Michael Denicola

@denicomc

Economic Analyst working in the financial services industry. Degree in Quantitative Finance & Financial Economics from James Madison University views are my own

ID: 94489239

04-12-2009 04:48:07

23,23K Tweet

431 Followers

4,4K Following

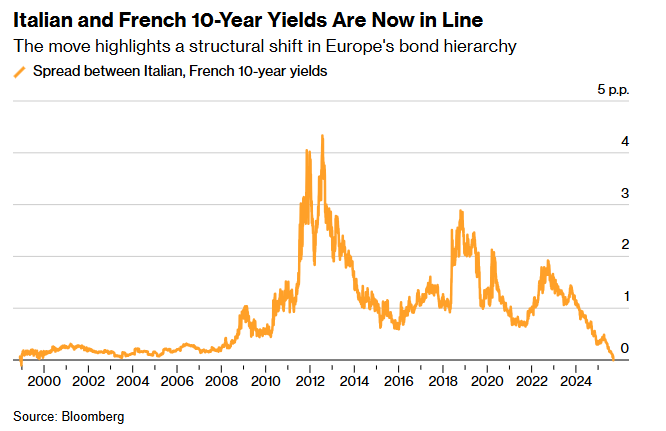

French 10-year bond yields are higher than Italy's for the first time in the history of the euro area Credit to Greg Ritchie bloomberg.com/news/articles/…

French borrowing costs top Italy’s in historic market shift bloomberg.com/news/articles/… via Greg Ritchie

As we approach a potential government shutdown, here’s a handy shortcut on Bloomberg Terminal to view a sampling of alternative and private economic data: WSL ALTE<GO>. Feel free to MSG/IB me with additional suggestions!