Americans For Tax Fairness

@4TaxFairness

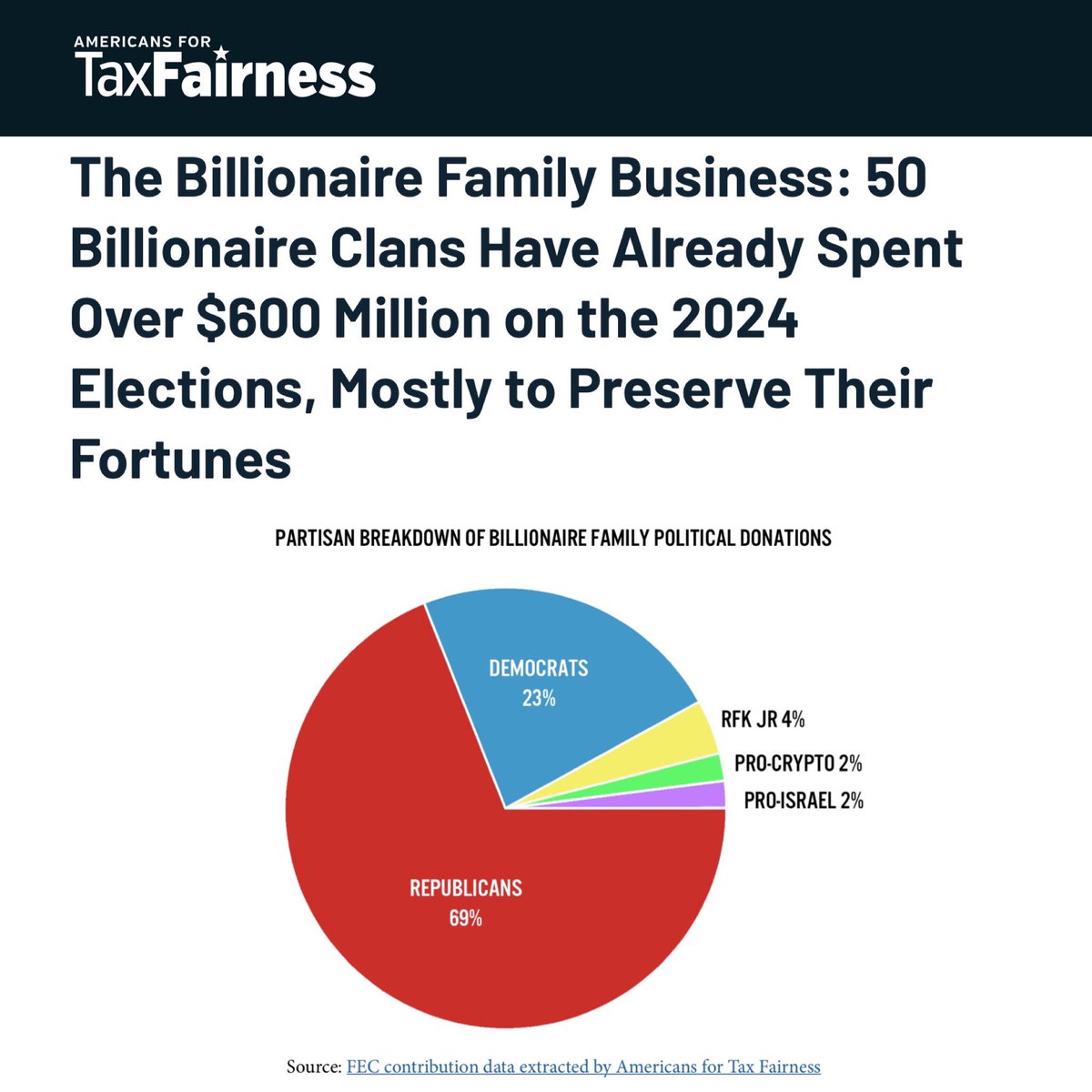

We’ve been fighting for ten years to build an economy that works for all of us by making the wealthy and corporations pay their fair share in taxes.

ID:583377732

http://linktr.ee/4taxfairness 18-05-2012 00:20:33

37,6K Tweets

32,5K Followers

11,8K Following

Follow People

NEW: We've joined 100+ leading organizations, including AFL-CIO ✊ AFSCME Americans For Tax Fairness American Progress ColorOfChange MoveOn Public Citizen SEIU UAW, in calling on Congress to pass bold tax reform when Trump tax law provisions expire.

Read the full #TaxLetter : groundworkcollaborative.org/wp-content/upl…

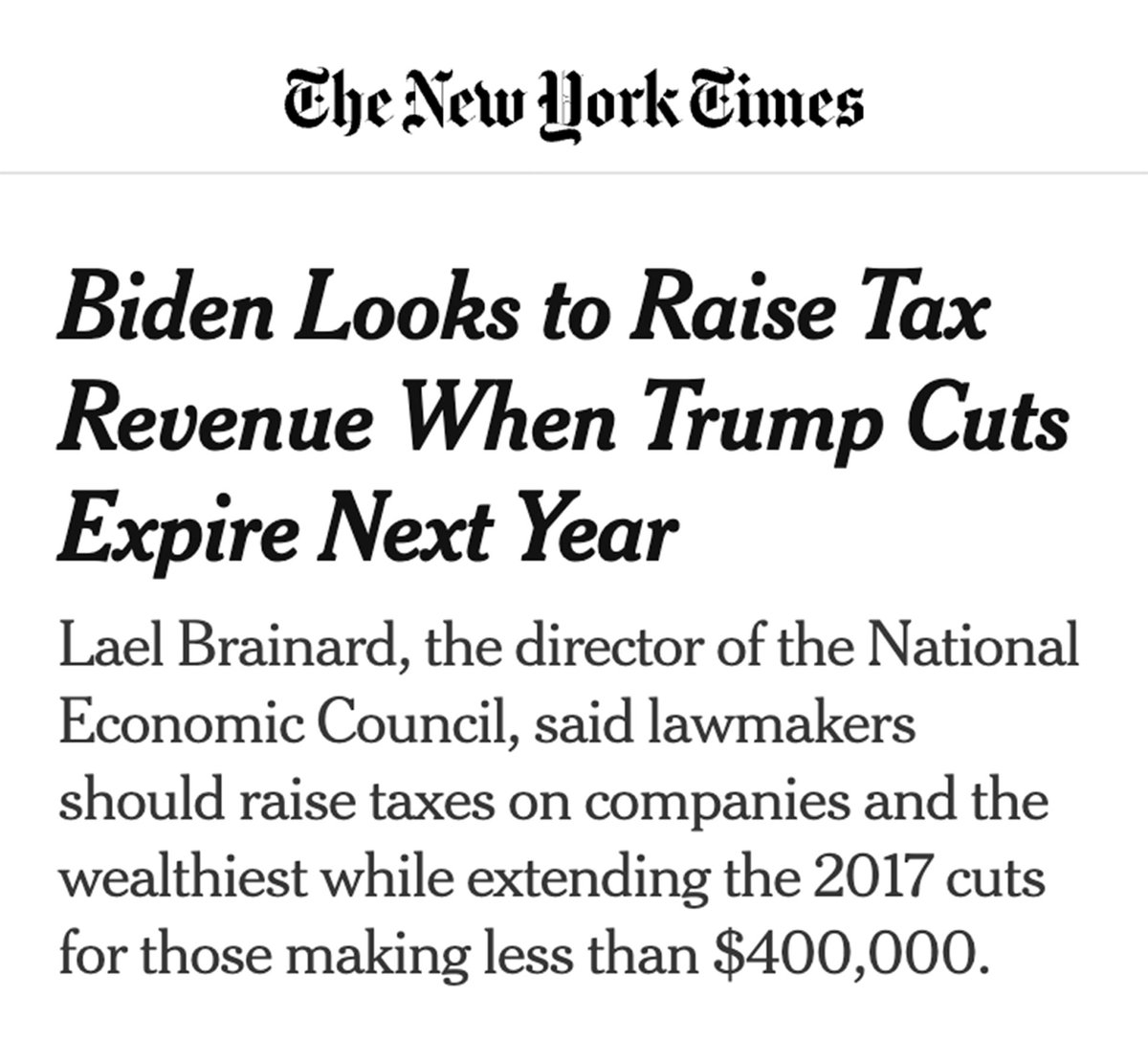

“As the president has said, tax cuts for the wealthy will stay expired on his watch.”

President Biden is right.

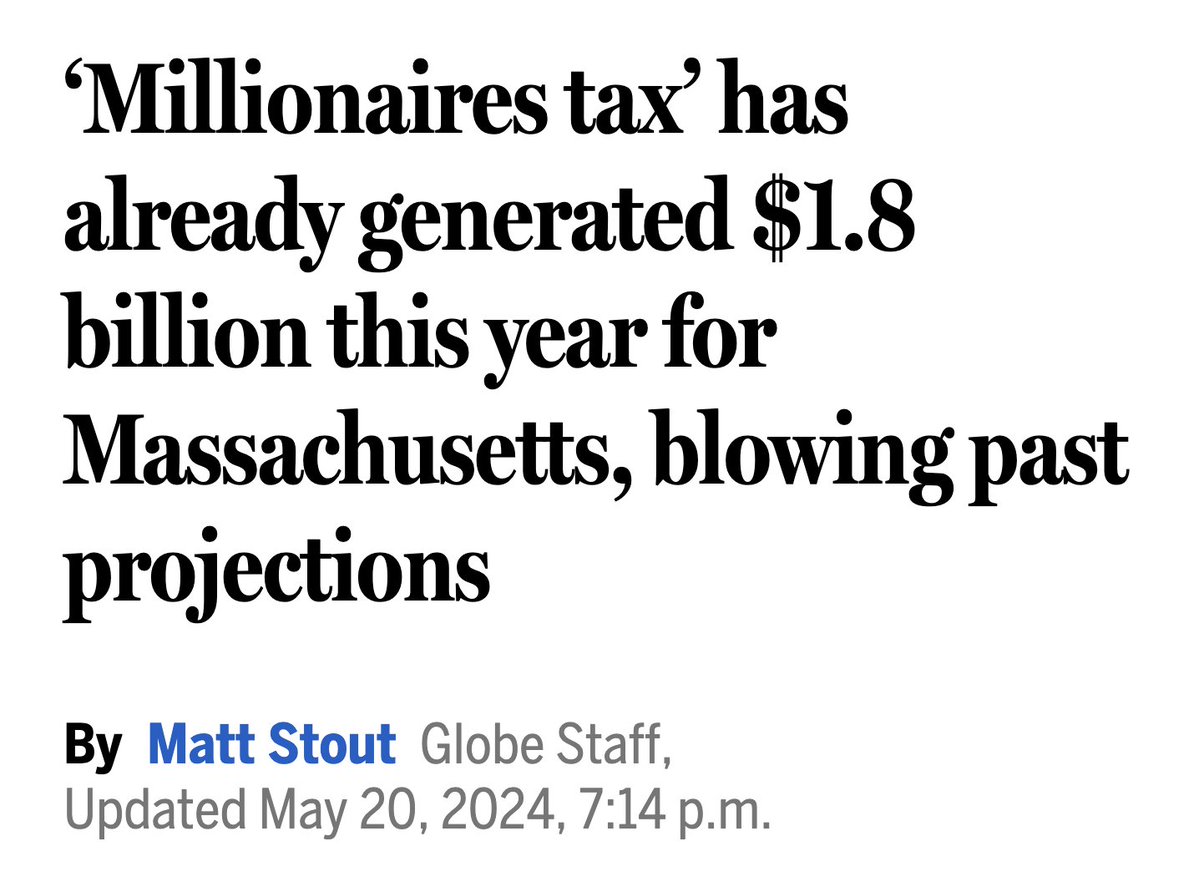

We don't need more tax breaks for billionaires and corporations—we need to make them pay their fair share in taxes.

THIS is how you build a fair economy.