Invesco US

@InvescoUS

Invesco is dedicated to helping investors around the world rethink possibility. Important disclosures: https://t.co/AQCXLDX1C0

ID:240826569

http://www.invesco.com/fundprospectus 20-01-2011 20:53:50

5,6K Tweets

222,9K Followers

513 Following

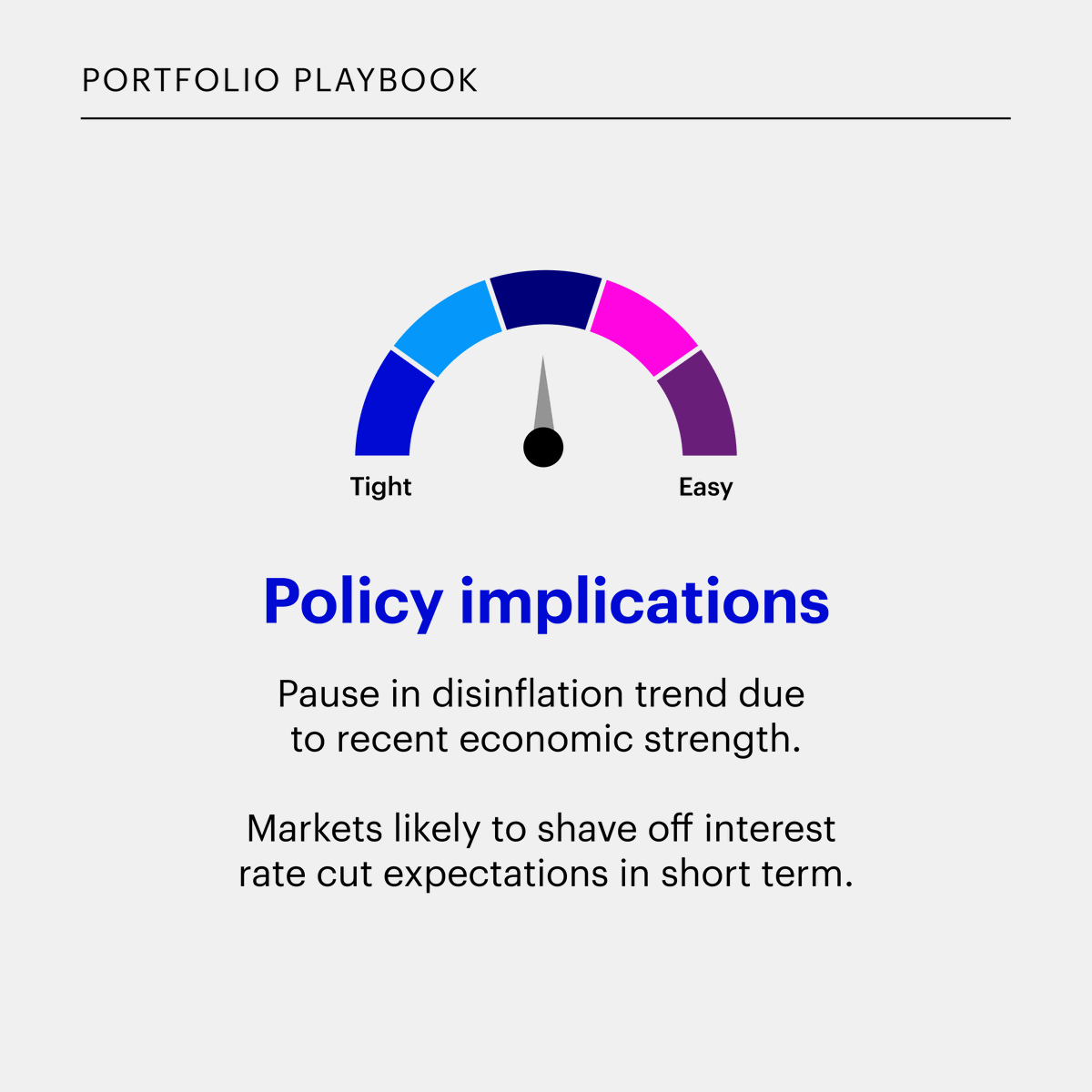

Chief Global Market Strategist Kristina Hooper shares her thoughts from this afternoon’s Federal Reserve interest rate announcement and press conference. Read more: inves.co/4b40MV1

Follow our Chief Global Market Strategist Kristina Hooper for live updates on today's Federal Reserve meeting.

Despite hawkish talk from Federal Reserve members, Kristina Hooper still believes a rate cut in June and a total of three cuts for the year are very real possibilities, but markets need to see more data to change their minds. #WeeklyMarketCompass .

inves.co/4d9bjzH

In between cheering on the teams in the NCAA® Women's Final Four® in Cleveland, Kristina Hooper had the privilege of participating in an #InvescoQQQ financial education conversation for female student-athletes alongside basketball great Candace Parker and Fidelity Investments…

In honor of #FinancialLiteracyMonth , Global Market Strategist Brian Levitt dedicates his latest column to his teenage daughter’s personal finance class and shares five financial tips for teens. inves.co/3Q5hA5v

Chief Global Market Strategist Kristina Hooper puts first-quarter global markets into perspective and highlights some “little victories” that may have been easy to overlook. inves.co/3TGIwJN

In a momentous week for monetary policy, Japan ended its negative rate policy and the Swiss National Bank was the first developed central bank to cut rates this cycle. Kristina Hooper explains in her #WeeklyMarketCompass . inves.co/3TyQbtG

Some would argue that the strong Japanese stock market rally over the past year has priced in all the improvements in Japan’s economy.

But Kristina Hooper says there are additional reasons why Japanese equities could move higher going forward. inves.co/43yFwE4