Akshay Naheta

@Akshay_Naheta

Entrepreneur; Investor; Personal opinions only; No investment advice

ID:1681648074

18-08-2013 21:33:37

92 Tweets

2,1K Followers

234 Following

Fortunate to be part of an ever-evolving UAE. محمد بن زايد HH Sheikh Mohammed have provided a safe, clean and efficient environment for its citizens and expats alike to flourish and prosper! #UAENationalDay 🇦🇪

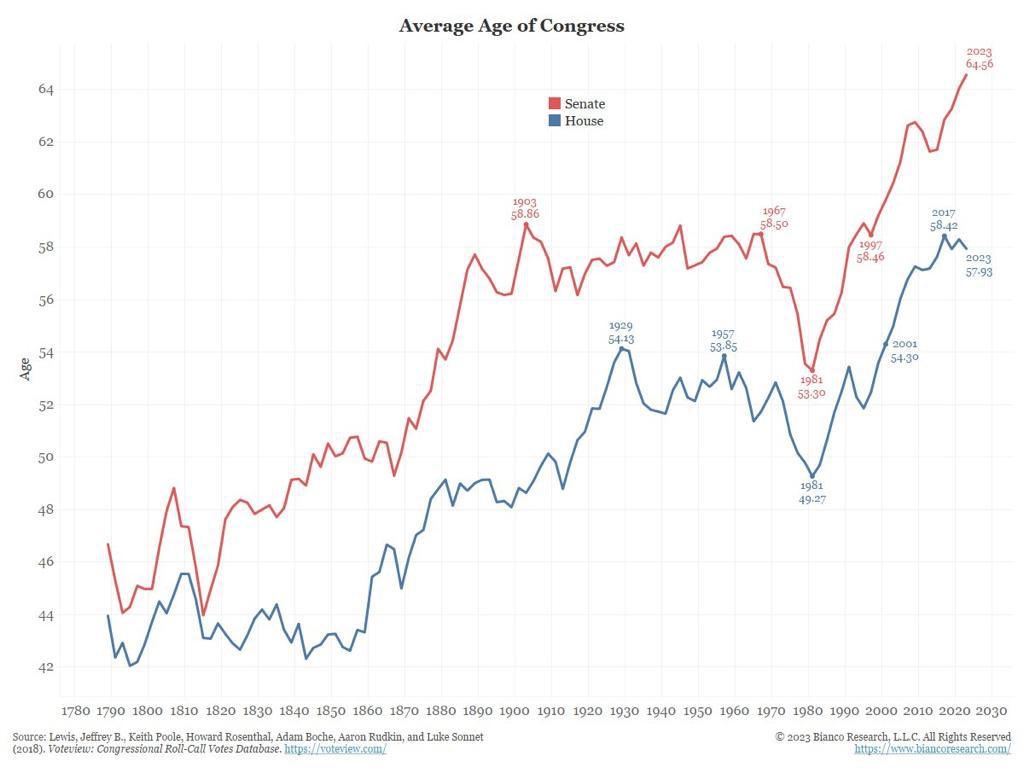

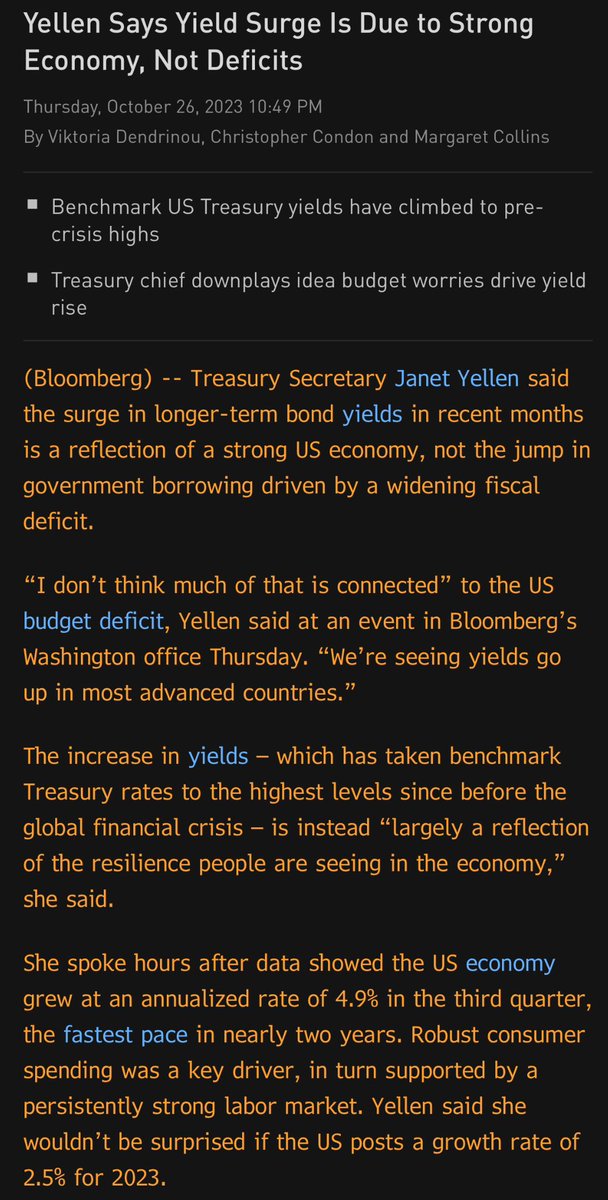

How to be consistently wrong - another nugget from Secretary Janet Yellen. Yields are going a lot higher in the medium-term, unless Federal Reserve starts printing money again - QEᴺ

A prediction for year-end 2023:

- inflation down (for the US)

- commodities down

- equities down

- treasury yield down (rates rally)

Thereafter, it’s a rocky road.

Too much issuance from the US govt will make it extremely uncertain. And, Federal Reserve actions will add to it.

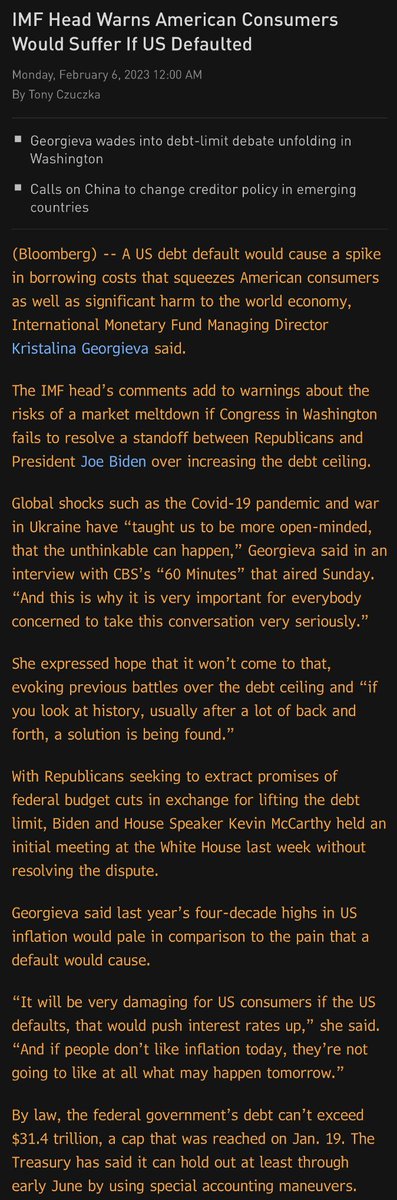

It’s all about liquidity! And here we sit, nearly 500bps higher on short rates, but between the BOJ, European Central Bank and the SVB “bailout” a liquidity drain never happened. With the debt ceiling charade to be soon behind us, is a liquidity drain in store for markets due to t-bill issuance?

US$1.5tn in CRE loans coming due in the next 3 years. Industry now wants a govt bailout, because losses are meant to be socialised & profits are privatised in America! The US is becoming a banana republic, where capitalism is dying by a thousand cuts. Federal Reserve Treasury Department

America has truly become a #BailoutNation . The Federal Reserve & Treasury Department are working hard to undermine the USD’s dominance as a global reserve currency - with bailouts, endless money printing with different acronyms (QE, BTFP, etc), and uncontrolled federal spending/deficits.

The equity value of PE LBO deals - deals with substantial debt/leverage - based on where their debt trades in the secondary market is basically ZERO. Most PE firms still have to recognise this in their fund NAV. Next the Federal Reserve will backstop the investors in these funds?

It’s baffling to see more policy errors on the part of Federal Reserve. We’re in for a massive spike in inflation if they back off from rate hikes and QT. Federal Reserve’s balance sheet is as screwed as that of SVIB’s. Its the blind leading the blind!

America and most of the developed world needs a disruption in politics along with an end to woke culture. I’m rooting/hoping for Vivek Ramaswamy to run for President Biden.

The US consumer will suffer most if the govt debt is not brought under control. The inflation problems of today stem from crony capitalism in the name of brazen money printing by Federal Reserve & all kinds of bailout policies. Congress should pass a bill for no budget deficits.

Totally unsustainable debt trajectory, Secretary Janet Yellen. The debt has increased by 50% in 5 years. And Federal Reserve wonders why inflation is going to stay sticky? Stop printing money and pull cash out of the system. Wars will end, asset prices will fall and inflation will collapse.