Gert van Lagen

@GertvanLagen

MSc Systems and Control | 🇳🇱 | Technical Analyst | NFA | Strate𝔾 | https://t.co/fys1Zw7xKW | https://t.co/Goj99zfepL

ID:94587116

http://gertvanlagen.substack.com 04-12-2009 16:11:06

11,2K Tweets

95,6K Followers

1,3K Following

Follow People

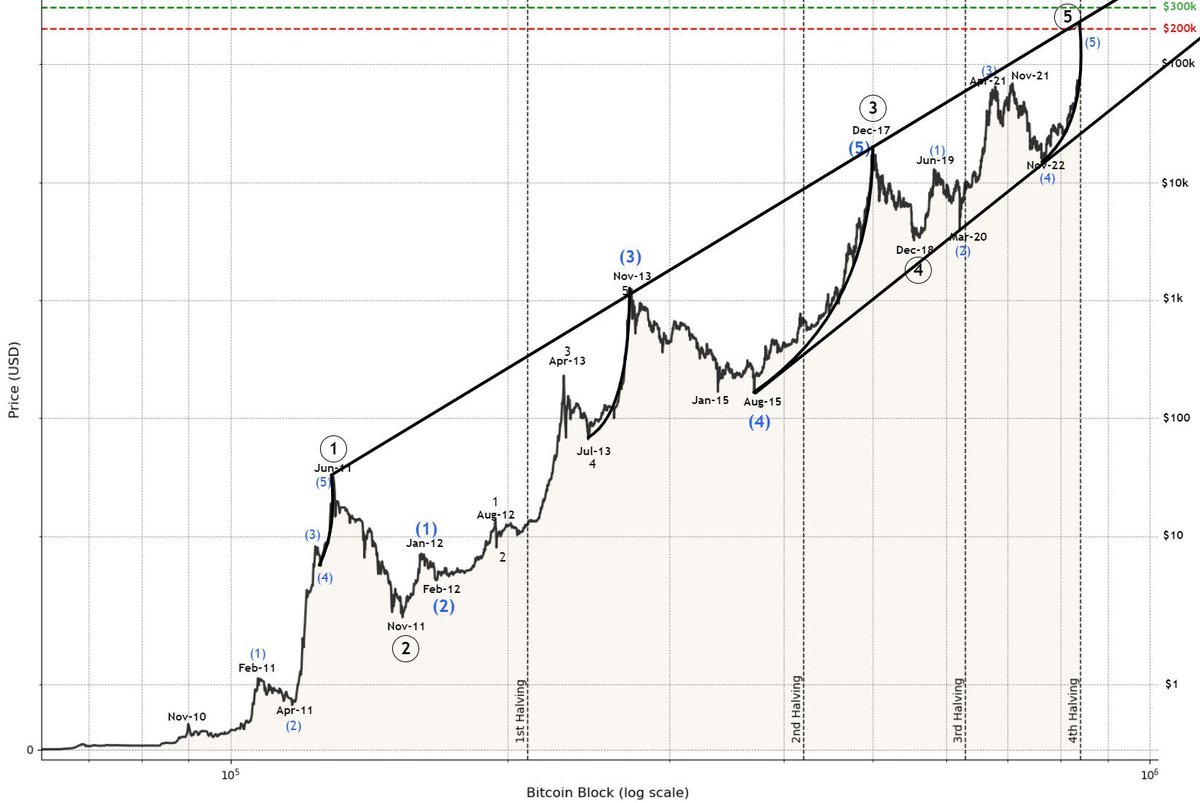

![Gert van Lagen (@GertvanLagen) on Twitter photo 2024-04-29 08:57:01 $BTC [1M] - Comparing A/B/C: 🔻 All had rejection at the 78.6% Fibonacci level; 🔻 A saw a strong rejection at 161.8% bear market extension; 🔻C saw a double rejection at 161.8% bear market extension, which is now being tested for support at $62k A and B both topped at the… $BTC [1M] - Comparing A/B/C: 🔻 All had rejection at the 78.6% Fibonacci level; 🔻 A saw a strong rejection at 161.8% bear market extension; 🔻C saw a double rejection at 161.8% bear market extension, which is now being tested for support at $62k A and B both topped at the…](https://pbs.twimg.com/media/GMUgLJeWcAAM_pu.jpg)

![Gert van Lagen (@GertvanLagen) on Twitter photo 2024-04-24 20:49:14 ALTCAP-ETH (TOTAL3) [1W] - Target inverse head and shoulders pattern shared in Nov-23 has been reached. Altcap struggles with the 61.8-78.6% Fib. resistance zone, but has closed each time within this green box c.q. launchpad. Structural parabolic move remains intact. ALTCAP-ETH (TOTAL3) [1W] - Target inverse head and shoulders pattern shared in Nov-23 has been reached. Altcap struggles with the 61.8-78.6% Fib. resistance zone, but has closed each time within this green box c.q. launchpad. Structural parabolic move remains intact.](https://pbs.twimg.com/media/GL9TfaCXsAAGMK8.jpg)

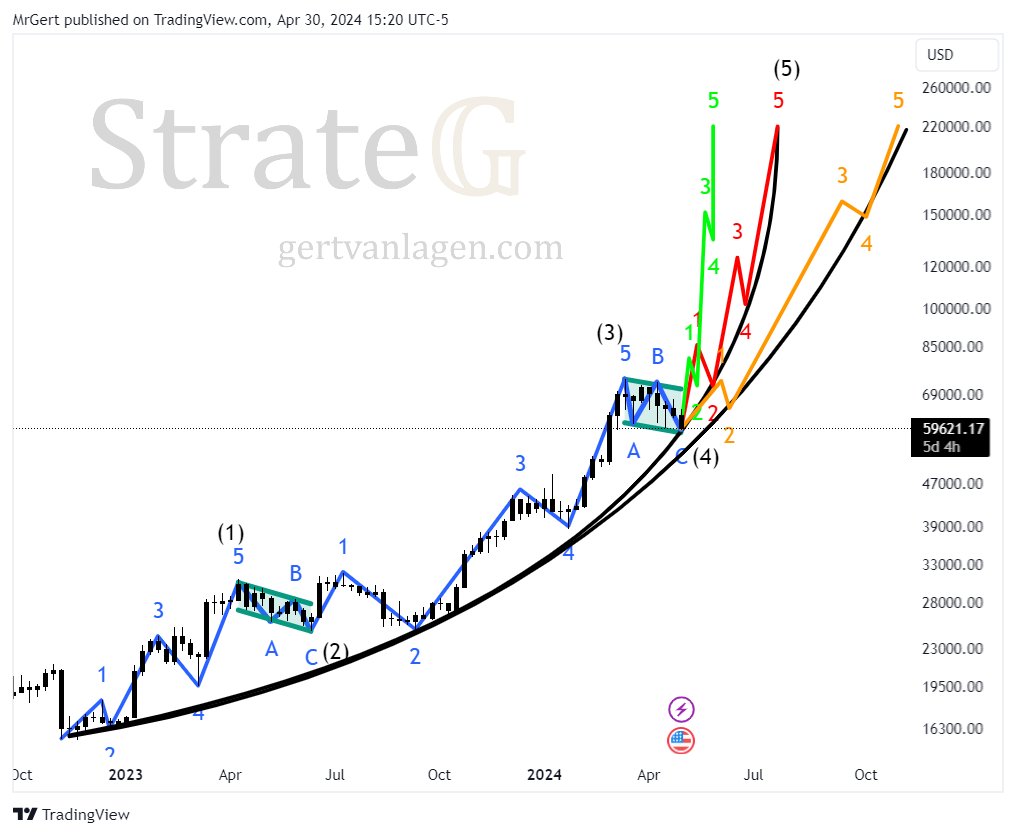

![Gert van Lagen (@GertvanLagen) on Twitter photo 2024-04-20 13:29:00 $BTC [1W] - Parabolic move to $222k remains intact. Currently price is finalizing the 4th subwave of the blow-off wave we're tracking since Nov-23. Note that the first correction was a zigzag type of correction, the current correction qualifies as a sideways flat correction (so… $BTC [1W] - Parabolic move to $222k remains intact. Currently price is finalizing the 4th subwave of the blow-off wave we're tracking since Nov-23. Note that the first correction was a zigzag type of correction, the current correction qualifies as a sideways flat correction (so…](https://pbs.twimg.com/media/GLnIF0iW8AAxP_y.jpg)