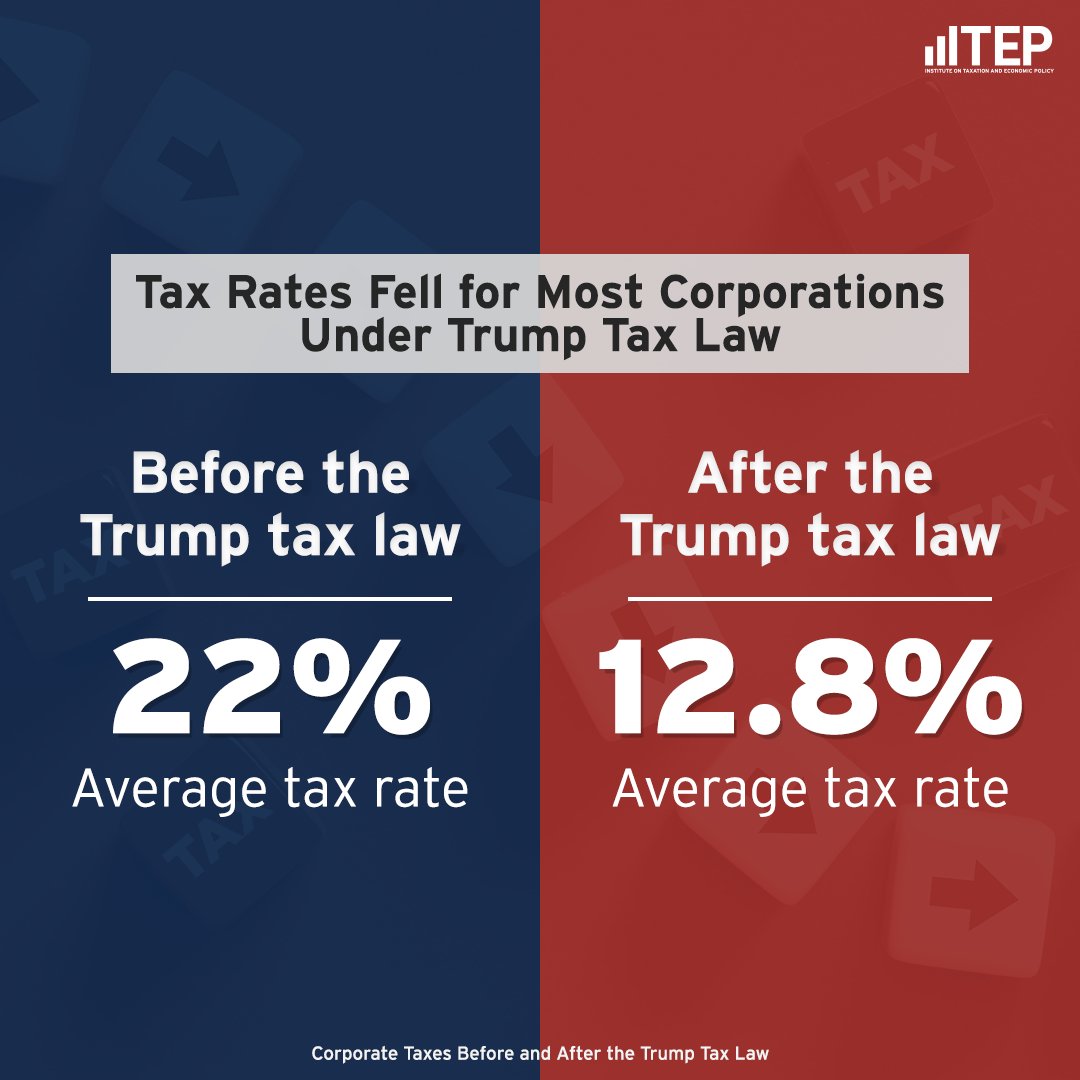

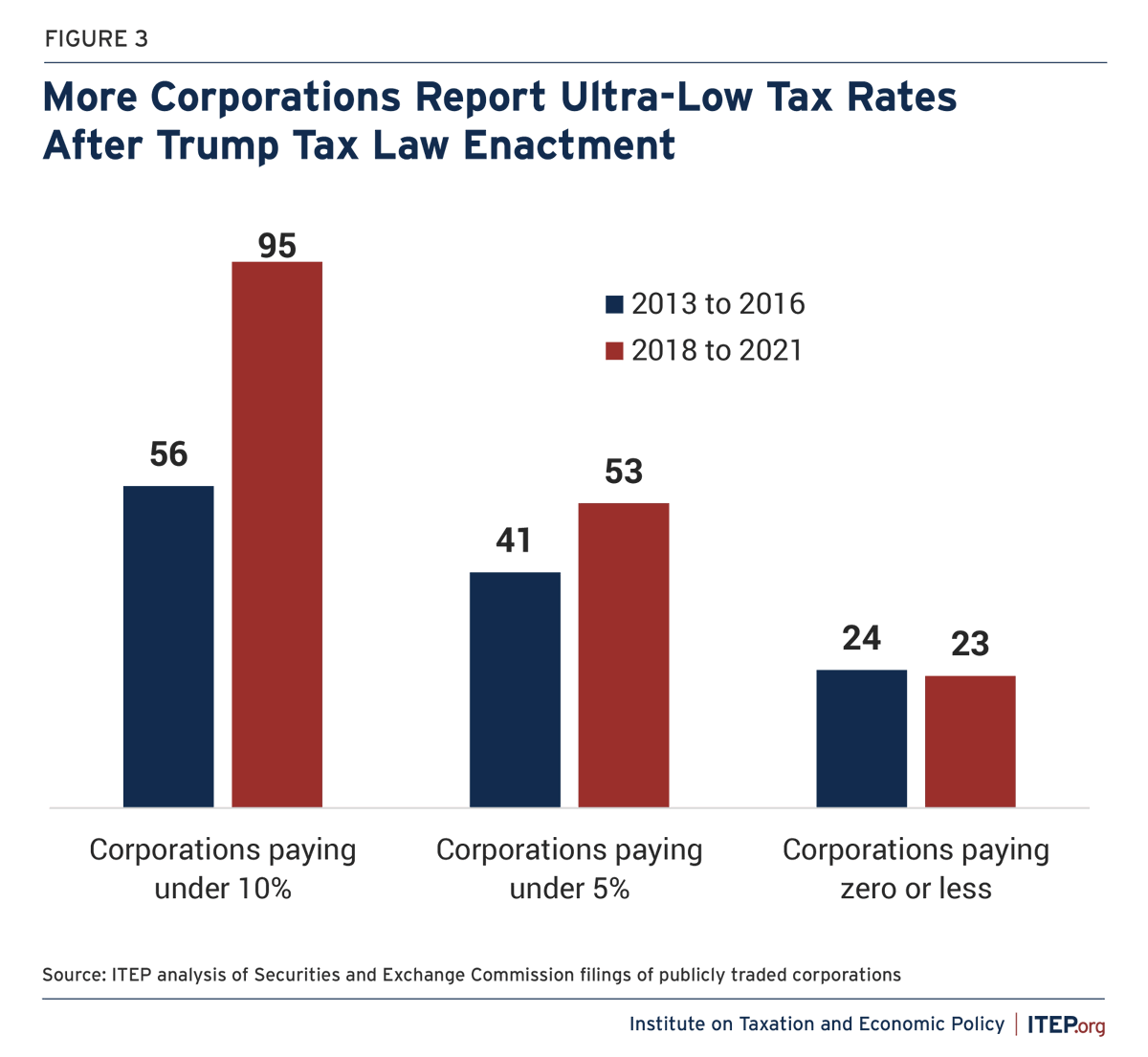

Unsurprisingly after TCJA when the corp tax rate dropped to 21%, most of the nation’s largest corps saw substantial tax reductions. New ITEP research shows biz profits grew by 44%, but their federal tax bills dropped by 16%. #TaxTwitter #EconTwitter itep.org/corporate-taxe…

One of the most regressive tax systems in the nation, Tennessee taxes poorer households at higher rates while generating less revenue than most states.

That leads to lower funding for education, health, & other investments that benefit working families. thinktennessee.org/press/tennesse…