Andrew Sentance

@asentance

Independent business economist. Former CBI Director of Economic Affairs and BA Chief Economist. Member of #BoE MPC 2006-11. Guitarist & organist.

ID:340961193

http://andrewsentance.com 23-07-2011 15:38:46

27,2K Tweets

22,8K Followers

1,8K Following

A timely article by David Smith given this is exactly what’s happening with yesterday’s announcement on defence spending increases as well as earlier tax cut announcements ahead of the election

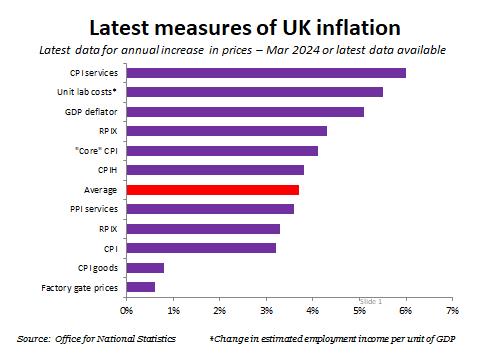

As David Smith argues in the Sunday Times today, some key measures of inflation are still 2-3 times the 2 pc target - including services prices, unit labour costs, GDP deflator, RPI and 'core' CPI. Stubbornly high inflation is set to delay expected interest rate cuts.

Another good article from David Smith today - arguing that persistent above-target inflation will delay interest rate cuts, quite rightly in my view.

Andrew Sentance The key problem with the model is that the BoE/MPC are duplicitous about it. They use it to signal expertise and authority [see, the model]; but at the same time they invoke maximal judgement so that it does not bind them at all. I don't know how you can address this.