FactSet

@FactSet

We help financial professionals stay ahead of market trends, access company & industry intelligence, monitor portfolio risk and performance, and execute trades.

ID:17473062

http://www.factset.com 18-11-2008 22:20:31

21,6K Tweets

115,8K Followers

295 Following

Discover how the synergy between FactSet's data and MRKT Call's analysis can drive your investment decisions to new heights. Join us for the next episode: bit.ly/3SaPtUi #FactSetXMRKTCall

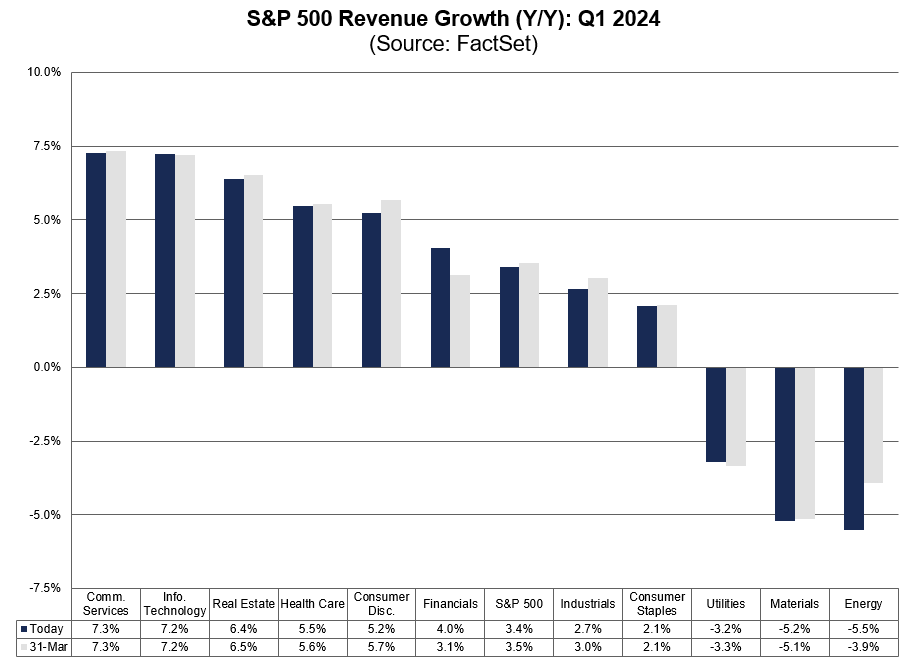

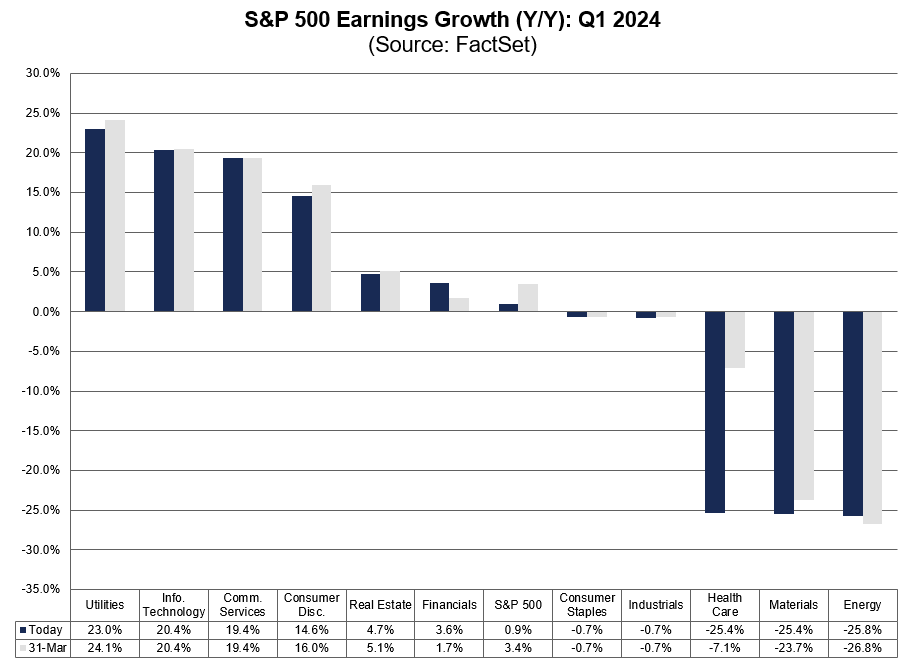

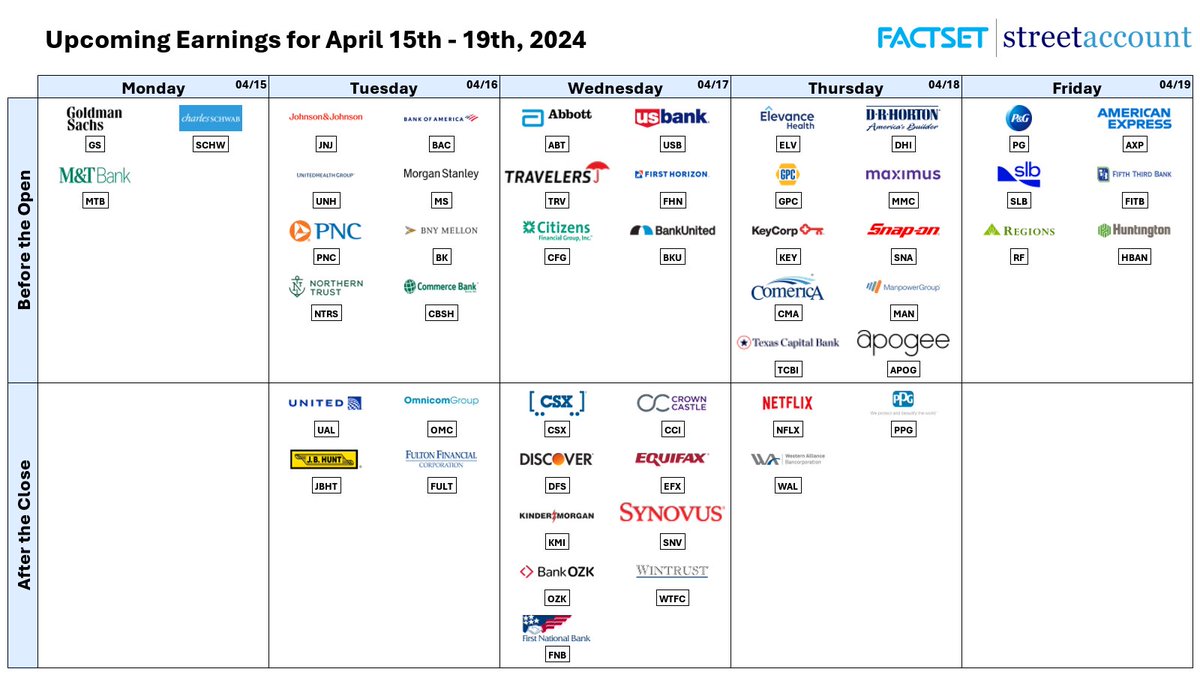

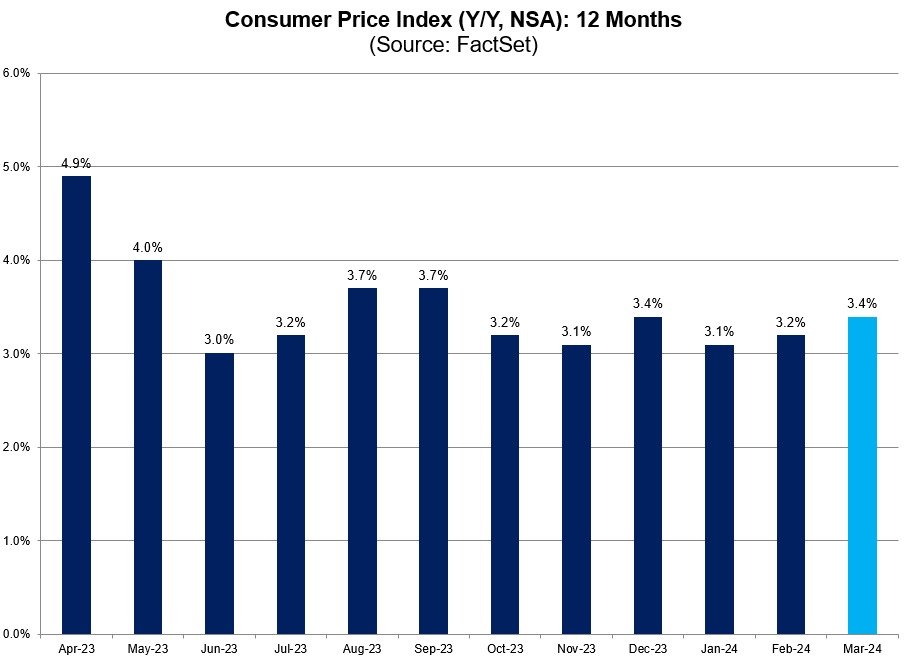

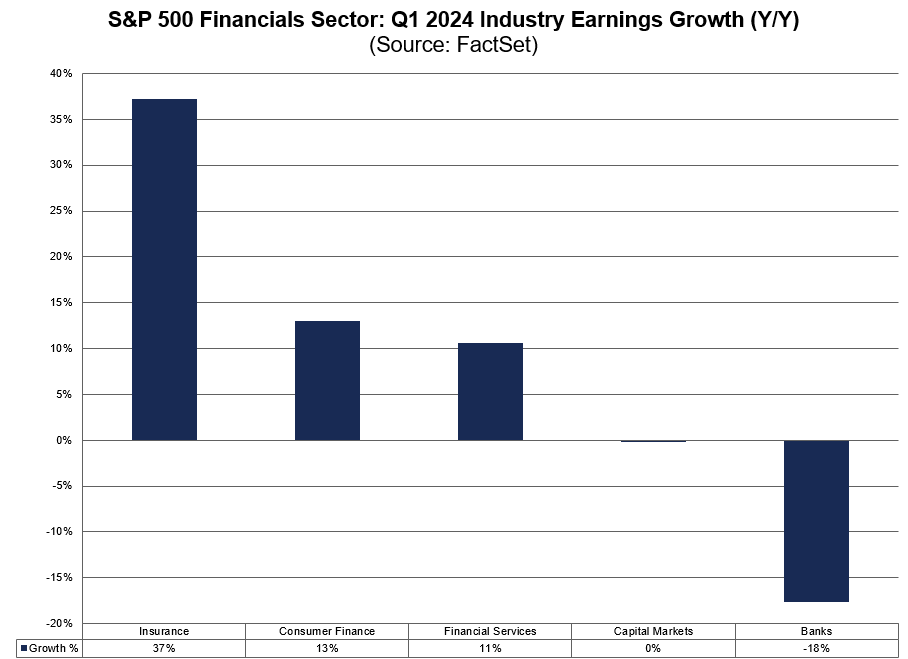

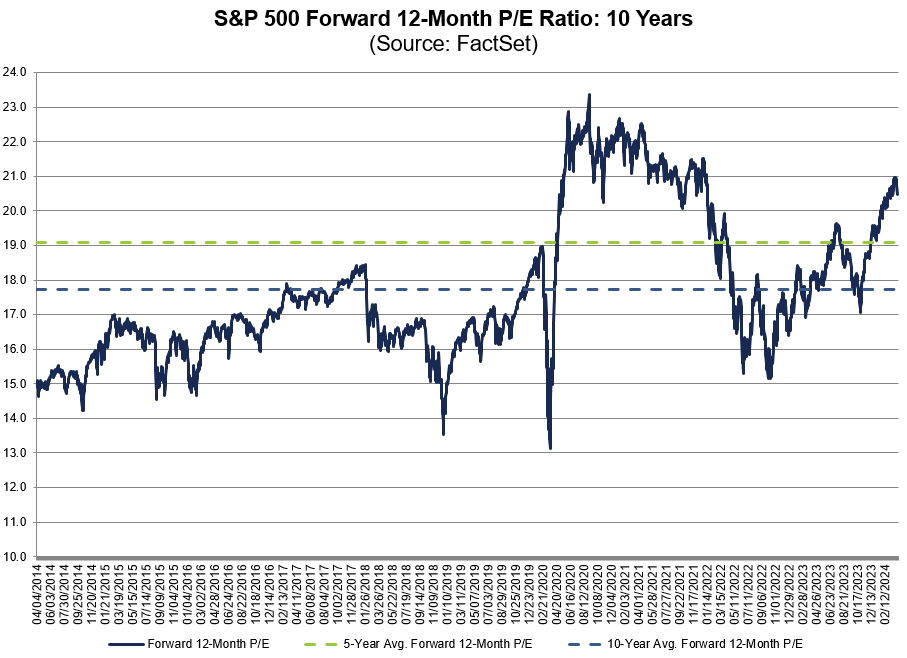

Check out John Butters’ latest article!

Read here: insight.factset.com/sp-500-will-li…

#Earnings #stockmarket #marketdata