Alpha_Ex_LLC

@Alpha_Ex_LLC

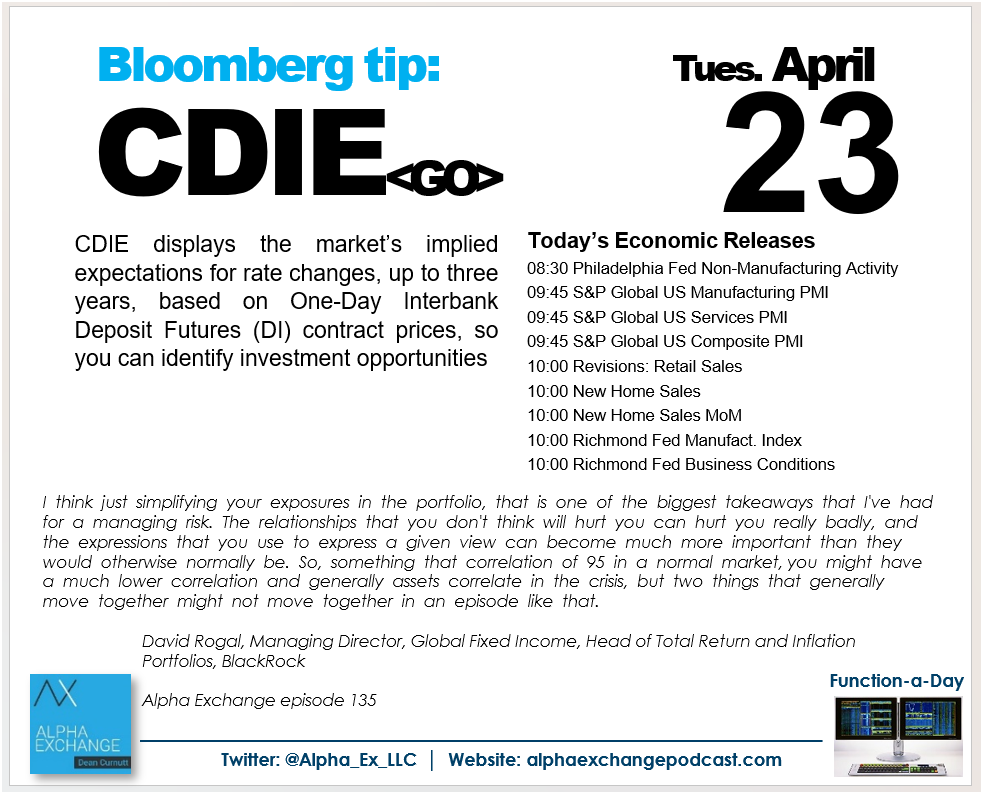

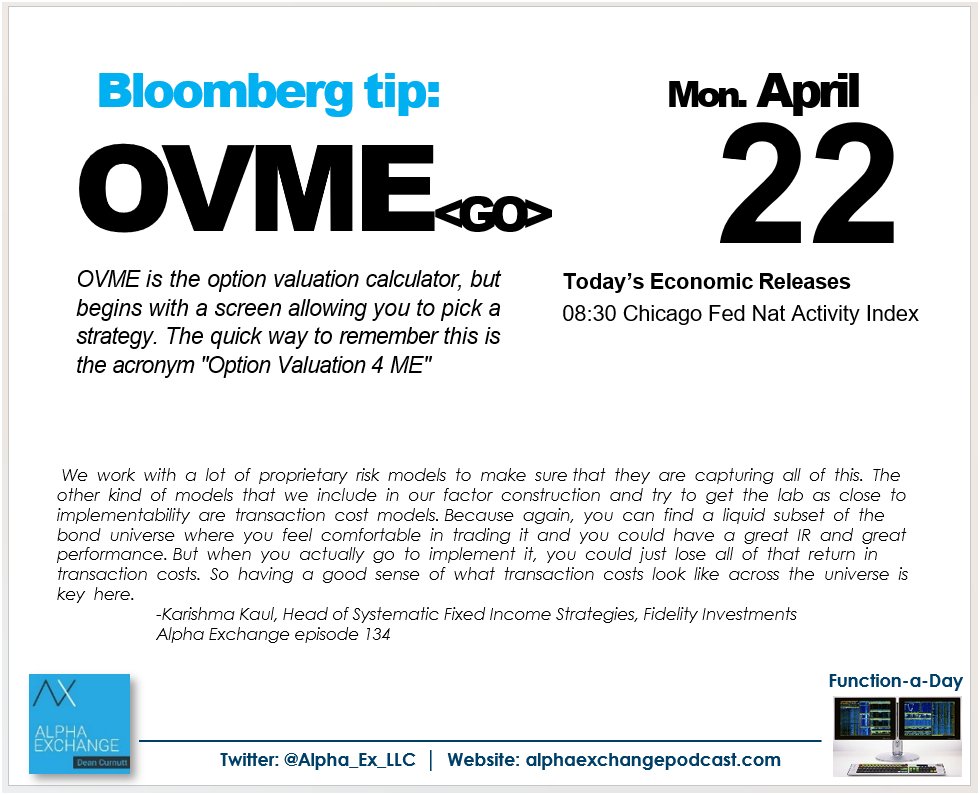

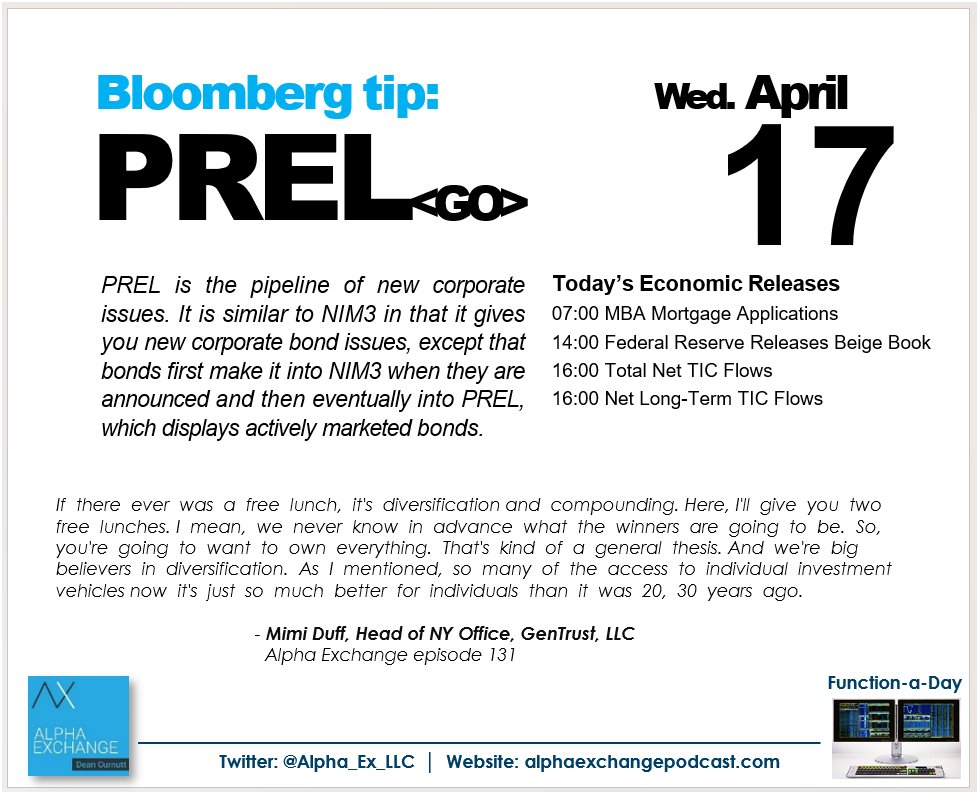

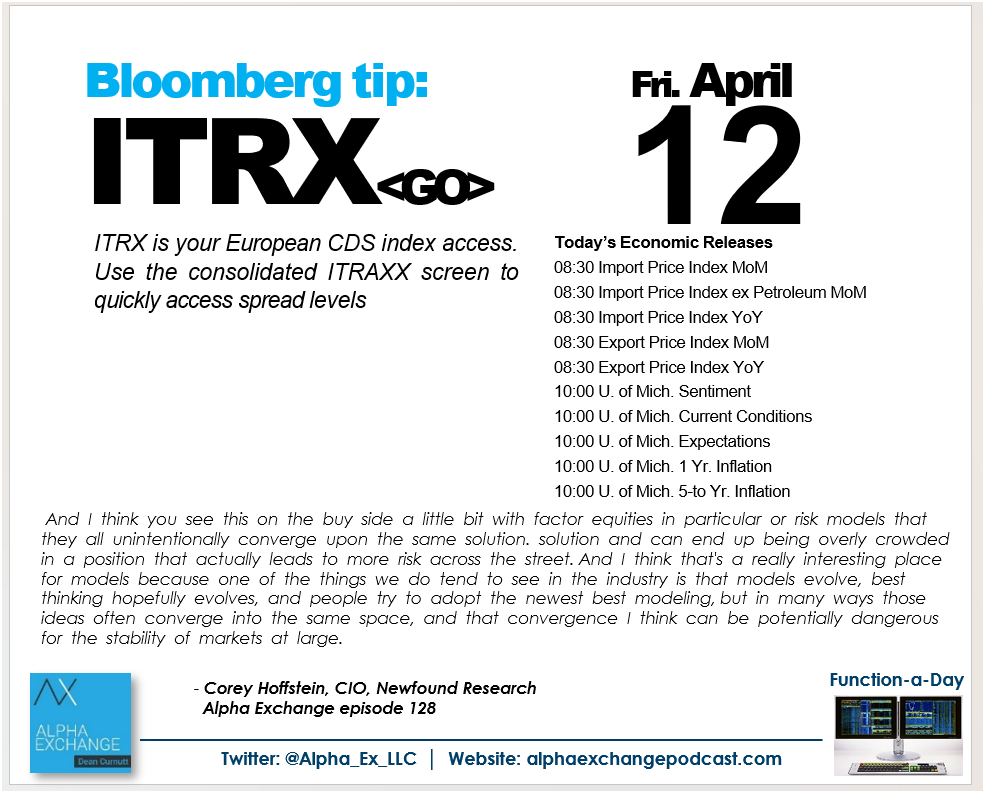

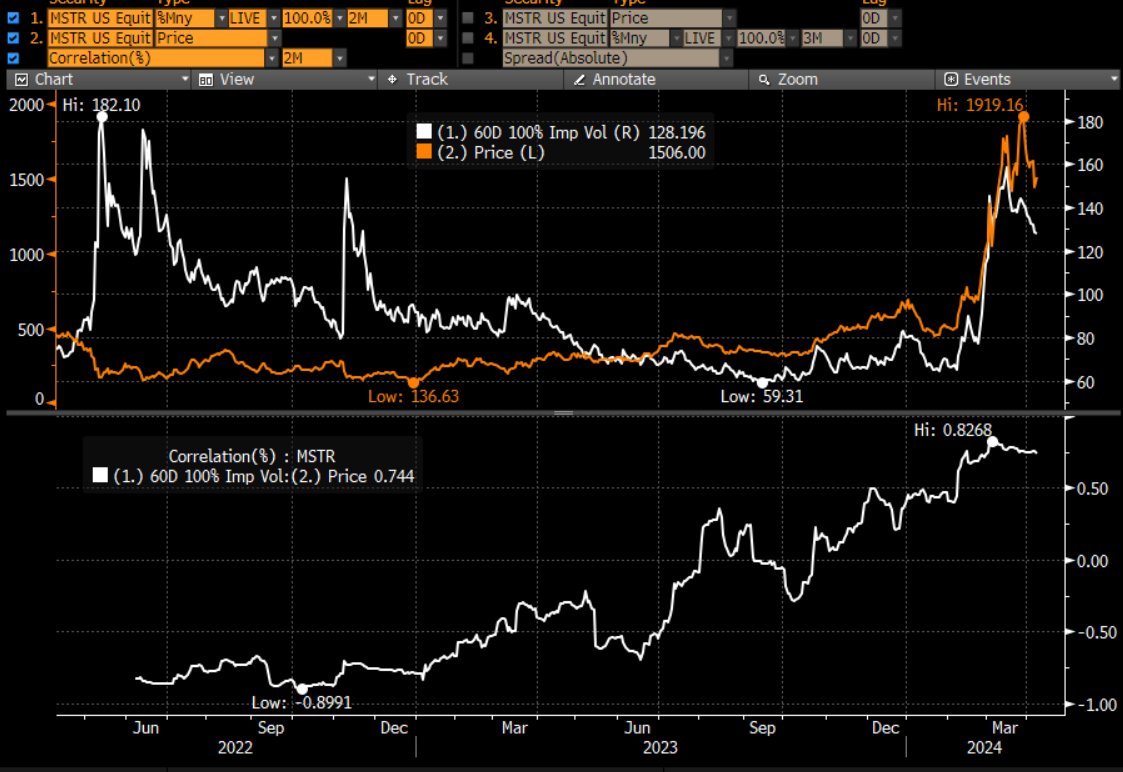

Alpha Exchange is a podcast series by Dean Curnutt to explore topics in financial markets, risk management and capital allocation in the alternatives industry

ID:1225490224106627074

https://alpha-exchange.podcastpage.io/ 06-02-2020 18:44:23

3,4K Tweets

12,6K Followers

860 Following