S&P Global Ratings

@SPGlobalRatings

S&P Global Ratings is the world’s leading provider of independent credit ratings. We’re a division of S&P Global (@SPGlobal)

ID:182876615

http://www.spglobal.com 25-08-2010 16:25:26

18,0K Tweets

117,9K Followers

740 Following

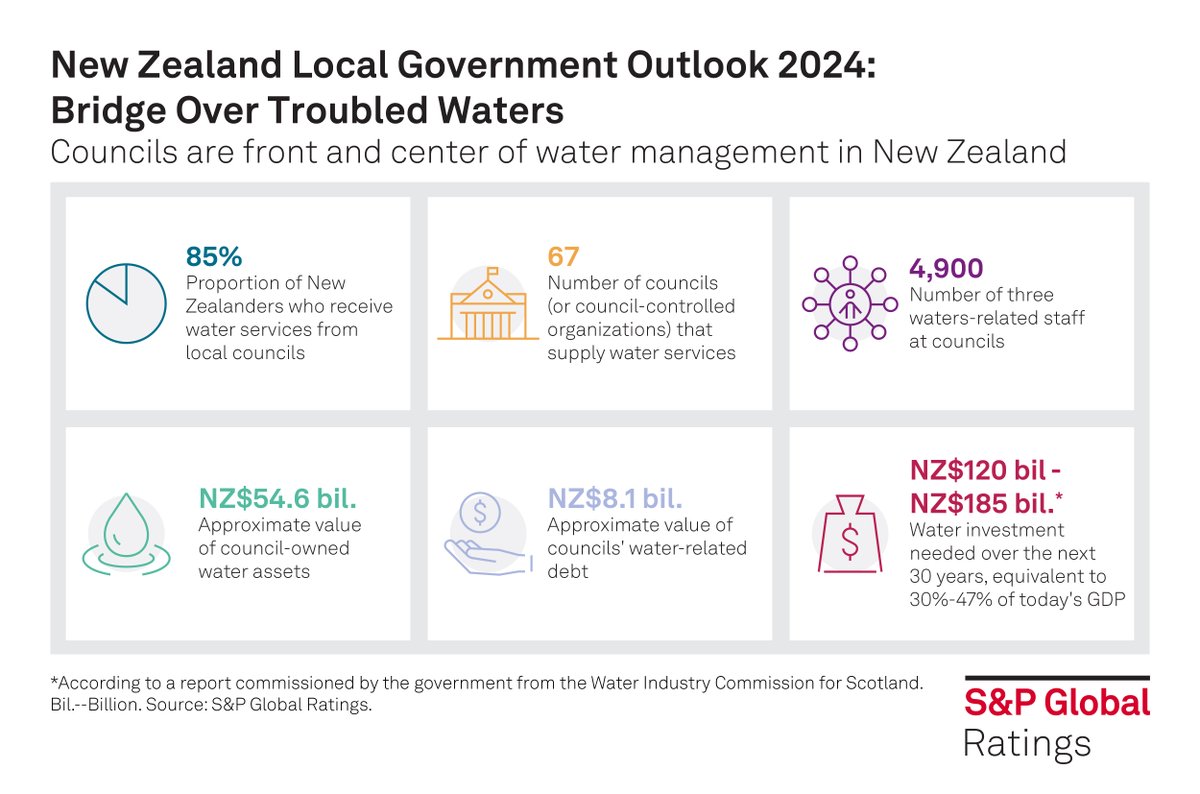

Either ratepayers, taxpayers, levy-payers, or tariff-payers look set to face steeper bills in the future to address #NewZealand 's water woes. Read more: New Zealand Local Government Outlook 2024: Bridge Over Troubled Waters ow.ly/1g8h50Qa9uL #AffordableWaterReform

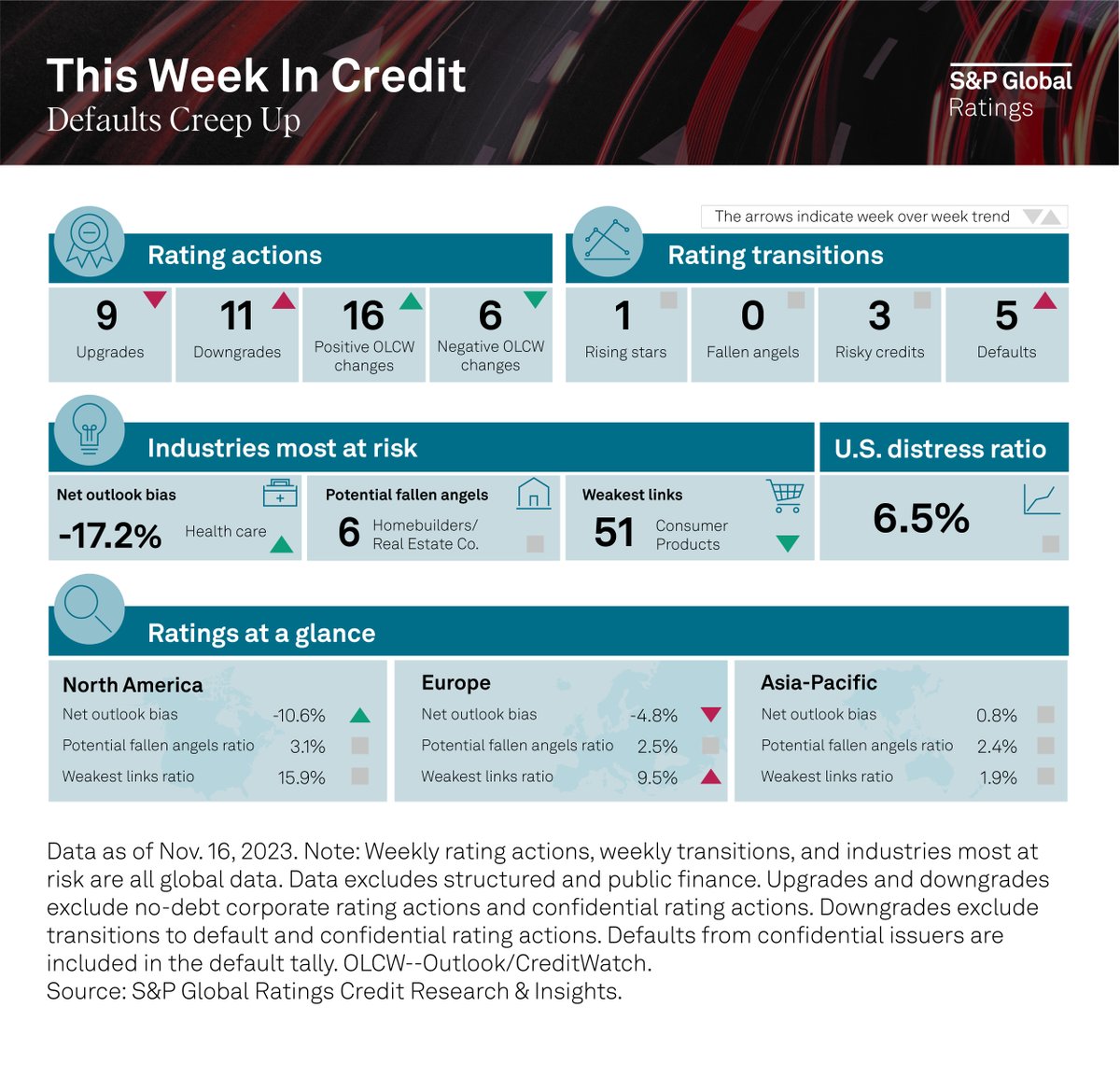

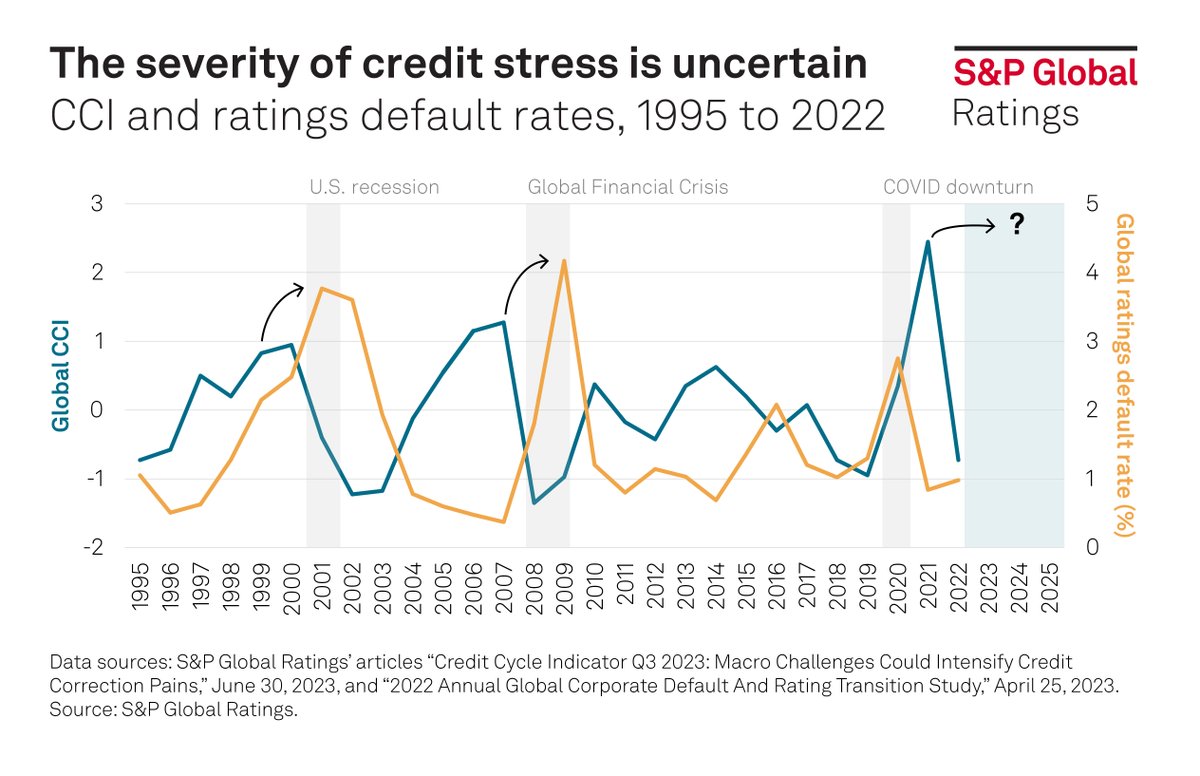

#ThisWeekInCredit :Five defaults last week brought this year's total to 138—1.8x higher than over the same period last year. This week will be calm on the data front with Thanksgiving holidays in the U.S. and minimal data from China and Japan.

Go deeper:ow.ly/GHSp50Q9rPj