Rohit Srivastava

@indiacharts

The Truth About The Markets Founder https://t.co/4ViZBalz3w https://t.co/0dWSceNBpy. Former Fund Mgr Sharekhan Trader Investor Mentor Elliottwave Building @strike_ic

ID:2834248800

https://play.google.com/store/apps/details?id=com.indiacharts&hl=en_IN 27-09-2014 18:15:46

31,0K Tweets

57,6K Followers

179 Following

This Wednesday on Mid-week with Indiacharts we discussed Market Pulse: Emerging vs Developed Markets, Dollar Trends, & Election Impact! Watch the episode here - youtube.com/watch?v=0ev34b…

#MarketPulse #DollarTrends #GoldAndSilver #ElectionImpact #TechStocks #MarketSentiment

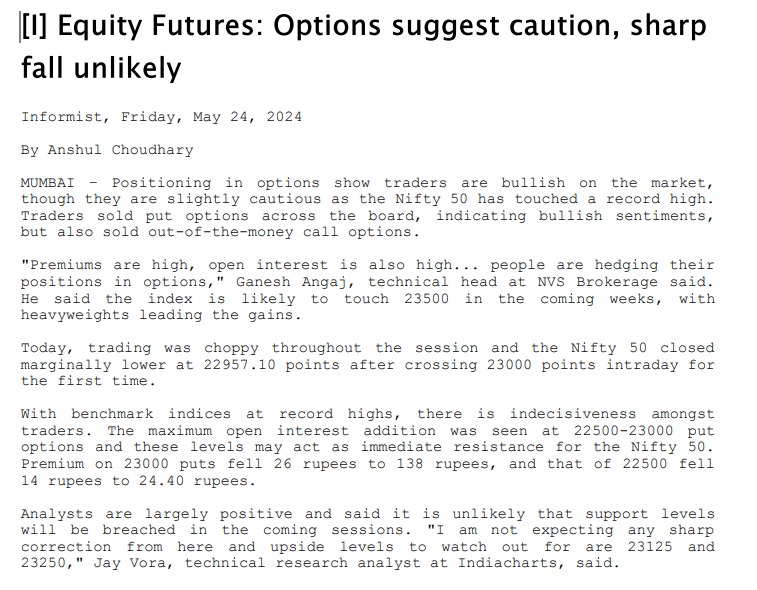

Equity Futures: Options suggest caution, sharp fall unlikely. Informist, Friday, 24th May - featuring Jay Vora - senior Market Analyst, Indiacharts & Strike.

#EquityFutures #MarketAnalysis #OptionsTrading #StockMarket #IndiaCharts #Strike #MarketCaution

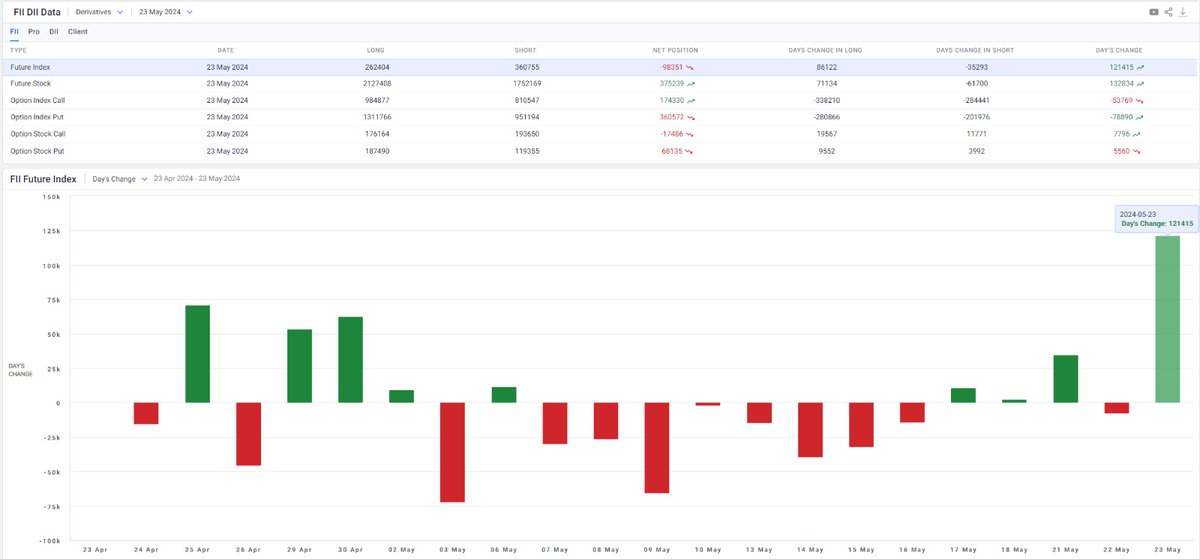

The FII's Future Index position saw one of the biggest single-day Change of +121415 contracts. The net position is however still short by over 98000 contracts.

Stay tuned with Strike for more such actionable insights!

#trading #futures #options #MarketTrends #StockAlert

This Wednesday on Mid-week with Indiacharts we discussed Market Pulse: Emerging vs Developed Markets, Dollar Trends, & Election Impact! Watch the episode here - youtube.com/watch?v=0ev34b…

#MarketPulse #DollarTrends #GoldAndSilver #ElectionImpact #TechStocks #MarketSentiment

वैश्विक संकेतों की अनदेखी करते हुए निफ्टी में तेजी बनी रहेगी

#StockMarket

#BullishTrend

#MarketOptimism

#NiftyUptrend

#EconomicNews

Nifty to follow it's own pattern ignore global cues.

#Nifty

#MarketTrends

#GlobalCues

#StockMarket

#Trading

Elections 2024- Market Outlook | Where are the Markets? How are they placed. Mr Rohit Srivastava's take on the interesting set-up of the markets. Video just went live

youtu.be/f-267VbS6iM

#Elections2024 #MarketOutlook #RohitSrivastava #MarketAnalysis #EconomicForecast

Can the Nifty FMCG Index Outperform the Market? Discover Insights with Strike Analytical Tool!

Start you 7-day-free-trial here - bit.ly/strike_twitter

#NiftyFMCG

#StockMarket

#MarketOutperformance

#Strike

#StockAnalysis

#MarketTrends

#FMCGStocks

Watch the insightful video featuring Mr Rohit Srivastava on ET Now Swadesh

x.com/ETNowSwadesh/s…

#MarketWithSwadesh

#Nifty NewHigh

#StockMarket

#Nifty

#MarketTrends

#RohitSrivastava

#IndiaCharts

#MarketWithSwadesh | #Nifty ने बनाया नया शिखर, पहली बार 22,800 के पार; निवेश के लिहाज से क्या हो रणनीति?

देखिए Indiacharts.com के Founder & Strategist, रोहित श्रीवास्तव से खास बातचीत

#Nifty 50 #MarketUpdate Rohit Srivastava Pooja Tripathi

Direction is higher but speed is hard to place

#StockMarket #MarketTrends #MarketAnalysis #StockTrading #StockMarket News