Philipp Heimberger

@heimbergecon

Researcher, Vienna Institute for International Economic Studies (@wiiw_ac_at); macroeconomics, economic policy, public finance, political economy.

ID:765430697041461249

https://wiiw.ac.at/philipp-heimberger-s-1138.html 16-08-2016 06:11:13

11,4K Tweets

59,4K Followers

772 Following

Follow People

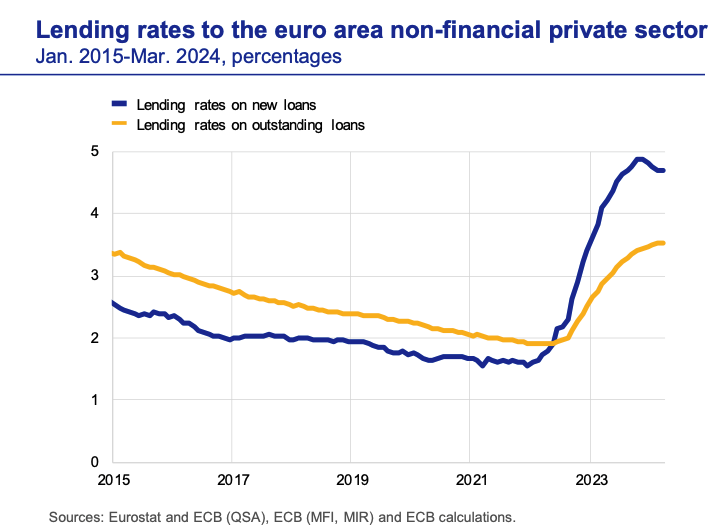

Wages in the €zone typically react to headline inflation with a lag. As headline inflation has recently fallen strongly, we must also expect wage growth to fall markedly.

via Ángel Talavera

Wages in the €zone typically react to headline inflation with a lag. As headline inflation has recently fallen strongly, we must also expect wage growth to fall markedly.

via Ángel Talavera